SOPHIA ANTIPOLIS, France – January 26, 2023 │KnowMade explains the critical role of intellectual property (IP) in the next decade of the power SiC market. In the escalating tech war between US and China over semiconductors, Wolfspeed is the main US player in the way of the rising Chinese SiC industry.

The EV market: a springboard for SiC power electronics

Since 2019, early movers — STMicroelectronics, Wolfspeed, Rohm, onsemi, Infineon and others — in the nascent silicon carbide (SiC) industry have been accelerating their strategic plans, running to jump on the bandwagon of electric vehicles (EV). Getting on that wagon means convincing automotive players to adopt SiC power electronics and supporting the emergence of the supply chain that suits this ambition.

The scale of the challenges faced by SiC players might be measured according to the billions of dollars SiC players have invested in the sector since 2019, in terms of new facilities, strategic mergers & acquisitions (M&A), sourcing agreements, etc., for a business that currently account for less than 1% of the total semiconductor market.

While the industry strives to accelerate its product development and supply chain to secure and widen the adoption of SiC power devices, intellectual property (IP) issues are lurking too. Among these issues, there is a growing concern that SiC technology will become another battlefield between the US and China in their competition for semiconductor supremacy.

The rise of Chinese IP in SiC power semiconductor technology

Undoubtedly, China will fight for the SiC power device market. Indeed, Beijing recently confirmed SiC technology as being critical for deploying its future transportation, communication, and energy infrastructure. During the past decade, China has supported the emergence of a domestic SiC industry in many ways, resulting in the presence of numerous Chinese IP players across the whole SiC supply chain (Figure 1).

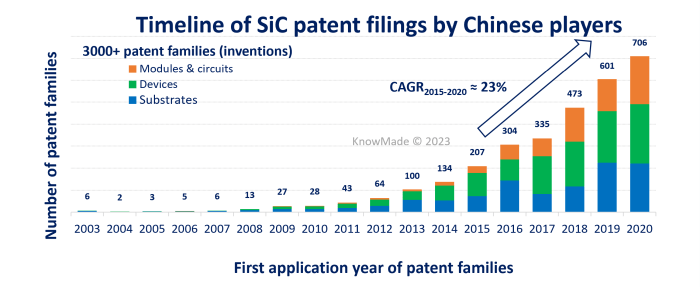

Figure 1: The patenting activity of Chinese patent applicants in the SiC patent landscape 2022.

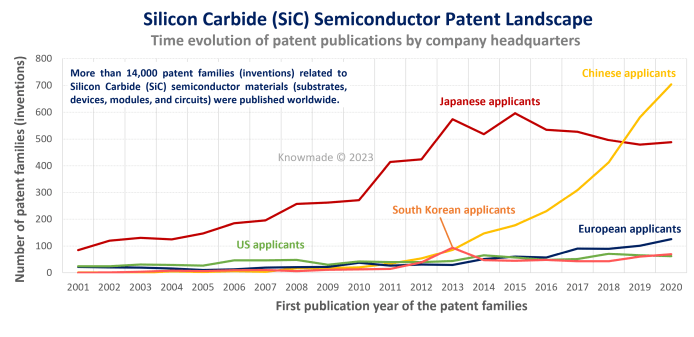

Today, Chinese patent applicants are among the most active in the global SiC patent landscape. Their patenting activity hardly extends beyond the Chinese borders (more than 90% of their patent filings are Chinese patent applications). However, it exhibited a 23% compound annual growth rate (CAGR) between 2015 and 2020. Chinese IP in the field of power SiC is growing much faster than in the rest of the world (Figure 2).

Figure 2: Countries of patent applicants in the SiC patent landscape 2022.

Why does it matter? Let’s recap the figures. Chinese SiC players have filed over 3,000 patent applications since 2000, most of them after 2015. As a result, more than 1,100 SiC patent applications have already been granted and are now enforceable by Chinese players for the next 15 to 20 years. Following the current trend in patenting SiC inventions, these figures are only expected to grow. They will eventually establish a high barrier to entry for SiC players on the Chinese market.

There are currently no Chinese SiC players with a global IP strategy. Today, Chinese SiC players are focused on restraining competitors’ activities in their own country rather than challenging Western SiC players in the rest of the world.

SiC power semiconductor technology: The next battlefield in the US-China trade war?

So far, historical players in the US, Europe, and Japan have been technologically ahead of their Chinese competitors. What’s more, they aim to further widen the gap after investing massively in deploying SiC in EV applications. If Chinese SiC power device manufacturers follow the same trajectory, they still depend on foreign players for SiC wafer supplies. Under these circumstances, Chinese players are unlikely to leverage their IP to limit foreign competitors’ access to production and sale activities in China.

However, this situation may change sooner than expected as several domestic suppliers such as SICC, Tankeblue, or Synlight Crystal are now working hard with the support of public research organizations and local authorities to catch up with foreign SiC wafer suppliers. Therefore, China may complete its SiC supply chain and reach domestic self-reliance for SiC wafers long before the expiration of its current patents (2035–2040). At this point, enforcing Chinese IP against Western SiC suppliers may become an option for Beijing to get an edge in its trade war with the US.

IP strategy of US market players: Wolfspeed earned the pole position

In this scenario, incumbent players in the SiC power semiconductor device market would need cutting-edge technology, a safe supply chain, and a comprehensive patent portfolio to protect their products in key markets for SiC technology. Furthermore, building a sizeable patent portfolio in an emerging SiC market could be a strategy to discourage competitors from conducting aggressive moves against a business, either in the market or in the legal fields.

As of 2023, Wolfspeed is one of the best examples of such players in the SiC industry. This US vertically integrated company is a leading wafer and device supplier for the SiC industry, with plans to invest more than $5 billion in new production capacities. It is also the only player able to supply 8-inch SiC wafers and power devices to the market, which might give the company a competitive edge in the future market.

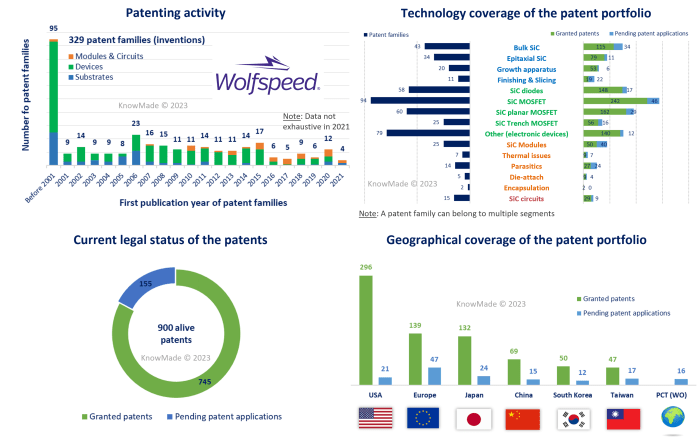

From a patent perspective, Wolfspeed has been a top patent applicant in the upward and middle parts of the SiC supply chain, from SiC substrates to SiC power devices (planar MOSFETs, diodes), since the 1990s (Figure 3). Its patent portfolio stands out from most IP competitors because of the number of patents and the number of countries where its patents are granted (geographic coverage of invention protection).

Interestingly, the IP strategy remains consistent with Wolfspeed’s move to become a fully vertically integrated semiconductor powerhouse. Indeed, since 2015 and the acquisition of APEI the same year, Wolfspeed has accelerated the filing of new patent applications in power module technology and circuit technology. Still, power modules and circuits remain the weak spot in Wolfspeed’s patent portfolio compared to its main competitors downstream in the SiC supply chain.

Figure 3: Overview of Wolfspeed’s patent portfolio in the SiC patent landscape 2022.

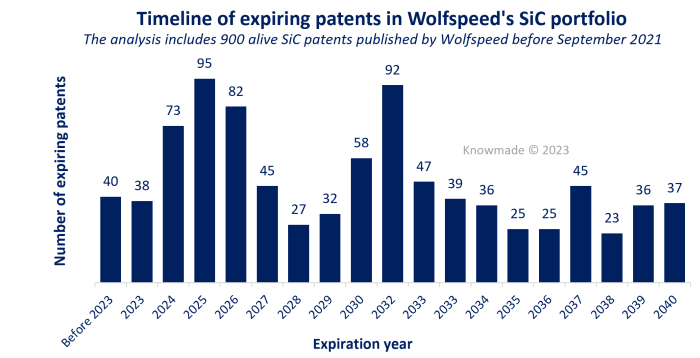

Will Wolfspeed maintain its dominant IP position in the next decade? As of September 2021, the US company was assigned to 900 alive SiC patent applications (either granted or pending). However, more than 30% of these patents were expected to expire by 2026, including numerous key patents for SiC technology (Figure 4). This is huge and opens new opportunities for competitors to reuse the technology disclosed in the expired patents freely.

Despite the ageing of its patent portfolio and the relatively lower patenting activity since 2016 (Figure 5), Wolfspeed will maintain a significant pool of patents in the next decade. Furthermore, new patents were recently filed by Wolfspeed to cover its products, either 8-inch SiC wafers or SiC planar MOSFETs. Importantly, they would extend the protection of the products for the next two decades. Wolfspeed aims to maintain a solid position in the future SiC patent landscape.

Figure 4: Timeline of Wolfspeed’s expiring patents, including all alive patents (pending and granted) in the SiC patent landscape 2022 (“Best case” scenario: all pending patent applications have been granted).

Major SiC players to strengthen their IP position in the next decade

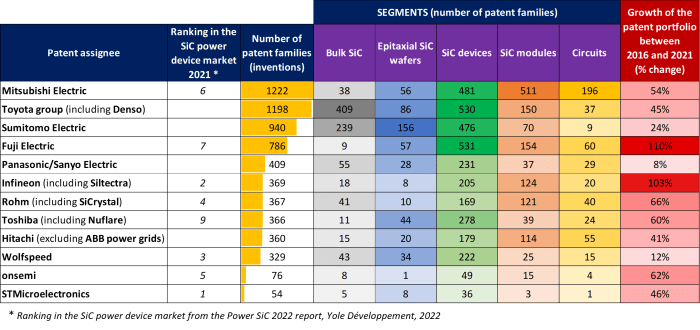

Most SiC players have sped up their IP strategy in recent years, reflecting the acceleration in R&D activities and, more generally, in the execution of their strategy to address the SiC market (Figure 5). This is not the case with Wolfspeed. As a well-established player in the SiC competitive landscape, the company has a mature SiC substrate and power device technology, which was already protected by many patents worldwide. It might change in the future as planar MOSFET technology reaches its limits in terms of performance. At this point, the company could shift to trench MOSFET technology, for instance, resulting in new patent filings.

Figure 5: Overview of the patent portfolio of the top 10 IP players and top 7 power device market players in the SiC patent landscape 2022.

Surprisingly, the other US market players — onsemi, Navitas (GeneSiC), and Qorvo (United SiC) — in the SiC patent landscape have built relatively small patent portfolios so far. This situation is not here to last. US players have different options to strengthen their IP position in the next decade:

- Develop their IP internally by filing new patent applications

This is not necessarily bad timing to resume its patenting activity, as the SiC market is just taking off. Therefore, much could happen in the SiC patent landscape in the next few years, providing IP challengers can find white spaces in a busier and busier patent landscape, especially in the SiC MOSFET area.

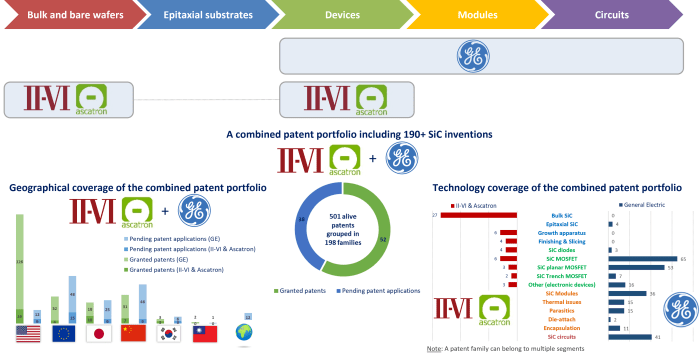

- Access to external sources of IP by licensing

II-VI (now Coherent), whose patent portfolio focuses on the very upward part of the SiC supply chain (SiC substrate technology), is already licensing the power SiC technology from General Electric (GE). Indeed, GE is a major IP player downstream in the SiC supply chain (from devices to modules and circuits). Accordingly, GE’s and II-VI’s patent portfolios were complementary across the whole SiC supply chain (Figure 6).

Figure 6: Overview of the patent portfolios combined by II-VI and General Electric across the SiC supply chain (SiC patent landscape 2022). II-VI’s portfolio includes patents filed by Ascatron, a Swedish company acquired by II-VI in 2020 (patents related to SiC devices).

- Access to external sources of IP by mergers or by acquisitions (M&A)

Another way could be acquiring players with substantial and complementary IP assets in the SiC patent landscape. However, in the current context, where M&A are unlikely to happen beyond borders, few possibilities remain for US players to acquire such companies, except for Wolfspeed. For a company such as onsemi, which has little IP related to SiC substrates, despite GTAT acquisition, Wolfspeed could be a good fit in terms of IP and technology. On the one hand, onsemi could strengthen its IP position on SiC substrates, SiC diodes, and SiC planar MOSFETs. On the other hand, it could leverage its expertise in power module and circuit technology to develop its IP downstream on the SiC supply chain.

In the current political and economic situation, it has become clear that, with regard to IP strategy, one cannot just “hope for the best” but needs to “prepare for the worst”. Although presently focusing on US and China, it is conspicuous that a lot is happening or will happen in Europe and Japan, two of the most important regions for the EV industry and the EV market (Figure 5). Interestingly, IP could be part of building and stabilizing the SiC supply chain. Device makers with no internal supply of SiC wafers — such as Toyota/Denso — could leverage their extensive IP related to SiC substrate technology to secure their relationship with SiC wafer suppliers through licensing agreements. Another card to play in the competition with China? Let’s see. But one thing is certain: The next few years will be very busy for all teams working with innovation and IP in SiC technology.

KnowMade offers its expertise in the field of Power electronics with patent landscape reports.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Rémi Comyn works for KnowMade as a Patent Analyst in the field of Compound Semiconductors and Electronics. He holds a PhD in Physics from the University of Nice Sophia Antipolis (France) in partnership with CRHEA-CNRS (Sophia Antipolis, France) and the University of Sherbrooke (Québec, Canada). Rémi previously worked in compound semiconductors research laboratory as Research Engineer.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.