SOPHIA ANTIPOLIS, France – August 31, 2023 │The quarterly report for the Q2 2023 Therapeutic mRNA patent monitor is now available! This report covers all aspects of mRNA design, delivery, manufacturing, storing, mRNA-based vaccines, and mRNA-based therapeutics. Let’s focus on current dynamics in mRNA design.

Exploring the dynamic activity of therapeutic mRNA innovations

Therapeutic mRNA, which became widely known as vaccine against COVID-19, are expected to be applied to various areas such as cancer and regenerative medicine. In this fast-evolving context, monitoring the patenting activity related to therapeutic mRNA is crucial to be aware of weak signals, that might be the future of this technology, and understand the intellectual property position and strategy of the different players.

KnowMade has developed a strong expertise in therapeutic mRNA that allows detailed pictures of this disruptive technology, thanks to IP landscape reports such as the recent report on self-amplifying RNA (SA mRNA) vaccine. From these starting points, the monitoring activity follows, for each quarter, IP dynamics comprising new inventions (i.e., new patent applications), new granted IP rights and new litigations (US and Europe). The fine-tuned segmentation of KnowMade’s monitoring activity allows a deep understanding of technological sectors of current interest in therapeutic mRNA innovation. Indeed, this survey covers mRNA design (self-amplifying and circular RNA), carriers (lipid-based, polymeric, cell derived and inorganic), manufacturing & storing process, but also application and therapeutic area.

Q2 2023: LNP still a first-choice delivery

Therapeutic mRNA’s IP monitoring activity has already shown in the past quarters, that delivery is the most active technical segment and is highly dominated by LNP delivery systems. Q2 2023 confirms this tendency with more than 118 new patent applications related to such nanoparticles. Recent innovations regarding this technological segment are being led by Moderna (13 new patent applications), Suzhou Abogen Bioscience (9 new patent applications), Penn University (8 new patent applications) and BioNtech (6 new patent applications).

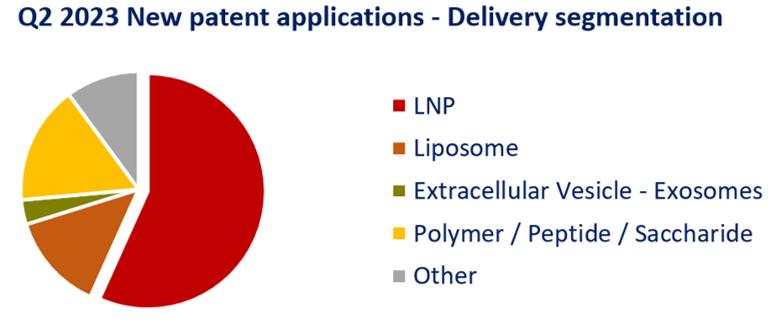

LNP is the delivery system approved for COVID-19 vaccines and also subject of major litigation between main players such as Alnylam, Moderna and Pfizer, illustrating the importance of this technological aspect in the therapeutic mRNA industry (see our last press release here). Nevertheless, on the past quarters, its proportion in new patent applications decreased from 70% in Q4 2022 to 56% in Q2 2023 while other systems, such as extracellular vesicles and polymeric nanoparticle, show positive dynamics in their development. Alternative to LNPs is one of the solutions developed to overcome their main drawback, i.e., LNP accumulation in the liver limiting the access to other organs wherein the therapy is needed. Figure 1 below illustrates the proportion of new patent applications for main delivery systems.

Figure 1: New patent applications in Q2 2023 – Delivery segmentation Newly published patent families (WO, EP, US, JP or KR) were manually segmented according to their technological features. Other delivery options encompass virus like particles (VLP) or polymeric nanoparticles for example.

Q2 2023: Focus on Self-Amplifying mRNA

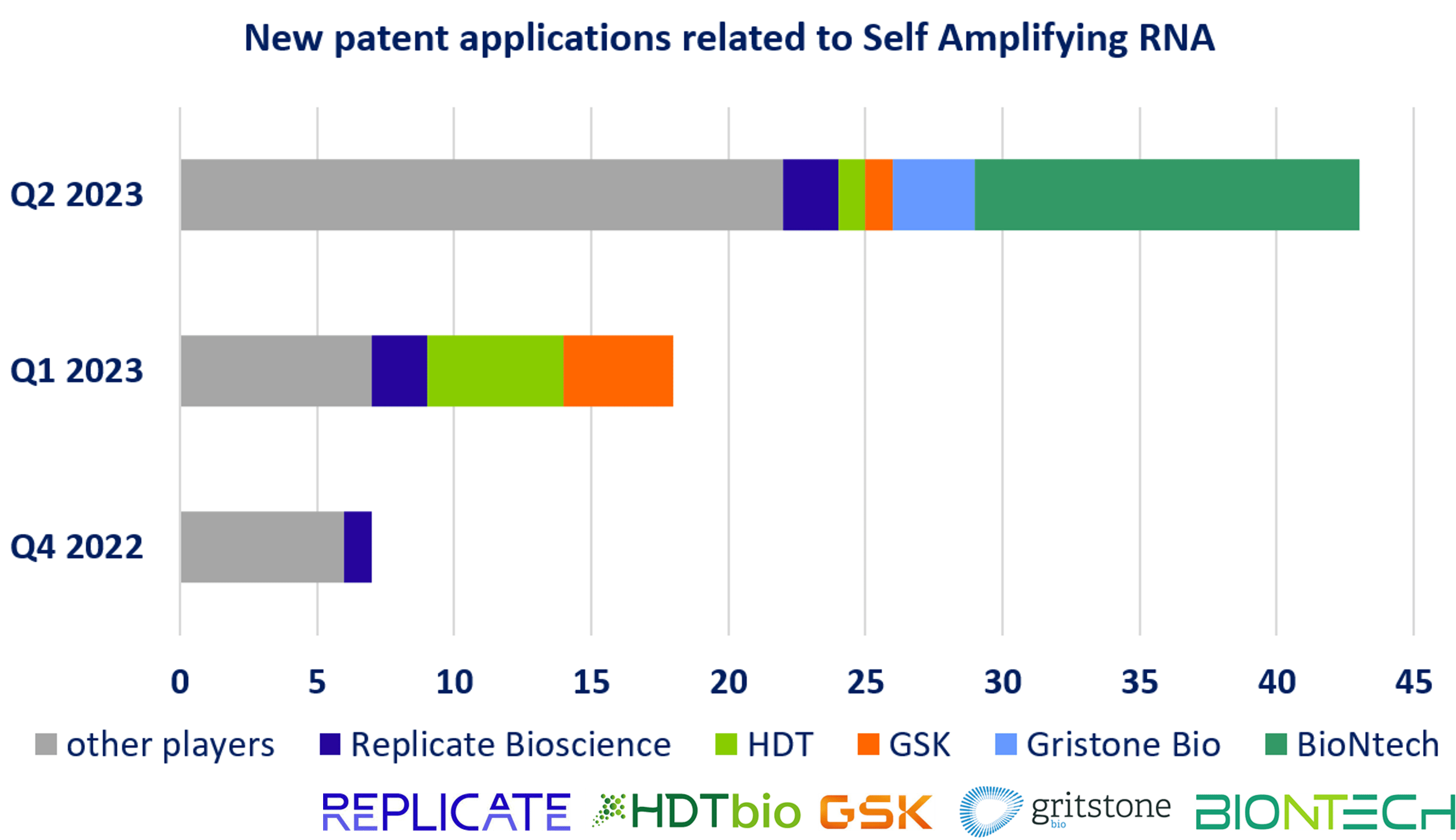

Another growing technological development observed in the monitoring activity relates to SA mRNA. The advantage of SA mRNA therapy compared to the conventional mRNA technique, is in terms of its lower dosage requirements, relatively fewer side effects, and possessing long-lasting effects. Over the past quarter, new patent applications raised from 7 in Q4 2022 to 18 in Q1 2023 and 43 in Q2 2023. New patent applications related to SA mRNA comprise innovation in the RNA design itself but also on delivery system efficient for SA mRNA. Among main players in this segment, some companies are specialized in developing therapeutic SA mRNA platforms, such as Replicate Bioscience and HDT Bio. Moreover, it is worth noting that the well-established player in mRNA field BioNTech filed 14 new patent applications related to SA mRNA this quarter. Half of these applications results from the collaborative work between BioNTech and CSIC on ionizable oligosaccharide complexes efficient for SA mRNA and conventional mRNA delivery. In addition, BioNTech, in collaboration with TRON, filed 2 patent applications describing modified replicable RNA for use in various types of therapy, illustrating the growing interest in SA mRNA design. Evolution of new patent applications related to SA mRNA as the main players is illustrated in Figure 2.

Figure 2: New patent applications related to Self Amplifying mRNA Newly published patent families (WO, EP, US, JP or KR) were manually segmented according to their technological features. Other players are academics or industrials with similar proportion, and mainly from North America or Europe.

The monitoring of mRNA therapeutics allows up-to-date data on patent activity, with a quarter-tendency regarding technological segments, but also on therapeutic tendencies and novelty as information on main IP players (established or newcomers). If you need more information, reach us at contact@knowmade.fr or with our contact forms.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Sophia Antipolis, France

www.knowmade.com

About our analyst

Elodie Bovier, PhD., works at KnowMade as a Patent Analyst in the field of Biotechnology and Life Sciences. She holds a PhD in genetic and molecular biology from the Paris Sud University. She also holds the Industrial Property International Studies Diploma (in Patent and Trademark & Design Law) from the CEIPI (Strasbourg, France).

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand their competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.