SOPHIA ANTIPOLIS, France – January 16, 2024 │ The last quarterly report for the 2023 Therapeutic mRNA patent monitor is now available! This report covers all aspects of mRNA design, delivery, manufacturing, storing, mRNA-based vaccines, and mRNA-based therapeutics. As we leave behind another year, we look back on the mRNA therapeutic patenting activity!

Q4 2023 close a highly dynamic year

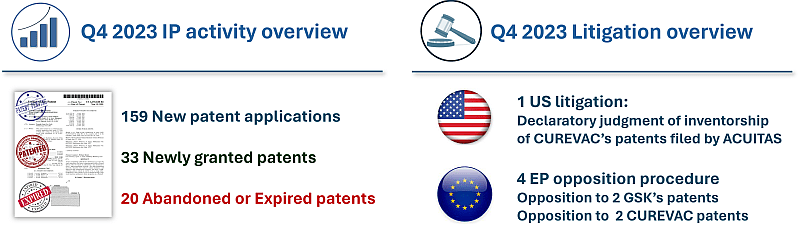

During Q4 2023, 159 new patent applications related to therapeutic mRNA were published, 33 patents were granted in US/EP/JP/KR and 20 patents were expired or abandoned. This level of activity is consistent with the previous quarter of 2023, indicating a continued growth in this technological field.

Figure 1: Q4 2023 IP activity and litigation overview

With the strong interest in therapeutic mRNA, the increasing number of granted patents and competition between industrial players, the litigations are increasing. This results in a complexification of the ecosystem. In the past quarter, ACUITAS filed a complaint against CUREVAC SE seeking inventorship in the US. This procedure may impact the whole COVID_19 vaccine ecosystem as detailed in a previous insight from KNOWMADE. The ALNYLAM third round in delivery battle was also a significant event in 2023 for the therapeutic mRNA area. Q4 2023 also relates to delivery focused patents, demonstrating the tension surrounding this aspect of technology.

The dynamic of 2023 highlights the importance to closely monitor the IP activity around therapeutic mRNA to keep an eye on competitors, current technology trends and to be aware of the whole ecosystem.

Well known leaders challenged by Chinese companies in 2023?

Innovation in therapeutic mRNA can be observed through the patent filing activity. Indeed, a new patent application results from a new invention developed by an industrial or an academic player. In 2023, 642 new patent applications were filled. These data are detailed in each monitor report released, with statistics on technological segment and application.

In Q4 2023, BIONTECH and MODERNA take the lead with 13 new patent applications published by each company. The Top 5 comprises two US academic institutions, PENN UNIVERSITY with 19 new patent applications and the MIT with 10 new patent applications.

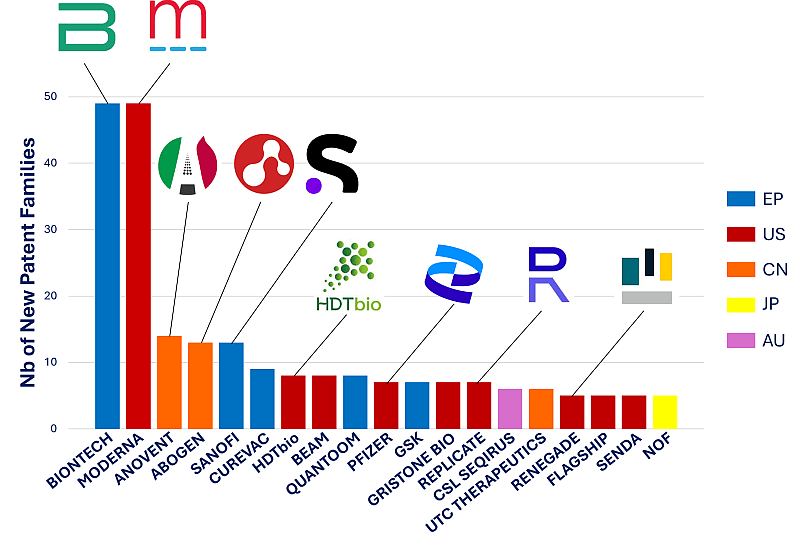

If we focus solely on the patent filing activity of industrial players in 2023, leadership of BIONTECH and MODERNA is strongly confirmed as illustrated in the Figure 2 presenting the number of new patent applications published by the main industrial players (i.e., representing 50% of the patent filing activity).

Figure 2: 2023 Patent filing activity for main industrial players

The 19 industrial players of the figure represent almost 50% of the whole patent filing activity of 2023. European players are in blue, US in red, Chines in orange, Japanese in yellow and Australian in purple. Are also highlighted the following players for 2023: BIONTECH, MODERNA, ANOVENT, ABOGEN, SANOFI, HDTbio, PFIZER, REPLICATE and RENEGADE.

Interestingly, these main players are directly followed by two Chinese companies, ANOVENT PHARMACEUTICAL and ABOGEN BIOSCIENCE. ANOVENT, established in 2014 in Shanghai, develops cationic lipids for LNP production. ABOGEN, established in 2019 in Suzhou, also develops cationic lipids, but also vaccines for coronavirus. ABOGEN was already identified as a leader in the LNP segment in the Q2 2023, see our press release, and presented as a main player in the 11th mRNA Health Conference in Berlin (October 2023) in KNOWMADE’s poster. It is worth noting that the first mRNA Covid vaccine approved in China was developed by a third company, CSPC Pharmaceutical Group Ltd.

2023 confirms SA RNA revolution and delivery challenge

Self-amplifying RNA (SA RNA), cis or trans, are mRNAs that can replicate in the cells, allowing a lower dose at the injection for an efficient protein production. The technology has the potential to create more potent cellular immune responses and increase duration of protection, while using considerably lower doses of mRNA. In the early 2023, KNOWMADE released a patent landscape analysis on Self-Amplifying RNA vaccine, detailing the ecosystem of this promising technology. During the whole year 2023 a boost for SA RNA was observed in the patenting activity (see Q2 2023 press release for more information), and more recently, Japan approved ARCT-154 from CSL and Arcturus Therapeutics, making it the first self-amplifying mRNA vaccine approved for use in adults to fight COVID-19 (November 2023). This technological revolution is confirmed by the 2023 patenting activity as two companies focused on SA RNA, HDT BIO and REPLICATE BIOSCIENCE are in the first row of players. Indeed, as illustrated in Figure 2, HDT BIO and REPLICATE filed 8 and 7 patent applications respectively.

Efficient delivery is also a key point for effective therapeutics. For now, LNPs is the current delivery vehicle used in mRNA approved therapeutics / clinical trial. Nevertheless, LNP has some drawbacks such as their immunogenicity and the difficulty to avoid liver targeting with such nanoparticles. The interest in developing new delivery vehicles (LNP or other types) is confirmed by the number of new patent applications related to this technological challenge every quarter, up to more than 50% in Q3 2023. RENEGADE THERAPEUTIC, a company founded in 2021 and based in Cambridge, owns a portfolio focused on LNP for mRNA delivery and recently presented results that validate a non-hepatic delivery in non-human primate and humanized mouse model. The technology and the portfolio of RENEGADE are analyzed in a previous KNOWMADE’s insight.

MODERNA and CUREVAC, still major players for therapeutic mRNA

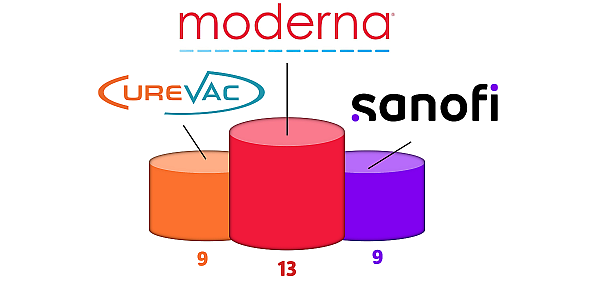

With 13 patents newly granted in 2023, MODERNA asserts its leadership position (see figure 3). Among these patents, some are related to manufacturing (In vitro transcription process or LNP formulation) or to specific applications (Chikungunya, Herpes simplex virus, or cystic fibrosis for example). CUREVAC completed its portfolio with 9 new patents also related to manufacturing (mRNA analyzing methods, RNA sequence adaptation) or to specific applications (wound healing or Burnyavirales vaccine for example). Regarding new granted patents in 2023, it appears that both leaders MODERNA and CUREVAC strategy cover the whole supply chain for therapeutic mRNA, from component fabrication, formulation to therapeutic products.

Figure 3: IP Portfolio strengthening leaders

IP portfolio strengthening is observed by the number of patents newly granted for the 1st time in 2023 within the geographical coverage of the monitoring service (US, EP, JP, KR). In the first position, MODERNA strengthening their portfolio with 13 new patents granted in 2023, at the second-place ex aequo CUREVAC and SANOFI strengthening their portfolio with 9 new patents granted in 2023.

SANOFI, a challenger thanks to TRANSLATE BIO acquisition

SANOFI acquired TRANSLATE BIO in 2021 to accelerate mRNA therapeutics development. Thanks to this acquisition, TRANSLATE BIO IP portfolio completes SANOFI portfolio. Indeed, in 2023, SANOFI’s patent portfolio was strengthened by 9 new patents comprising 6 patents filed by TRANSLATE BIO and 13 new patent families comprising 6 families filed under the name of TRANSLATE BIO (new patent application). Beyond vaccines, SANOFI also develops solutions that address therapeutic challenges in the fields of oncology, immune-related diseases, and rare diseases. The 2023 dynamic highlights the “challenger” position of the French company.

The Therapeutic mRNA patent monitor can be subscribed to at any time directly from here. If you need more information, reach us at contact@knowmade.fr or with our contact forms.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Elodie Bovier, PhD., works at KnowMade as a Patent Analyst in the field of Biotechnology and Life Sciences. She holds a PhD in genetic and molecular biology from the Paris Sud University. She also holds the Industrial Property International Studies Diploma (in Patent and Trademark & Design Law) from the CEIPI (Strasbourg, France).

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.