SOPHIA ANTIPOLIS, France, November 03, 2025 │ Skyworks Solutions, Inc. and Qorvo, Inc. announced on October 28, 2025, a definitive agreement to merge in an all-cash and stock transaction valued at approximately $22 billion, creating a new U.S.-based leader in high-performance RF and mixed-signal solutions. The combined company is expected to generate about $7.7 billion in annual revenue and $2.1 billion in adjusted EBITDA, with projected annual cost synergies of at least $500 million within three years. Approved unanimously by both boards, the merger aims to strengthen U.S. manufacturing capacity and expand reach across mobile, defense, automotive, and connectivity markets.

According to KnowMade’s patent intelligence, the merger holds major significance for the RF front-end components sector. Together, Skyworks and Qorvo hold a total of about ten thousand granted and pending patents., the vast majority of which are related to RFFE technologies, forming one of the world’s most comprehensive intellectual property (IP) portfolios in RF front-end modules and components, including filters, power amplifiers (PA), low-noise amplifiers (LNA), switches, and antenna tuning devices. The combination unites two complementary patent ecosystems and strengthens coverage across key jurisdictions such as the United States, Japan, China, Europe, and South Korea, reinforcing the new company’s position as a globally dominant RF front-end IP powerhouse.

Two Decades of RF Innovation: Patent Evolution and Legal Strength at Skyworks and Qorvo

According to KnowMade’s patent intelligence, both Skyworks and Qorvo demonstrate sustained and complementary innovation in RF front-end components, with patent portfolios that continue to grow across key technologies such as filters, power amplifiers, LNA, and switching devices.

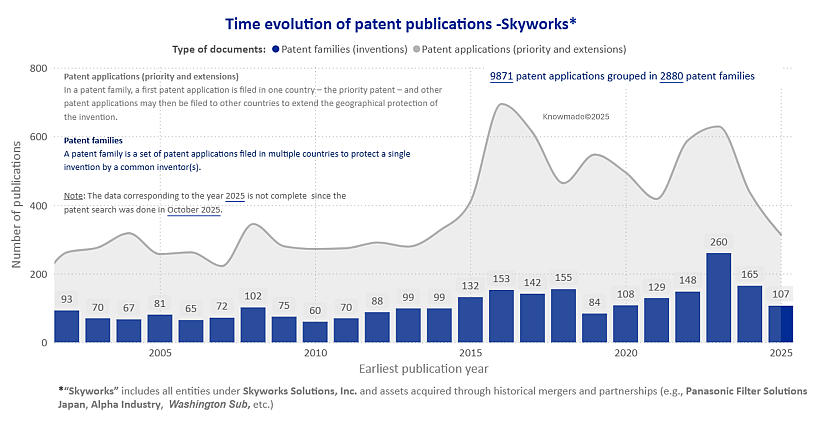

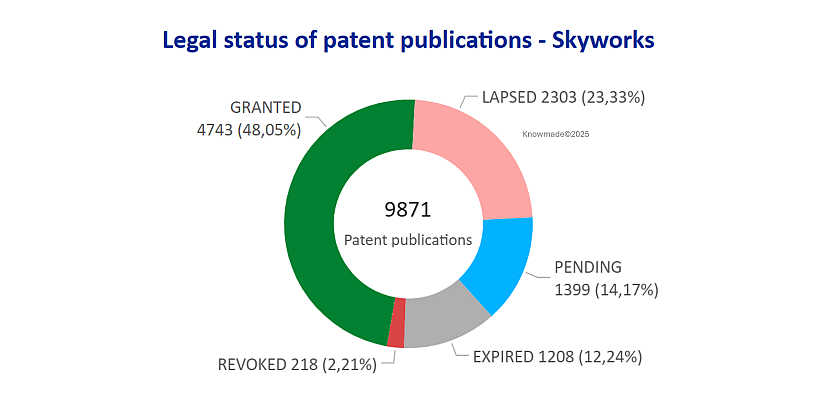

Skyworks shows steady patenting activity over the past two decades, with clear peaks around 2015 and 2023 that reflect intensive development of BAW and SAW filter technologies, power amplifiers, and RF module integration. As of October 2025, the company holds more than 9,800 individual patents grouped into over 2,800 patent families, of which approximately 85% are directly applicable to RF front-end technologies. Nearly half of these patents (48%) are in force, while about 1,400 applications (14%) are still pending, indicating that Skyworks maintains a strong and up-to-date patent base in the RF front-end domain.

Figure 1: Time evolution of patent publications – Skyworks

Figure 2: Legal status of patent publications – Skyworks

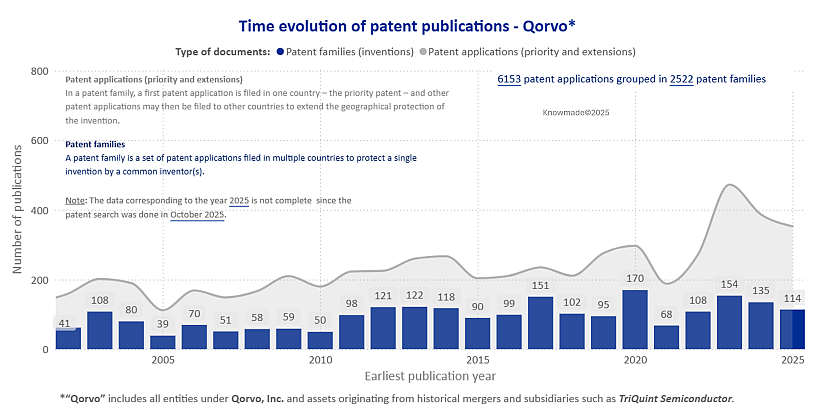

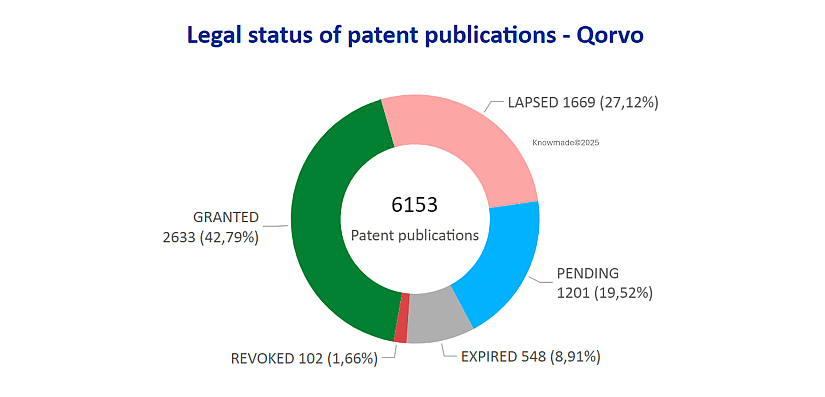

Qorvo, including its historical entities such as TriQuint Semiconductor and RF Micro Devices (RFMD), presents a stable and growing IP activity. As of October 2025, Qorvo holds more than 6,100 individual patents grouped into more than 2,500 patent families, with 43% granted patents and 20% pending applications. Nearly 80% of these patents are directly applicable to RF front-end technologies, highlighting Qorvo’s sustained commitment and specialization in RF domain.

Figure 3: Time evolution of patent publications – Qorvo

Figure 4: Legal status of patent publications – Qorvo

Together, the two companies represent more than 16,000 patent publications grouped into 5,400 patent families, illustrating a combined IP base that covers the entire RF front-end value chain from filtering and amplification to switching and antenna tuning. This complementary evolution and balanced legal status distribution reinforce the merged company’s ability to sustain technological leadership and long-term innovation within the global RF components industry.

RF Front-End Module and Component Patent Distribution and IP Leadership

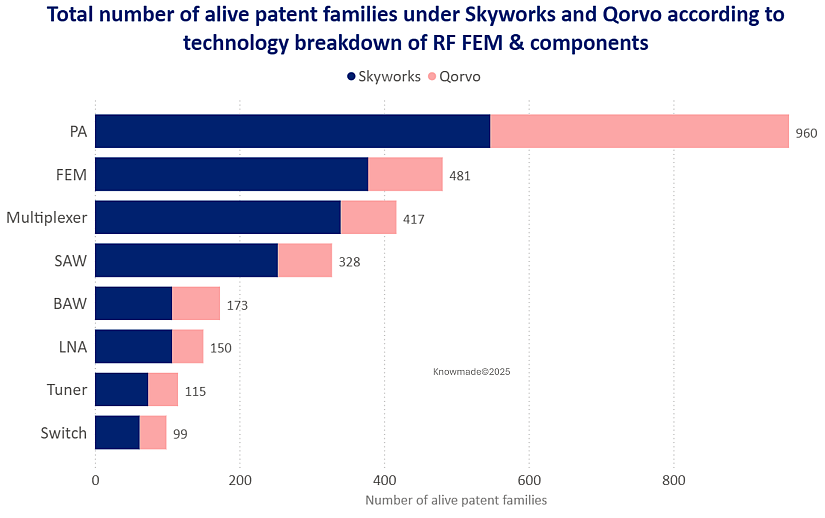

According to KnowMade’s patent intelligence, the combined Skyworks and Qorvo patent portfolio covers the entire value chain of RF front-end modules and components, showing both scale and technological complementarity. The analysis of alive patent families demonstrates that the two companies occupy distinct yet synergistic positions within the RF ecosystem.

However, KnowMade’s RF Front-End Modules & Components Patent Monitor indicates that both Skyworks and Qorvo experienced a period of relative slowdown in patenting activity over the past year, as competition in the RF front-end domain intensified. Emerging Chinese RF companies such as RoadRock, Maxscend, Lansus, Newsonic, Vanchip, MEMsonics, NSI Corp., Honor, and OPPO have been expanding their IP footprints rapidly, putting growing pressure on traditional U.S. players across multiple technology domains. This merger, therefore, represents not only a strategic consolidation but also a strong comeback for both companies. KnowMade has already detected early signs of this rebound in its Q3 2025 Patent Monitor, where Skyworks re-emerged as the second-ranked assignee worldwide for newly published and newly granted RF front-end patents, just behind Murata, signaling a renewed commitment to innovation and IP leadership.

Power Amplifier Technologies

The largest share of active patent families is related to power amplifiers (PA), totaling 960 families, where Qorvo contributes a dominant portion through its long-standing expertise in GaN high-power technologies, particularly in ultra-high-band (UHB) PA modules.. This strong foundation in high-frequency and high-power design enables the company to serve demanding applications such as base stations, radar, and defense systems, highlighting its leadership in high-power and high-linearity architectures.

Meanwhile, Skyworks demonstrates strong leadership in in low- and mid-band PA modules, focusing on high-efficiency, system-integrated PA designs optimized for mobile, Wi-Fi, and connectivity platforms. This reflects its core strength in compact, multi-band front-end module (FEM) architectures and reinforces its technological leadership in consumer and connectivity markets.

According to KnowMade’s RF patent monitor, both companies have been advancing on parallel tracks in the PA domain, facing intensely competitive IP battles against major rivals such as Murata and Samsung, as well as China’s emerging RF players including Vanchip, Lansus, and OnMicro. Their merger is expected to help the combined company break through this fierce IP race, consolidating their complementary strengths in GaN high-power architectures and high-efficiency integrated PA modules.

Filter Technologies

In front-end module integration, multiplexer, and filter technologies (SAW/BAW), Skyworks and Qorvo together demonstrate complementary leadership. Skyworks takes a leading role, leveraging expertise enhanced by its acquisition of Panasonic Filter Solutions Japan and its vertically integrated TC-SAW and BAW production lines, while Qorvo strengthens the partnership with advanced BAW and SAW architectures, including LowDrift™ and NoDrift™ designs that ensure temperature stability and low insertion loss for high-linearity systems. Both companies are recognized as IP leaders in FBAR technology, second only to Broadcom, and maintain strong patent positions in ML-SAW and TC-SAW designs, providing efficient and cost-effective solutions for low- and mid-band filtering.

According to KnowMade’s RF patent monitor, Skyworks further contributes meaningful IP in high-end TFSAW and XBAR filters, enhancing its competitiveness in next-generation handset architectures, while Qorvo focuses on BAW-SMR high-power filters that deliver the thermal stability and power-handling performance required for massive-MIMO and infrastructure systems.

Together, their complementary strengths create one of the most complete and defensible filter IP portfolios in the global RF front-end market. The merger of Skyworks and Qorvo is expected to propel their combined filter portfolio into the first tier of global IP leadership, posing a significant competitive threat to incumbent giants such as Murata, Qualcomm, and Broadcom, and reshaping the balance of power within the RF front-end ecosystem.

Both companies also show solid patent activity in low-noise amplifiers (LNA), antenna tuners, and switch circuits, ensuring complete coverage of the RF signal path.

Figure 5: Total number of alive patent families, i.e. comprising at least one granted patent or pending application, under Skyworks and Qorvo according to the technology breakdown of RF FEM and components

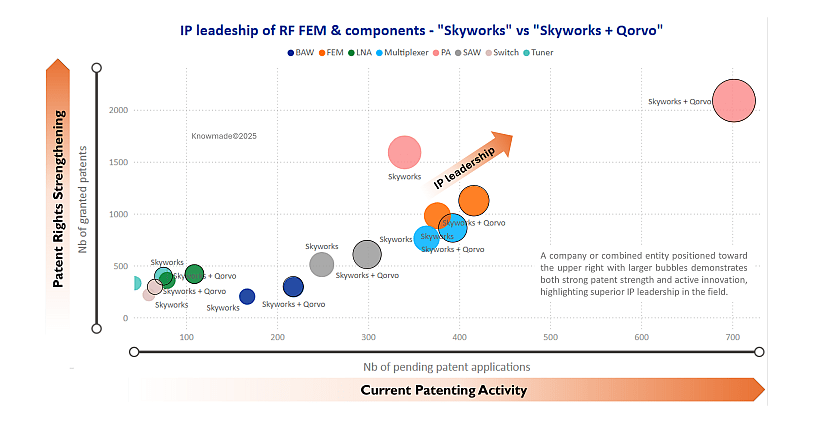

IP Complementarity, Synergies and Leadership

While Skyworks holds a higher share of patents across most component categories, the merger remains highly functionally complementary from an intellectual property perspective. Skyworks strengthens the integration, filtering, and low-noise domains and brings extensive expertise in highly integrated and high-efficiency power amplifiers for mobile and Wi-Fi platforms. Qorvo contributes deep strength in high-power, high-linearity, and signal routing technologies based on GaAs and GaN architectures, as well as a mature portfolio in BAW and SAW filter designs for infrastructure and high-performance applications. Together they cover the full RF signal path from power generation and amplification to filtering, multiplexing, and antenna tuning, creating a unified and coherent IP ecosystem that bridges device-level and system-level innovation.

The IP leadership analysis (Figure 6) further demonstrates this synergy. Each bubble in the chart represents a technology domain, plotted by the number of granted patents (vertical axis) and pending applications (horizontal axis), with bubble size reflecting overall portfolio scale. After the merger, the combined Skyworks + Qorvo positions move consistently upward and to the right, indicating simultaneous gains in patent rights strength and innovation activity.

Figure 6: IP leadership of RF FEM and components – “Skyworks” vs “Skyworks + Qorvo”

The most pronounced improvement appears in power amplifiers, where the combined entity reaches the upper-right quadrant, the region of IP leadership, combining a large volume of granted patents with a strong pipeline of ongoing filings. Significant upward movement is also visible in BAW, SAW filters and FEM, where the balance between mature IP and new filings becomes more robust. Steady improvements are also visible in Multiplexer, LNA, switch, and tuner technologies, showing that the merger strengthens the entire RF front-end value chain.

In KnowMade’s assessment, this pattern captures the essence of the merger’s intellectual property impact. The new company not only expands the scale of its patent portfolio but also strengthens its legal defensibility and sustains strong research and development momentum. The result is a unified RF front-end IP powerhouse that combines Skyworks’ expertise in module integration, filters, and high-efficiency amplifiers with Qorvo’s leadership in high-power devices, advanced filters, and high-linearity architectures. Together they consolidate U.S. innovation leadership across the global RF component industry and establish a new benchmark for next-generation wireless technologies including 5G-Advanced and Wi-Fi 7 and 8.

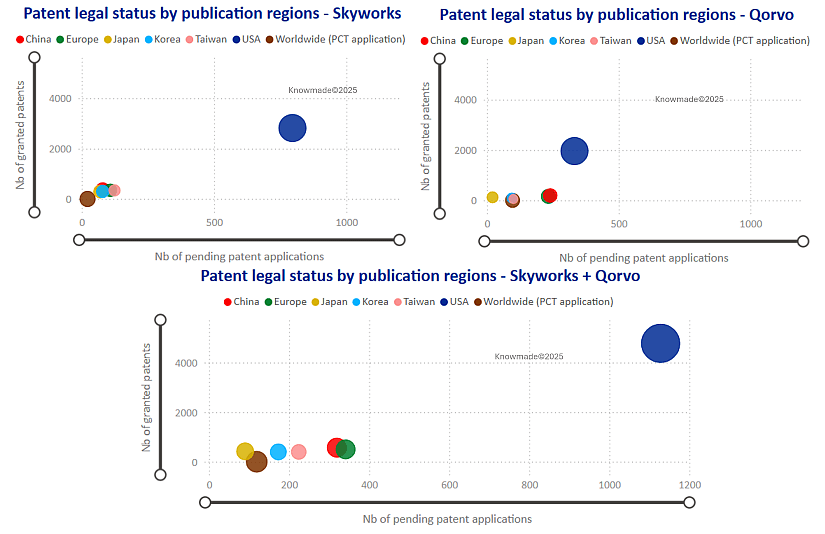

Global Patent Distribution and Strategic IP Coverage

Both Skyworks and Qorvo maintain strong international patent portfolios, but their geographical focuses differ. Skyworks has a broad and balanced IP presence across all key jurisdictions. Its U.S. patent portfolio dominates, with the largest number of both granted patents and pending applications, while Japan, China, Europe, and Korea form smaller but consistent clusters of granted IP rights. Qorvo, though similar in regional structure, shows a relatively denser concentration of patent filings in the U.S., Europe and China. After the merger, the combined Skyworks + Qorvo RF patent portfolio shows clear reinforcement across every major region. As shown in figure 7, the U.S. bubble expands dramatically, indicating a sharp rise in both enforceable patents and pending applications, while China and Europe move upward and rightward on the chart, demonstrating stronger granted IP rights coupled with continued innovation activity. The company also sustains global filings through PCT applications, ensuring flexibility for further international expansion.

Figure 7. Patent legal status by publication regions – Skyworks, Qorvo, and Skyworks + Qorvo

This combined footprint establishes a comprehensive and globally defensible RF front-end IP portfolio, ensuring legal protection in the field and offering strategic leverage to support its ability to operate across major technology markets. The merger not only expands U.S. leadership but also reinforces balanced international coverage, positioning the new entity as a worldwide force in RF front-end intellectual property.

Potential Leadership in the RF Front-End IP Race

Before the merger, Skyworks and Qorvo already stood side by side with global heavyweights such as Murata, Qualcomm, and Broadcom, each commanding strong patent portfolios and technological depth in RF front-end design. Now, through this union, the combined company brings together complementary strengths in filters, power amplifiers, and system-level integration, forming a unified strategic IP ecosystem that could enable it to move ahead of these long-standing rivals.

By consolidation R&D capabilities and IP rights across major jurisdictions, the new entity is equipped to compete directly with traditional industry leaders while also withstanding the accelerating technological and manufacturing rise of China’s RF sector.

This merger therefore represents far more than corporate consolidation, it marks the emergence of a strategically fortified, globally balanced, and innovation-driven RF front-end IP powerhouse. Whether it will ultimately rise above its peers remains to be seen, but one thing is certain: the industry will be watching closely.

📌 Is your organization prepared to monitor these changes, mitigate IP risks, and identify timely licensing or partnership opportunities?

➡️ Explore KnowMade RF patent monitor, RF acoustic wave filters report, custom analysis, and consulting services.

In addition to these public articles, we offer a full suite of in-depth, client-specific deliverables.

Contact us to learn how we can support your strategic positioning.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni Zhou, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on RF front-end systems and advanced sensing technologies. Her expertise also includes the design of radar sensing systems, enabling precise detection in complex and dynamic environments. She is the inventor of over 20 patents and has authored more than 10 scientific publications in the field.

Nicolas Baron, PhD., CEO and co-founder of KnowMade. He manages the development and strategic orientations of the company and personally leads the Semiconductor department. He holds a PhD in Physics from the University of Nice Sophia-Antipolis, and a Master of Intellectual Property Strategies and Innovation from the European Institute for Enterprise and Intellectual Property (IEEPI) in Strasbourg, France.

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.