SOPHIA ANTIPOLIS, France – August 10, 2023 │ The latest quarterly report of the RF Front-End Module & Components Patent Monitor is out! This is a good time to review what happened these last few years from a patent point of view, especially on LBAW filters (laterally excited or laterally coupled bulk acoustic wave filters).

At Knowmade we have been monitoring the patenting activity related to RF front-end module and components, especially RF acoustic wave filters, for many years. We have witnessed how the rise of 5G has impacted the industry. One main challenge of the RF acoustic filter industry is providing filters operating at higher frequencies and exhibiting large bandwidths.

LBAW, the new solution to high frequency filters

Since the 1990’s, the acoustic filter industry has been divided into two main technologies. Surface acoustic wave (SAW) filters for the lower bands and bulk acoustic wave (BAW) filters for the higher bands. This market and the players were well-established, and their products, technologies and know-how protected by large and strong intellectual property (IP) portfolios. Murata and Skyworks were leading the SAW IP landscape, while Broadcom was leading the BAW one. The expansion of mobile phone services and networks drove the need for progressively wider and higher frequency bands. 5G applications, for instance, require frequencies in the sub-6GHz range (e.g., 3.3–3.8 GHz (B78), 3.3–4.2 GHz (B77), 4.4–5.0 GHz (B79)) as well as mm-wave bands (e.g., 24.25–29.5 GHz (B257, B258, B261), 37–40 GHz (B260)). While reaching higher frequencies is one part of the challenge, the other part is to provide filters that not only work at higher frequencies, but also offer wider absolute and relative bandwidths.

Currently, SAW and BAW devices fulfill the requirements for bands below 3GHz. However, when it comes to the 3–5 GHz range, numerous issues arise. SAW devices require increasingly narrower electrodes which result in higher losses, reduced power handling, and more expensive lithography. BAW devices likewise have relatively small piezoelectric coupling and lack the capacity to support wider bandwidths required. Therefore, new acoustic wave filter solutions that address losses, power, and bandwidth needs above 3 GHz will be attractive.

To overcome these limitations, players are looking for new technologies. According to our patent analysis, solutions include the development of BAW with a ScAlN or Sc-doped AlN piezoelectric film in order to enhance the electroacoustic coupling characteristic, or a switch to the laterally excited BAW (LBAW) technology. LBAW devices carry out resonance by using longitudinal bulk acoustic waves and can potentially meet the requirements of a high-frequency and large bandwidth filter. Additionally, one major advantage of LBAW technology, aside from any technical considerations, is that there is very little prior art available in this field, and thus players have the potential to develop, strengthen, and value their IP without facing stiff competition.

Resonant is no longer alone.

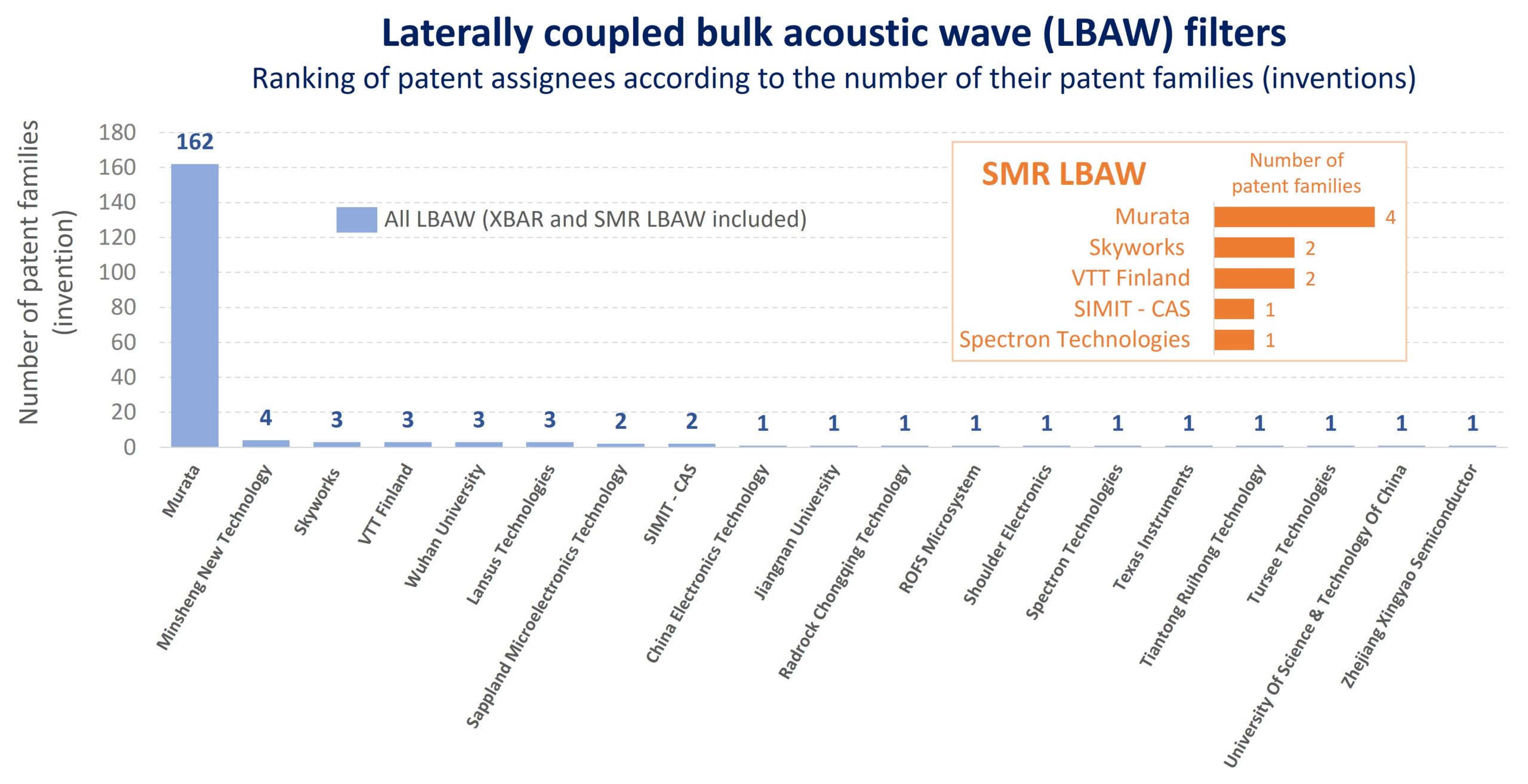

Until 2020, laterally excited BAW devices were almost exclusively developed and patented by Resonant (VTT Technical Research Centre of Finland filed 3 patents between 2018 and 2019). With more than 50 patent families (inventions) filed since 2018, Resonant has developed a strong IP portfolio related to its LBAW technology called XBAR®. This IP has supported and protected Resonant’s unique market and technological approach. Since 2022 and the acquisition of Resonant by Murata, this IP has strongly contributed to and secured Murata’s position in the development of high-band filters for 5G.

However, this IP position is no longer unique, as several players have filed patent applications for LBAW technology in the last two years. Although patent activity is still low compared to Murata’s, it demonstrates the increasing interest and R&D efforts of other players. Nowadays, most of the IP competition comes from Chinese players such as Lansus Technology (深圳飞骧科技股份有限公司), Wuhan University, Sappland Microelectronics (杭州左蓝微电子技术有限公司), Radrock Technology (锐石创芯), as well as American companies such as Skyworks and Texas Instruments.

Figure 1: Main players owning LBAW related patents. (insert: details for SMR LBAW technology)

IP players have also increased their patenting activities related to filter architectures. Like for other acoustic wave filters, a key strategy is to control multiple elements of the supply chain. Murata and its competitors have adopted the same approach for LBAW technology and have filed patent applications concerning its integration into a filter module or ladder type filters (patents US20230134889, US20220337224, CN116072553, US20210273631).

One technology, two approaches

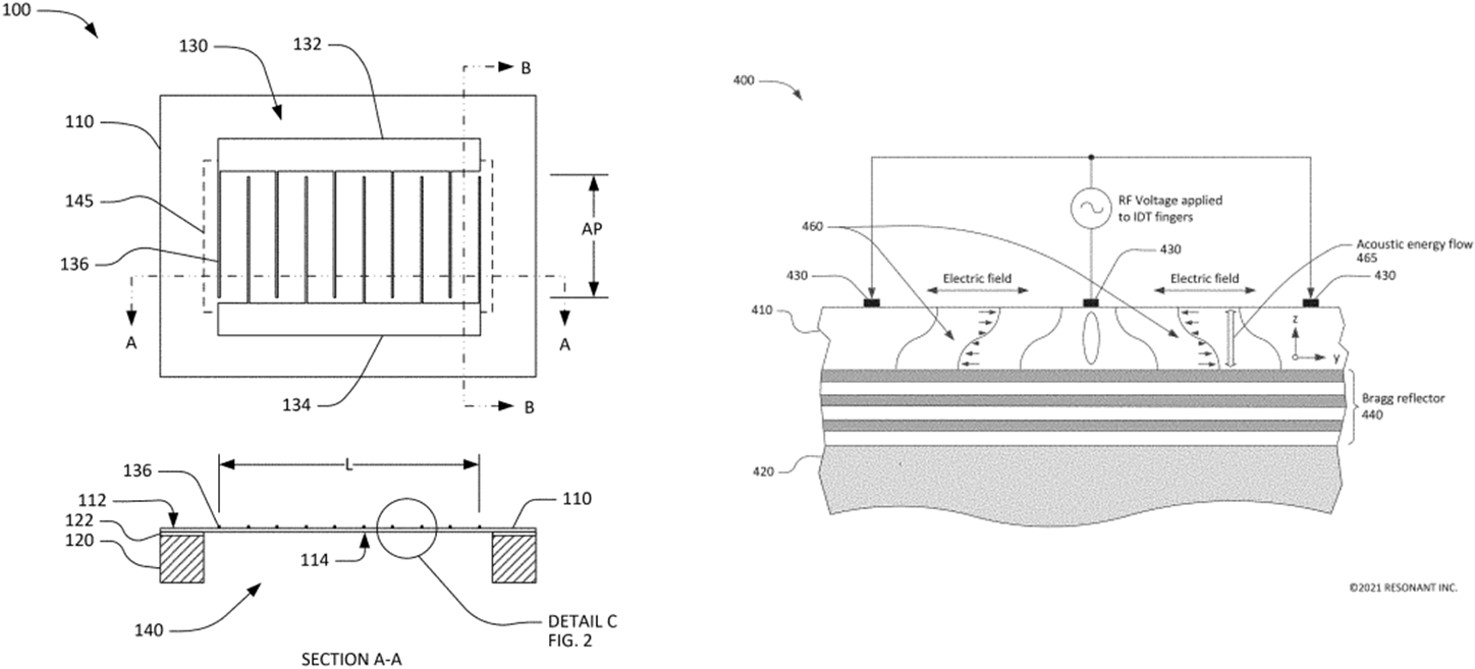

Like BAW, LBAW can be divided into two main designs: the XBAR® (laterally excited bulk acoustic resonator – figure 2 left) and SMR LBAW (solidly-mounted LBAW – figure 2 right).

XBAR, the most common and protected approach

The XBAR, proprietary of Resonant, is the most common LBAW which combines interdigit electrodes (IDTs) with the MEMS process to etch the back of the substrate. According to Knowmade’s patent analysis, XBAR is currently the technology of choice of Chinese IP players developing LBAW, despite Murata’s large patent portfolio and potential aggressiveness.

Murata and VTT are two players with a worldwide IP strategy. In particular, Murata has extended the protection of 26 of its LBAW-related inventions in China. Conversely, Chinese players have mostly adopted a national IP strategy. To date, with one exception (Lansus Technology PCT application WO2023/071516), no Chinese LBAW-related patents have been extended outside of China. In the context of the IP war, Chinese companies can however use their patents to limit or regulate Murata’s entrance into the Chinese market. Apart China, Murata can face IP competition in the US, Europe, and Japan due to patent extensions from VTT and Skyworks.

Recent patents attest of strong efforts being directed toward the development of the IDT. This is especially true of Murata, which is utilizing its extensive expertise and background in the development of IDT for SAW to transfer it to the XBAR design. One challenge behind this is to reduce large passband ripple. Another issue is to provide XBAR devices with better thermal dissipation (e.g., patents US20230120844, US20230006129, US20220149807). Last, bus bar design (i.e., position, manufacturing process, etc.) is also a subject of development for the XBAR technology (see patents US20220263494, CN115694403, US20230111410).

SMR LBAW, a small segment with more room

The solidly mounted LBAW is rarer. This approach was first described in patents from VTT Technical Research Centre of Finland back in 2018 (US10630256). Like for SMR BAW, an acoustic reflector is deposited between the substrate and the piezoelectric layer to confine the acoustic wave within the active layer. Skyworks has recently claimed this design in two of its patents US11463065 and US11552614. Advantages to this SMR LBAW design are that it requires no etching and addition of stopping layer, and with careful engineering of the reflector and intermediate layers between the substrate and the piezoelectric material, heat dissipation can be better managed. An additional benefit is that, by using SMR LBAW, players can avoid Murata’s IP and benefit from more IP white spaces to strengthen their patent portfolio.

Figure 2: Left – Transversely-excited film bulk acoustic resonator with low thermal impedance (patent US20220149807). Right – High Q solidly mounted transversely excited film bulk acoustic resonators (patent US20220123726)

As patenting activities around BAW show intense competition, with each actor striving for the best way to develop and protect their technologies, LBAW technology offers a new and promising path. With only 200 inventions claiming LBAW, there is still plenty of room for players to enter the patent landscape and build a strong and valuable IP portfolio. Nonetheless, if the patent filing dynamics and the entry of new actors continue at this pace, these spaces will soon be filled, and the competition will be as fierce as it is for BAW. The clock is ticking!

Knowmade’s RF FE Module & Components Quarterly Patent monitoring service tracks and analyses all IP activities related to acoustic wave filters, including new patent publications, new granted patents, patents that have expired or been abandoned, IP transfers, and patent litigation. Identification of critical patents and thorough analysis of the IP players’ strategies give an understanding of how players are constructing their IP portfolio and how they can benefit from their patents to support their market position and technological development. In the case of LBAW technology, this patent monitoring service can help you identify newcomers, appraise recent patents, assess competitors’ level of investment in this technology, and evaluate the associated risks.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About our analyst

Paul Leclaire works for KnowMade as a Patent Analyst in the fields of RF technologies, Wireless communications and MEMS sensors. He holds a PhD in Micro and Nanotechnology from the University of Lille (France), in partnership with IEMN in Villeneuve-d’Ascq and CRHEA-CNRS in Sophia Antipolis (France). Paul previously worked in innovation strategy consulting firm as Consultant.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand their competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.