SOPHIA ANTIPOLIS, France – December 5, 2023 │ Knowmade is releasing a new GaN intellectual property (IP) report providing a deep dive into the power GaN and RF GaN electronics patents worldwide. In this report, both power GaN and RF GaN patent landscapes have been analyzed in a view to describe the global IP competition across the whole supply chains and the local ecosystems emerging to support the industrialization of GaN technologies.

More and more players exhibit a common IP strategy for power GaN and RF GaN technologies

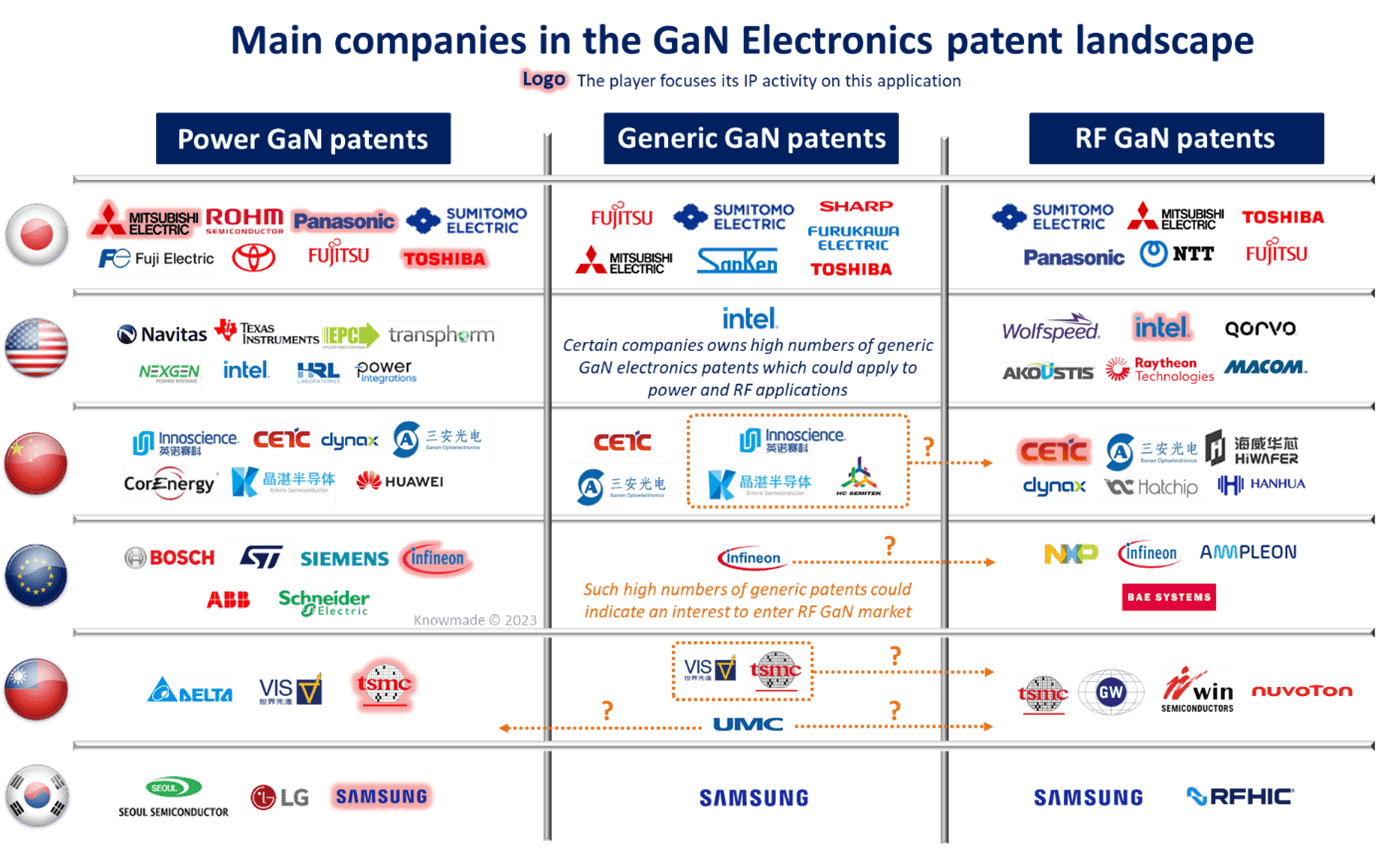

In addition to power GaN and RF GaN patents, KnowMade’s GaN Electronics IP report considers the impact of generic GaN electronics patents, applicable to both power and RF applications, on the global IP competition (Figure 1).

Figure 1: Main companies in the GaN electronics patent landscape.

For instance, some companies, such as United Microelectronics Corporation (UMC), don’t limit the application scope in most of their GaN electronics inventions, showing a common IP strategy for both RF and power markets. What’s more, well-established power GaN market players, such as Infineon Technologies and Innoscience, own high numbers of generic GaN electronics patents, that could be leveraged for RF applications in the next few years.

Power GaN patent landscape: a focus on national and regional ecosystems

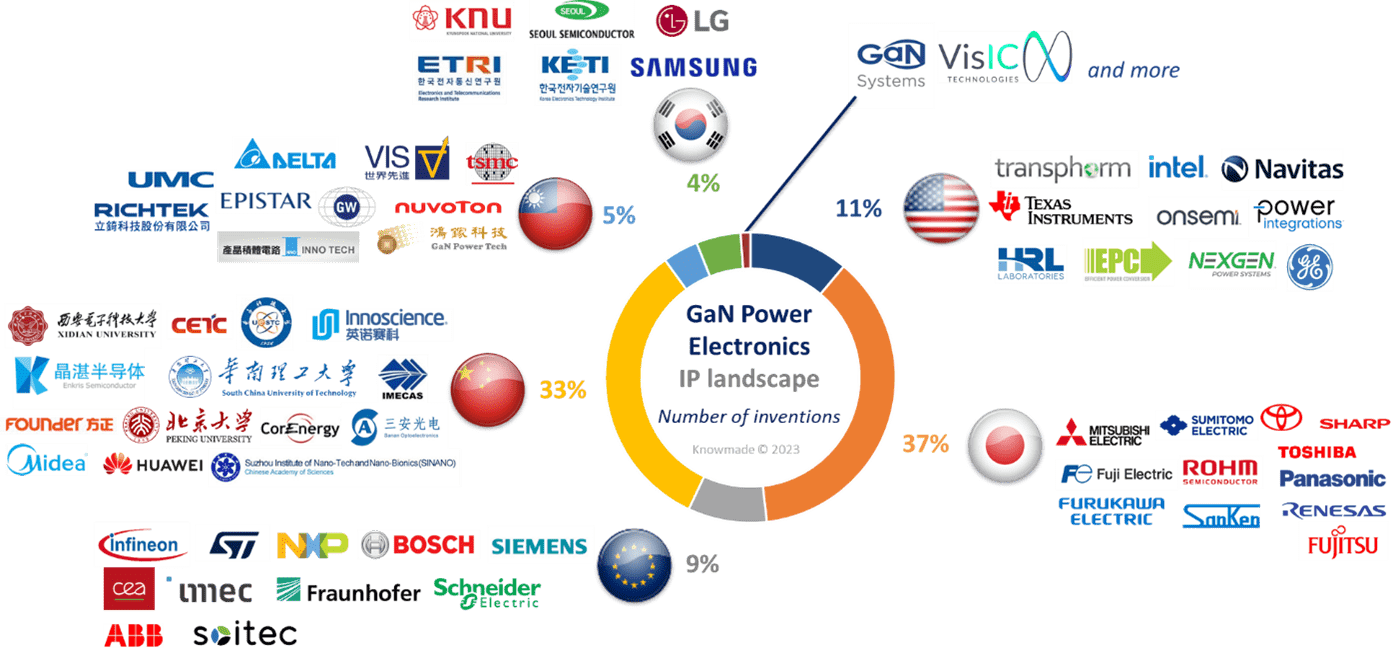

The inventive activity used to be dominated by Japanese players (2001 – 2015) until Chinese players took over the IP leadership in 2016. As a result, Japanese and Chinese players have produced more than 70% of all power GaN inventions together (Figure 2). Such intensive patenting activities are eclipsing important IP trends occurring in other regions (US, Europe, etc.). KnowMade’s GaN Electronics report unveils such IP trends providing separate analyses of the regional ecosystems in the power GaN patent landscape.

Figure 2: Main players in the power GaN patent landscape, split by country.

The GaN Electronics Patent Landscape report points out that most of the historical Japanese IP players are focusing on monetizing their power GaN IP portfolios (Sharp, Furukawa Electric, NTT, Fujitsu). Few of them are still actively filing patent applications to consolidate their IP position, but Fujitsu and Panasonic, in different parts of the supply chain. However, new Japanese IP leaders such as ROHM and Sumitomo Chemical are now aiming to turn their IP leadership into market leadership.

Taiwanese players are rising in the power GaN IP landscape, with most of the main Taiwanese foundries ramping up their activities across the power GaN supply chain, following TSMC’s lead. The Taiwanese IP activities highlight a reinforcement of the domestic supply chain for power GaN technology, with major players actively filing patents in the upstream supply chain (e.g., GlobalWafers) and accelerating their patent filings in the downstream supply chain (e.g., Delta Electronics). What’s more, several newcomers have entered the power GaN IP landscape in Taiwan lately.

The US-China trade war adds a new dimension to the power GaN IP competition, urging players to adapt their strategy in a view to secure the development of their power GaN activities internationally. In this context, several Chinese players such as Innoscience and Huawei are expanding their IP activities worldwide, looking to compete in the US and European markets.

Most of the main US market players don’t have a complete IP coverage of the power GaN supply chain. Instead, US players leverage IP and manufacturing partnerships and/or existing IP and know-how developed for other power semiconductor technologies (Si, SiC). According to their own patenting activities, main US market players are consolidating their own IP position in Asia and Europe, to support the development of their market activities outside the US.

Infineon is the main vertically integrated innovator in the power GaN IP landscape, with a global IP strategy aiming to cover the main important regions for power electronics. Since 2015, Infineon has successfully leveraged multiple acquisitions (GaN Systems, International Rectifier) and IP partnerships (Panasonic) in a view to accelerate its strategy in the power GaN market. In Europe, major research organizations (Cea, imec, Fraunhofer) are driving the establishment of a domestic supply chain, leading to the establishment of new startup companies, and to the emergence of more vertically integrated innovators such as STMicroelectronics.

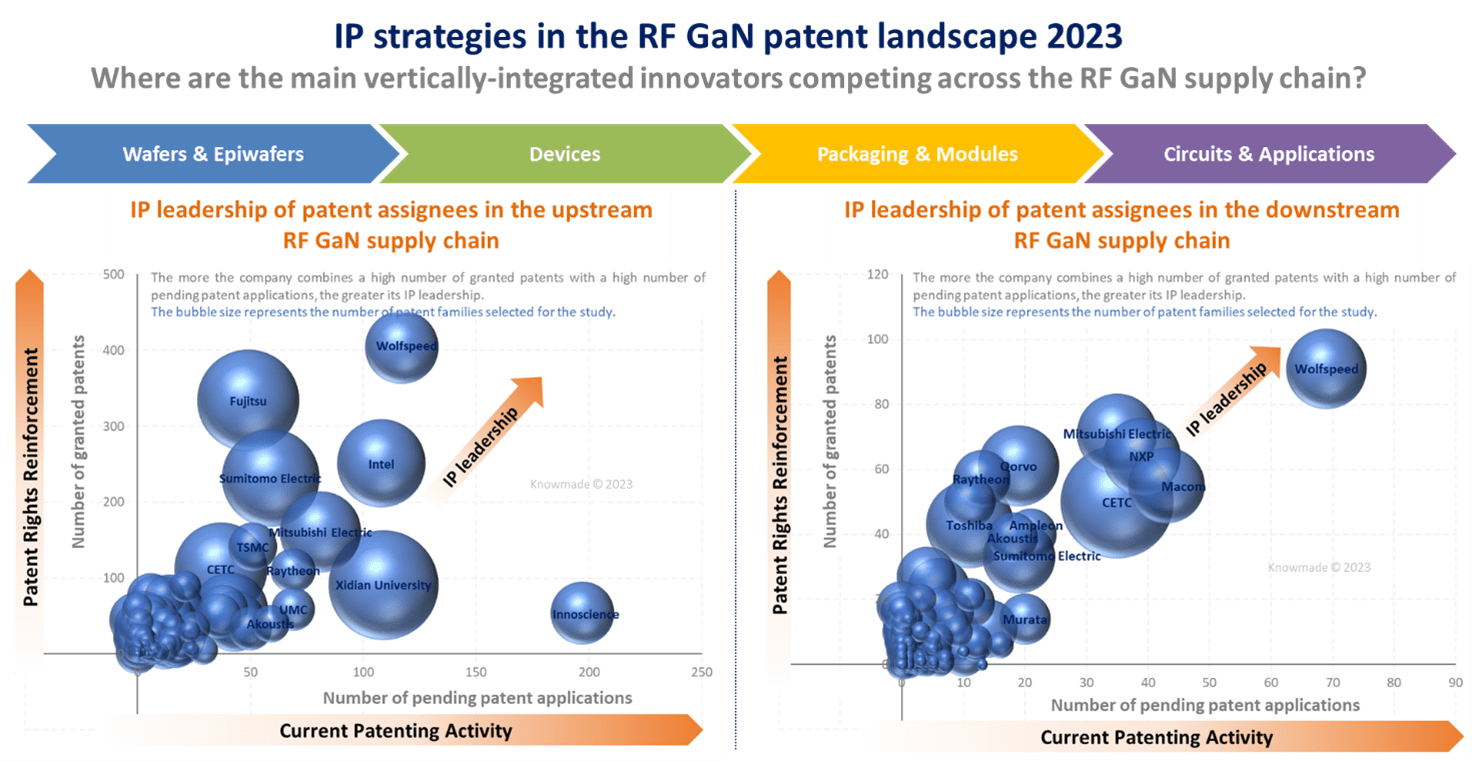

RF GaN patent landscape: a look into the IP strategies of key players across the supply chain

The GaN Electronics Patent Landscape report highlights different views from RF GaN market players about what innovation will be critical to protect in order to impact the future RF GaN supply chain (Figure 3). For instance, several incumbent players in the RF GaN market seem to consider wafer and epiwafer IP as less critical, while others, such as Sumitomo Electric, Raytheon and Mitsubishi Electric, are still competing in this IP space. Most vertically integrated players identified in this report are still focusing on the IP related to RF GaN devices. In this regard, NXP stands out as it soon shifted its focus to the downstream supply chain. It was followed by most of the main RF GaN market players which are now consolidating their IP position in packaging, modules, circuits and applications.

In recent years, Wolfspeed has taken over the IP leadership across the whole RF GaN supply chain, except for wafers and epiwafers (Figure 3). Just like Wolfspeed, MACOM has been actively filing patents across the RF GaN supply chain. Yet unlike Wolfspeed, MACOM’s IP activity did not translate into a global IP leadership. With the acquisition of Wolfspeed’s RF business, MACOM is expected to catch up with the competition in the global RF GaN IP landscape. Interestingly, this acquisition virtually positions MACOM as an undisputable IP leader for circuits and applications. Another stand-out player emerging in the RF GaN patent landscape is Mitsubishi Electric: it is currently the only vertically integrated innovator which is still competing across the whole RF GaN supply chain.

In contrast with the power GaN patent landscape, US players have established a complete IP coverage of the RF GaN supply chain and this IP ecosystem have been reinforced by many startup companies actively filing patent applications in different part of the supply chain during the last decade (Akoustis, Akash Systems, Eridan, Finwave, etc.). The analysis of their IP strategies shows that US companies are now expanding their patenting activities outside the national territory, especially in Europe, China and Taiwan, to support their international ambitions in the growing RF GaN market.

Figure 3: IP leadership of patent assignees in the upstream part (wafers, epiwafers, devices) and the downstream part (packaging, modules, circuits, applications) of the RF GaN supply chain.

In the wafer and epiwafer IP space, the competition is now taking multiple and different directions: GaN-on-Si (IQE, Shin Etsu), GaN-on-diamond (RFHIC, Akash Systems), GaN-on-engineered substrates (Soitec, Qromis, Shin Etsu), GaN-on-AlN (Fujitsu), in addition to the mainstream GaN-on-SiC platform (Sumitomo Electric, Sumitomo Chemical). Regarding the GaN-on-Si platform, the GaN Electronics IP report highlights a reduction in patent filings from most well-established IP players. In this context, Intel continues to lead the competition in the RF GaN-on-Si IP landscape, especially for RF GaN-on-Si devices. Aside from Intel, MACOM and TSMC are the main established IP players still actively filing patent applications for RF GaN-on-Si technology. Interestingly, the other Taiwanese foundries are following TSMC’s lead. What’s more, many power GaN IP players were seen to file RF GaN patent applications lately (Innoscience, Infineon, ST), indicating the development of RF GaN devices in a view to enter the RF telecom market with GaN-on-Si and/or other unconventional platforms such as engineered substrates (Qromis-VIS) or semi-insulating SiC on conductive SiC substrates (ROHM).

For a decade, Knowmade has investigated the full spectrum of GaN technology providing numerous GaN IP reports in optoelectronics, RF, and power electronics. What’s more, Knowmade’s GaN newsletter and patent monitoring services provide you with the latest updates on GaN technology and the flexibility to focus on the most critical aspects depending on your markets and your position in the value chain.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Rémi Comyn works for KnowMade as a Patent Analyst in the field of Compound Semiconductors and Electronics. He holds a PhD in Physics from the University of Nice Sophia Antipolis (France) in partnership with CRHEA-CNRS (Sophia Antipolis, France) and the University of Sherbrooke (Québec, Canada). Rémi previously worked in compound semiconductors research laboratory as Research Engineer.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.