SOPHIA ANTIPOLIS, France – February 02, 2023 │ KnowMade introduces two newcomers from China (MEMSonics and EPICMEMS) who appear to be strengthening their intellectual property in RF technology. What do their patents reveal?

MEMSonics and EPICMEMS: two good examples of rising RF front-end IP players

For ten years, China has been the patenting activity hub for many industries. The RF and telecommunications industry is one of them, with Chinese companies having massively invested in the development of RF infrastructures and devices supporting 5G. Consequently, China has gradually closed the technological gap that existed between its products and those of the rest of the world and moved the epicenter of the 5G industry from the US to its shores. The drawback to such fast-paced development is that Chinese companies did not have time to establish and strengthen a national supply chain. Patent analysis tells us that the situation is about to change, as numerous Chinese players along all parts of the supply chain are developing intellectual property (IP) on RF devices and modules and can now compete against established foreign players. Furthermore, their recent strong patenting activity combined with the trade war between China and the US may benefit Chinese companies by protecting their national market and offering them time to develop their product and supply Huawei, Oppo, Xaomi, and other major OEMs.

Two Chinese players— MEMSonics (武汉敏声新技术有限公司) (MEMSonics website) and EPICMEMS (开元通信技术) (EPICMEMS website)—illustrate the growing activity of players on both the market and IP side. In 2022 alone, and in addition to their notable patenting activities, these companies raised nearly CNY 600 million (USD 89.7M) and CNY 200M (USD 30M) respectively. They now have the capacity to go to the next level.

Two newcomers striving for growth

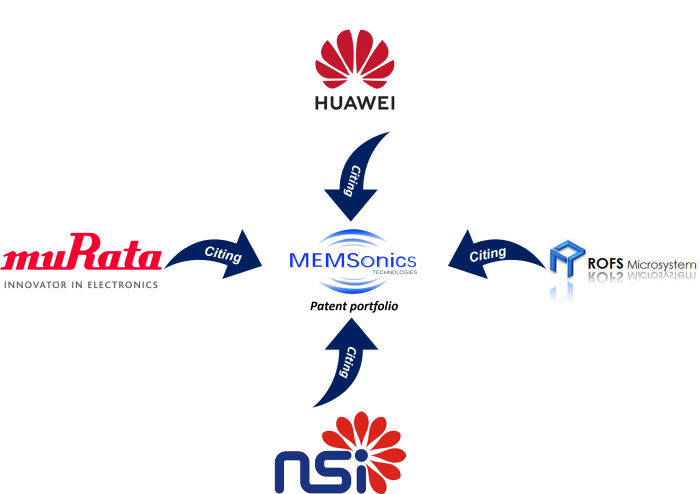

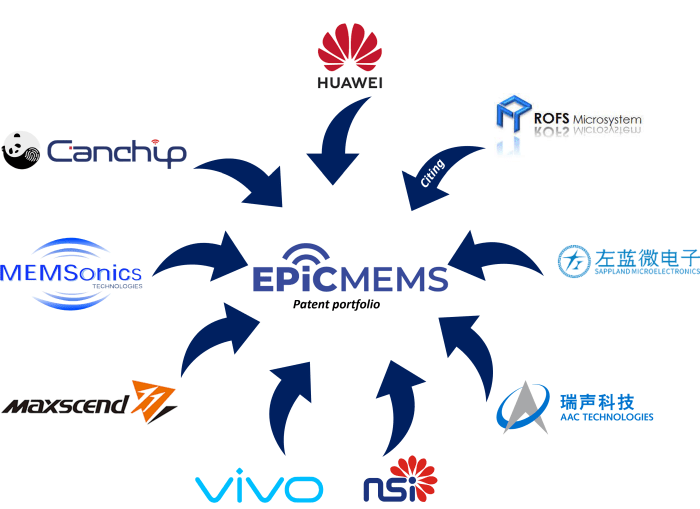

KnowMade has found that MEMSonics and EPICMEMS exhibit similar patent portfolios and IP strategies. Both have extensive technological coverage attesting to a will to build an IP portfolio covering several links in the supply chain. They have also started to extend their patents abroad to protect their inventions internationally (PCT and US applications). In addition, and despite their young age, both patent portfolios have demonstrated their impact in the field: they have already been cited by some major RF front-end companies including Murata, Huawei, and Vivo Mobile, as well as many Chinese IP leaders (ROFS Microsystem, NSI Corp, AAC Technologies, and Sappland).

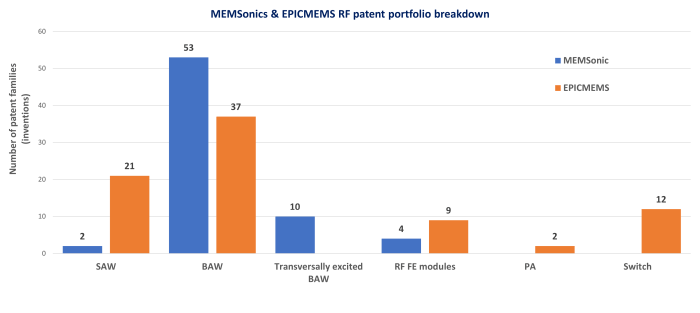

Figure 1 – MEMSonics & EPICMEMS RF patent portfolio breakdown.

MEMSonics: the next Chinese provider of BAW filters?

MEMSonics has built a solid IP portfolio that could contribute to its development in national and international markets. First, the company has patented 69 inventions related to RF filters and modules since its incorporation in 2019. Two of these are connected to surface acoustic wave (SAW) filters, 53 to bulk acoustic wave (BAW) filters, 10 to transversally excited BAW, and 4 to RF front-end modules. Like most newcomers, MEMSonics has specialized its IP activity on one BAW technology. However, the company is one of few to also develop transversally excited BAW: a highly protected technology almost exclusively developed by Resonant (Murata). It is worth noting that MEMSonics filed two SAW-related inventions in 2022. Although minor for now, this IP activity must be monitored to avoid missing the rise of a new SAW IP player. Second, the company just filed its first US patent application (US20220278669) and WO application (PCT procedure). Even if it is only one invention, this overseas IP extension indicates that the company does not intend to limit its activity to China, and highlights its extensive investment in the field of acoustic wave filters. According to MEMSonics, the funds from the round will mainly go towards purchasing more manufacturing equipment to accelerate the mass production of products and further boost the capacity of RF filters. MEMSonics may be the first company in China capable of the independent mass production of BAW filters by the end of 2022. This ramp-up will undoubtedly be supported by an acceleration of their patenting activity to, at the very least, protect their national position.

The patenting activity of MEMSonics shows that the company is developing BAW components that can be made of ScAlN, the core technology of which relies on two critical points: electrode shape and process method (CN113810010). The contour of the orthographic projection of MEMSonics electrodes is formed by a curved line. This design reduces the risk of cracks forming during polishing or when mechanical stress is applied (CN113904653, CN113810016). In terms of preparation method, MEMSonics patents describe solutions to improve the electromechanical coupling coefficient of the film bulk acoustic resonator by reducing discontinuity at the border of the electrodes (CN216649646, CN113328722).

Figure 2 – Most notable players citing the MEMSonics patent portfolio.

EPICMEMS: a broader portfolio targeting the RF FE module segment

The EPICMEMS patenting activity technology coverage is also very broad with, contrary to MEMSonics, IP not only describing acoustic wave filters (21 patent applications related to SAW technology, 37 to BAW technology, and 3 to RF acoustic wave filter package applications), but also power amplifiers (2 patent applications), RF switches (12), and RF front-end modules (9). The EPICMEMS patent portfolio of 82 inventions is quite remarkable because of its extensive technological coverage: the strategy of an IP newcomer is usually focused on one or two technologies only (as is the case with ROFS Microsystem, Samsung Electro Mechanics, and Akoustis). Even long-standing players such as Murata and Skyworks were slow to broaden their IP activity to BAW technology. In addition, EPICMEMS has already started to extend some of its patents outside China: notable activity for a Chinese newcomer. With 11 WO patent applications (PTC procedure) and 5 US patent applications and such a large IP portfolio, the company’s ambition is clear.

The EPICMEMS patent portfolio for acoustic wave filters is well-balanced between SAW and BAW technology. For SAW components, the company patents describe different interdigital transducer (IDT) structures to suppress the parasitic transverse mode (CN215871344, CN215871343). As for BAW components, EPICMEMS has developed IP on BAW structures with a reflection layer to achieve improved wave confinement (CN212115279, CN111669147, CN210405246). According to its recent patent applications, other EPICMEMS developments include the use of a pillar centered in the middle of the cavity that lowers the impact of external stress on the resonant frequency of a device, thereby being suitable for applications with a high-frequency stability requirement (WO2020/124369, CN109687835). Thanks to its solid expertise in both technologies, EPICMEMS has also developed IP on a hybrid acoustic filter where a SAW and BAW component are co-integrated on the same substrate, so the surface of the filter is reduced (US10958236). It is worth noting that—despite its extensive patenting activity—EPICMEMS patents do not claim any SAW components based on piezoelectric-on-insulator (POI) substrate or BAW components using ScAlN active layer, which are today’s most innovative approaches.

Figure 3 – Most notable players citing the EPICMEMS patent portfolio.

Check out all of KnowMade’s analysis on this topic: RF & Wireless communications patent landscapes.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Paul Leclaire, PhD. Paul works for KnowMade in the field of MEMS, Sensors, and RF technologies. He holds a PhD in Micro and Nanotechnology from the University of Lille, France, in partnership with IEMN in Villeneuve-d’Ascq and CRHEA-CNRS in Sophia-Antipolis. Paul previously worked at an innovation strategy consulting firm as a consultant.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specializing in the analysis of patents and scientific information. It helps innovative companies and R&D organizations understand their competitive landscape, follow technology trends, and discover opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technical expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented reports for decision-makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence, and freedom-to-operate analysis. In parallel, the company proposes litigation/licensing support, technology scouting, and an IP/technology watch service.

KnowMade has solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.