SOPHIA ANTIPOLIS, France – October 21, 2025 │ The global RF front-end patent landscape continued its rapid expansion in Q3 2025, reflecting both technological acceleration and intensifying strategic rivalry among leading innovators. Knowmade’s Q3 2025 RF Front-End Modules & Components Patent Monitor highlights a quarter of intense global activity, analyzed over 1,200 patent events worldwide, comprising 596 new patent families (inventions), 475 newly granted patents and 182 expired patents, signaling a tightening race among key players from Japan, the United States, and China.

Murata Leads the Global Field and Skyworks is back

Murata remained the top global patent contributor, with the highest number of both new patent families and newly granted patent families among all observed players. The company continues to dominate SAW/BAW and power-amplifier (PA) integration, while leading industry advances in XBAR (laterally excited bulk acoustic resonator) technology, one of the fastest-growing fields in the recent years. This quarter saw a clear rise in XBAR-related patent filings, highlighting the push toward high-frequency, wideband acoustic architectures for 5G and 6G devices. Murata’s latest patents strengthen its position in resonator design, thermal stability, and miniaturized module integration.

Skyworks followed as the second most active patent applicant, showing a clear rebound from the first half of 2025, driven by SAW/BAW and PA innovations, under a U.S.-centric IP strategy.

Global Pending vs. Granted Patent Portfolios

The Q3 2025 patent landscape reveals a strong and balanced pipeline between pending applications and newly granted patents, illustrating how active RF front-end innovation remains across all major regions.

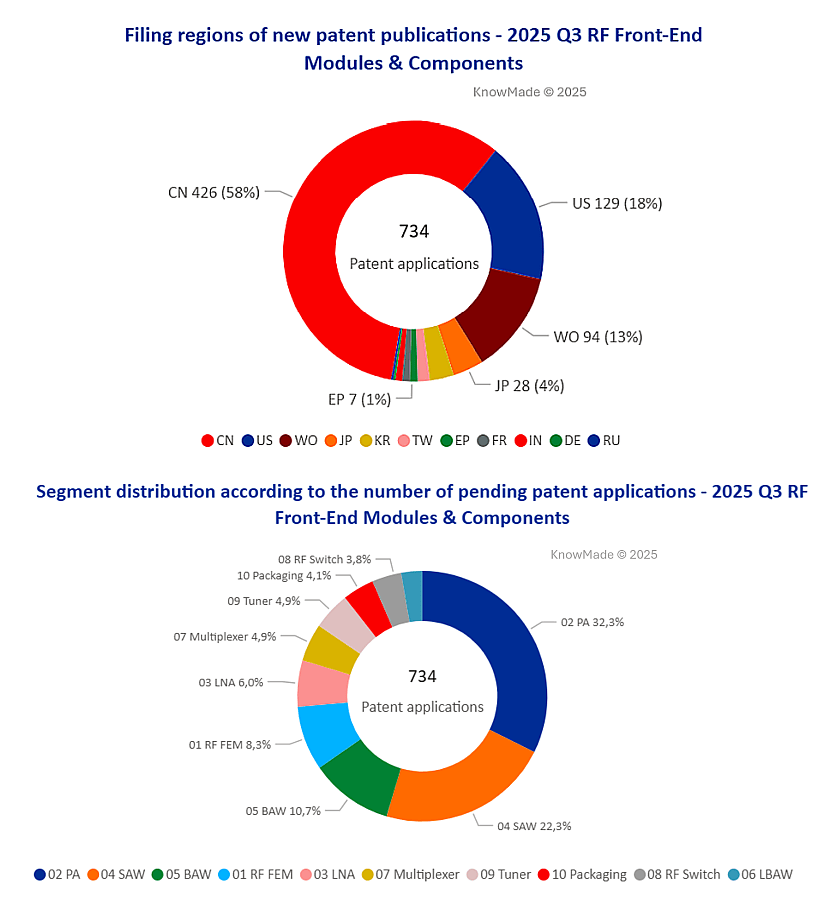

A total of 734 patent applications were published this quarter, dominated by filings in China (58 %), followed by the United States (18 %) and Patent Cooperation Treaty (PCT) application routes (13 %).

From a technology perspective, power amplifiers (PA, 32 %) and surface acoustic wave filters (SAW, 22 %) represent more than half of all pending patent applications, confirming the continued emphasis on high-efficiency, filter-centric architectures.

Figure 1: Filing regions and segmental breakdown of new RF front-end patent applications in Q3 2025.

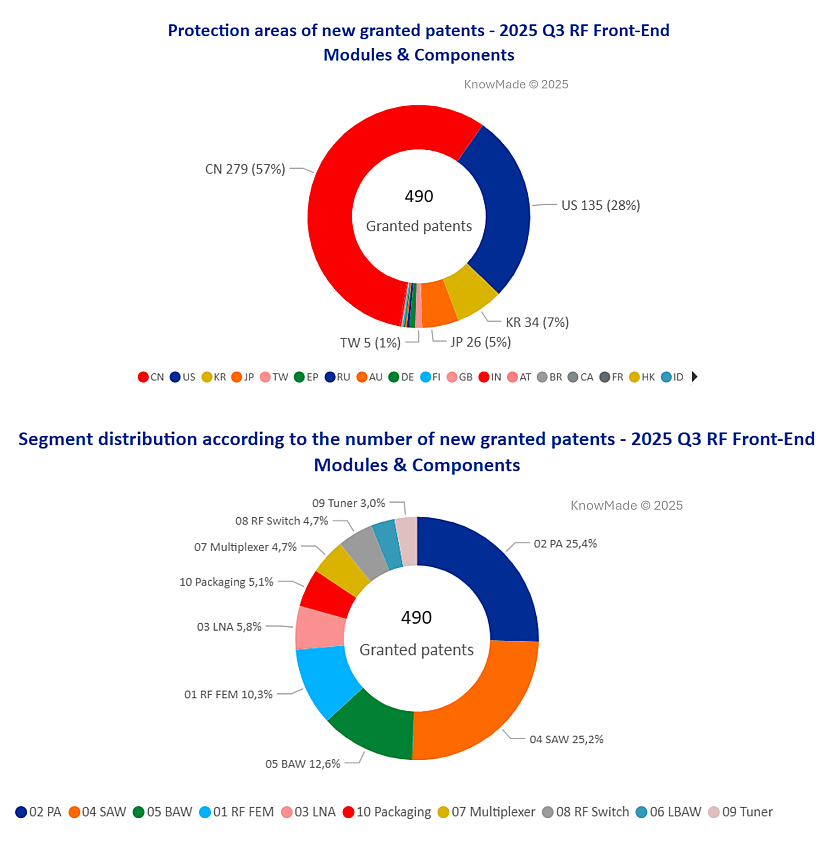

On the granted-patent side, 490 new granted patents were recorded during the quarter. The protection landscape shows China (57 %) as the leading jurisdiction, ahead of the United States (28 %). Technically, PA (25 %) and SAW (25 %) remain the two largest categories, followed by BAW, front-end module and LNA, reflecting the industry’s focus on acoustic filtering and power-amplification efficiency at the module level.

Figure 2: Protection areas and segmental breakdown of newly granted RF front-end patents in Q3 2025.

China’s RF Front-End Landscape Enters a Phase of Fierce Reshuffling

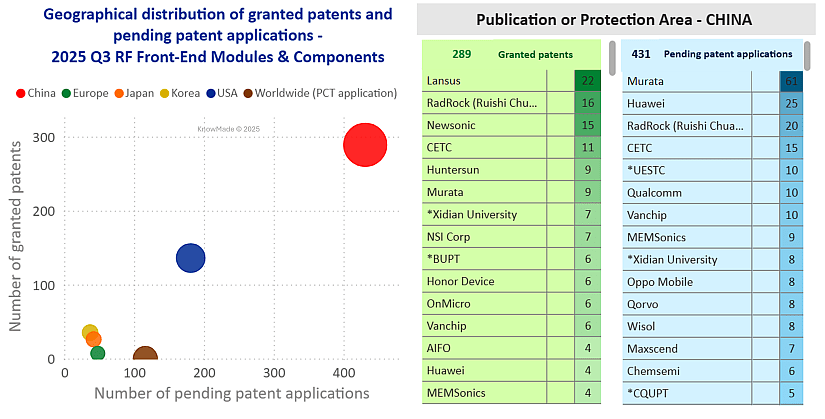

Q3 2025 was marked by intensified IP competition and frequent IP leadership reshuffling within China’s RF front-end ecosystem.

Huawei made a strong comeback, doubling its number of new patent filings from Q2 2025. Its patent portfolio expansion covers acoustic filtering, signal amplification technologies, RF front-end modules, and advanced packaging, with international extensions through PCT routes and U.S. filings.

Lansus rose to the top of the domestic ranking for the first time, leading in newly granted patents (22), followed by RadRock (Ruishi Chuangxin), Newsonic, and CETC. Together, these five companies captured the largest combined total of new patent families and new granted patent families this quarter.

They were closely followed by Vanchip, MEMsonics, NSI Corp, Honor, OPPO, Huntersun, Maxscend, AIFO, Chemsemi and OnMicro, illustrating how domestic rankings shift from quarter to quarter. This dynamic ecosystem reflects China’s broader strategy to expand from discrete filters to integrated RF modules and SoC-level solutions. Notably, Beijing Xinjie Technology (Xuanjie), established by Xiaomi at the end of 2023, emerged as a new entrant in Q3’s RF patent landscape, reflecting early R&D efforts toward system-level RF optimization. The company develops the XRING SoC, Xiaomi’s self-developed smartphone SoC chip.

Importantly, the most active Chinese players are increasingly extending their IP protection beyond domestic borders, with Huawei, Newsonic, and Lansus pursuing U.S. and PCT routes to build globally relevant patent portfolios.

Figure 3: Global distribution of granted patents and pending patent applications for RF front-end modules & components in Q3 2025, and ranking of patent assignees by the number of pending or granted patents in China.

IP Transfers and Collaborations Reshape the Landscape

Q3 2025 also featured strategic IP movements and collaborations. A major transfer of 13 RF switch-related patents from OPPO to Nokia was recorded this quarter, reinforcing Nokia’s RF system portfolio in multi-path switching and antenna integration. The transaction likely stems from an earlier cross-licensing and settlement arrangement between OPPO and Nokia, indirectly confirming that OPPO’s IP assets in this area are viewed as strategically valuable within the industry.

Joint patent filings between China Electronics Technology Group Corporation (CETC), Beijing University of Posts and Telecommunications (BUPT), and Shanghai Jiao Tong University (SJTU) on terahertz reconfigurable antennas and SAW optimization structures underscore the growing co-operation between research institutions and industry players in China’s RF sector.

📌 Is your organization ready to stay ahead of RF front-end IP shifts?

➡️ Explore KnowMade’s RF Front-End Modules & Components Patent Monitor, we offer quarterly updates on:

- Quarterly reports with updates on new, granted, and dead patents

- Insights into key IP players, technology trends, and litigation activity

- Segmented analysis by component type and innovation focus

- Direct access to analysts and tailored Excel databases

🔍 In addition to public insights like this article, we offer client-specific research and strategic support to align with your R&D, IP, or business goals.

Contact us to learn how we can support your strategic positioning.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.