Extracted from: RF Acoustic Wave Filters: Patent Landscape Analysis report | RF Front End Modules and Components for Cellphones report | Smartphone RF Front-End Module Review – Yole Group of Companies, 2017

OUTLINES:

- The upcoming 5G communication technology is creating a new order in the communication market.

- Acoustic wave filter IP dynamics are changing.

- There will be opportunities for low cost competitors in the SAW filter market for low band communications…

SOPHIA ANTIPOLIS, France – November 15, 2017 │ Since 2000 and the development of smartphones, the number of frequency bands used in mobile telecommunication has undergone a huge increase from 4 bands in the 2000’s to more than 30 bands today. To manage this growth, also pushed by the upcoming 5G, RF modules have been widely developed. Today filtering is the strongest growing market among the numerous RF component families dedicated to mobile telecommunication applications, with a US$16 billion revenue by 2022, thanks to the traditional need of new antennas and development of multiple carrier aggregation (1).

“Under this dynamic context, RF acoustic wave filters have appeared as the best solution to achieve filter operations in the sub 6GHz regime” asserts Dr. Paul Leclaire, Patent Analyst at KnowMade. “Indeed, acoustic wave filters offer low manufacturing cost as well as a high level of integration and performances. Up to now, no other technological solution offers a better trade off.”

KnowMade is part of Yole Group of Companies including Yole Développement and System Plus Consulting. The 3 partners are exploring the RF world and propose high added-value analyses focused on this sector. Market trends, companies’ positioning, IP landscape, technology roadmaps, manufacturing processes and related costs have been investigated by Yole Group and are presented in a collection of report.

The latest report is today proposed by KnowMade: RF Acoustic Wave Filters patent landscape analysis. KnowMade has investigated the patent landscape for RF acoustic wave filters including SAW, TC-SAW, BAW-FBAR, BAW-SMR, etc. to describe the related ecosystem. The technology intelligence & IP strategy consulting company has evaluated the IP position of key players through detailed analysis of their patent portfolios, including the legal status of the patents, their geographic coverage, their claimed inventions and their prior art contribution. IP strategy and IP blocking potential are also part of this analysis.

What are the key players involved? What are their IP positions? How will the IP landscape evolve? IP dynamics are changing and KnowMade’s analysts, combined with Yole Développement and System Plus Consulting expertise, put the RF acoustic wave filter players and their strategy in the spotlight.

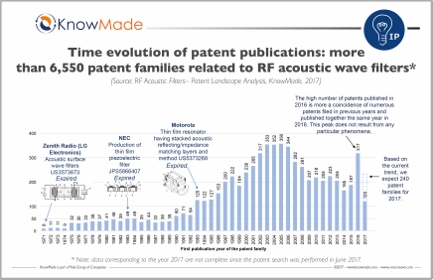

Acoustic wave filters patenting activity was very high between 2000 and 2006. Since then, it has progressively decreasing and reached a plateau since 2010. The market is dominated by historical players with a strong international position that strongly reduce the penetration of new comers in this industry. Between 2017 and 2022, 8% CAGR is expected: acoustic wave technology has become the best way to deliver high performance, small and low-cost filters in analog RF communication.

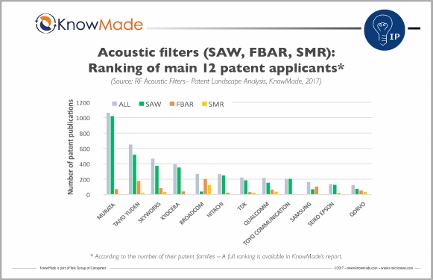

The IP landscape is showing the same evolution, dominated by a limited number of large companies including Broadcom, Skyworks, Taiyo Yuden, Murata and more. After the fast growing period of 2000-2006, acoustic wave filter players have consolidated their position. The recent and numerous mergers and acquisitions have led to the strengthening of players portfolios. Broadcom’s acquisition by Avago Technologies is one good example. Moreover, as 5G communication protocols take shape, players are now developing filters that will address the requirements of the upcoming sub 6GHz applications and future 5G mass market.

SAW is the main technology use in mobile telecommunication. Patenting activity started in the early 90’s and IP players are now well established. The IP activity is driven by Murata Manufacturing thanks to its impressive number of granted and pending patents.

BAW patenting activity is showing more dynamism compared to SAW market segment. Broadcom has the strongest portfolio also consolidated thanks to its acquisition by Avago Technologies. BAW IP landscape is less established than SAW one and KnowMade’s analysts expect a reshaping of this market segment during the next 5 years due to the race between the main IP challengers. For example both companies, Qualcomm and Qorvo are showing interesting IP activities focused on the 4G to 5G transition. This strategy will probably reshuffle the BAW IP landscape and enhance the competition.

In the 1990s, SAW filter patent publications grew rapidly, heralding the development of the RF acoustic wave filter market in the 2000s. Since 2010, the market has consolidated, while we have witnessed of the flattening of the patent activity growth and the strength of the IP position of several companies. It is now essential to understand the RF acoustic filter patent landscape, the key patented technologies and players’ IP positions. Such knowledge can help anticipate the upcoming revolution, detect business opportunities, mitigate risks and make strategic decisions to strengthen one’s market position…

Yole Group of Company including KnowMade, System Plus Consulting and Yole Développement is definitely involved in the RF FE Front-End industry. Based on its market, technology, patents, reverse engineering and manufacturing costing expertise and its knowledge of the “More than Moore” industry, analysts are answering the industry questionings with a comprehensive collection of reports.

Source:

(1) RF Front End Modules and Components for Cellphones report, Yole Développement, 2017

KnowMade’s expertise: RF technologies patent landscapes.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About our analyst

Olivier Thomas, MSc, Olivier works at Knowmade in the field of Biotechnology and Life Sciences. He holds an MSc in Molecular and Cellular Biology from Paris VI University (France). He also holds an Industrial Property International Studies Diploma in Patents and Trademarks from the CEIPI (Strasbourg, France).

About Knowmade

Knowmade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

Knowmade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

Knowmade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.