SOPHIA ANTIPOLIS, France – January 31, 2023 │ Q4 2022 RF Front-End Module & Components Patent Monitor (covering PA/LNA, RF filters (SAW, BAW, XBAR), RF switch, RF tuner, and the RF Front End module) quarterly report is out! This is a good time to review what happened this year from a patent point of view. Let’s focus on two acoustic filters.

KnowMade has been monitoring the patenting activity related to RF front-end modules, especially RF acoustic wave filters, for many years. It has witnessed how the rise of 5G has impacted the industry. One main challenge of the RF acoustic filter industry is providing filters operating at higher frequencies and exhibiting large bandwidths. Both acoustic filter technologies — surface acoustic wave (SAW) and bulk acoustic wave (BAW) — must fulfill this new requirement to unlock the full potential of 5G.

Main acoustic filter innovations: ScAlN and POI, the future is in the materials

According to KnowMade’s latest quarterly RF patent monitoring report (see here), today’s main patents is to improve the k² of the BAW filter while improving the bulk wave confinement. ScAlN is the preferred solution for the k²/quality factor Q improvement challenge. to KnowMade analysis, incremental innovation related to the BAW design and manufacturing, such as improving the insertion layer, raised frame (using oxide), or packaging manufacturing, is the solution to get better wave confinement.

In the SAW filter IP segment, the tale is similar. Indeed, to provide SAW filters operating in the sub-3GHz range, players have developed, on the one hand, their interdigital transducer (IDT) structure and metal stack (incremental innovation) and, on the other hand, work on new substrates to improve the surface acoustic wave confinement and avoid leakage through the substrate. In that case, the leading solution described in patents is piezoelectric on insulator (POI) substrates. Players could create an acoustic mirror by stacking a low acoustic velocity layer and a high-velocity layer. Since 2018, the common approach has been to use a Lithium niobate crystal bonded to a Si substrate via a SiO2 bonding layer. However, many other approaches have been described in the patent and scientific literature. These include, for instance, using a Bragg acoustic reflector composed of several SiO2/Si layers or of a SiN interlayer. In 2022, we also witnessed the development of intellectual property (IP) related to POI on SiC or diamond substrates offering better thermal and electric performance while offering a good acoustic filter parameter.

These two new approaches have opened new spaces for players to develop their IP. Indeed, before that, the IP landscape was very stable and settled, with Murata (SAW) and Broadcom (BAW) being two solid IP leaders. Today, SAW and BAW IP landscapes exhibit very different dynamics.

SAW filters: some major innovations but no impact on the acoustic filter-related IP landscape

SAW players have developed RF filters on POI substrate technology since early 2010. Indeed, Murata was the first to develop such substrates (first patent published in 2009) and then used it in its IHP SAW product in 2017. Today, this approach is well-known, used, and protected by many patents owned by all SAW filters key players (Murata, Skyworks, Qualcomm, Kyocera, Wisol, etc.). In the meantime, substrate makers (Soitec, Shin Etsu, and NGK Insultators) have also built their IP portfolio related to POI for SAW filter applications. They now offer a large range of structures with diverse manufacturing processes. All historical and leading IP players (Murata, Skyworks, Taiyo Yuden, Wisol, Qualcomm, etc.) have quickly reacted to keep their IP and market leadership. Despite this major innovation in the SAW filter segment, the IP landscape does not show any changes in the ranking of IP players or their IP and R&D strategies.

The fall of Broadcom and the rise of new IP leaders

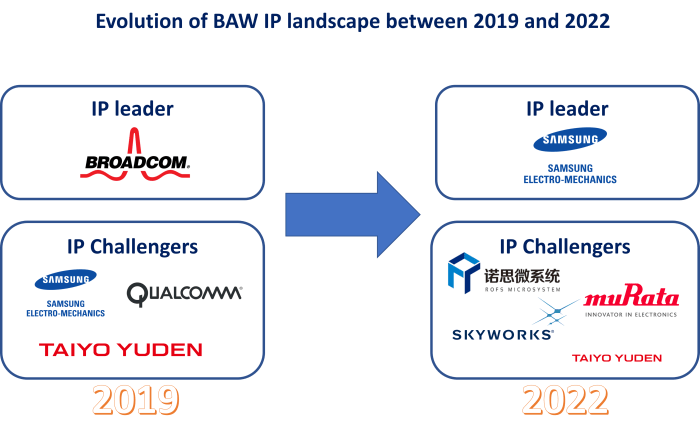

The BAW segment dynamics are significantly different. Indeed, former IP leader Broadcom’s patenting activity is very low compared to its competitors, resulting in Broadcom’s loss of assets. For instance, in 2022, Broadcom filed no new patent applications, while 15 patents have expired. Thus, Broadcom’s IP portfolio is weakening, which offers serious opportunities for IP challengers to lead the IP landscape and strengthen their market position with dedicated IP. In addition to the acceleration of the patenting activities of historic players such as Qorvo, Akoustis, or Taiyo Yuden, former SAW specialized players have entered the BAW IP landscape and numerous Chinese entities.

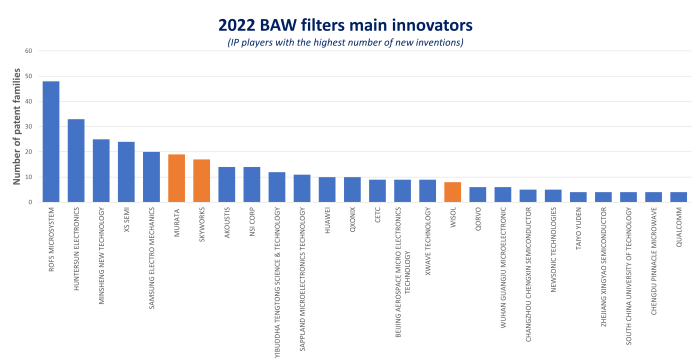

Figure 1: Main BAW filters innovators in 2022 (former SAW specialized IP players are highlighted in orange).

In 2022, Samsung Electro-Mechanics and ROFS two new leading IP players. The new IP challengers (apart from Chinese players) were none other than Skyworks and Murata. All these players have accelerated their patenting activity on BAW. For Murata, this increasing IP activity related to BAW comes with the development of its portfolio related to XBAR (coming with the acquisition of Resonant). Qorvo, Qualcomm, or Akoustis complete the list of noticeable non-Chinese IP players in BAW filter technology. Considering that ScAlN BAW will be the future of BAW filters and the leading patenting activity of Chinese, Korean (SEMCO, Wisol), and Japanese (Murata) players, we are witnessing a complete change in the patent landscape where the valuable patents will be owned by Asian players and where former SAW specialized IP players will play a major role.

Figure 2: Evolution of BAW filters IP leadership from 2019 to 2022. The IP leadership of a patent assignee is assessed based on its patent portfolio size, number of enforceable patents, and number of pending patent applications.

Other Semiconductor patent monitors.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About our analyst

Paul Leclaire works for KnowMade as a Patent Analyst in the fields of RF technologies, Wireless communications and MEMS sensors. He holds a PhD in Micro and Nanotechnology from the University of Lille (France), in partnership with IEMN in Villeneuve-d’Ascq and CRHEA-CNRS in Sophia Antipolis (France). Paul previously worked in innovation strategy consulting firm as Consultant.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand their competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.