SOPHIA ANTIPOLIS, France – October 16, 2025 │ The therapeutic mRNA field is accelerating with strong innovation and expanding global interest. The Q3 2025 edition of KnowMade’s Therapeutic mRNA patent monitor reveals key insights into new patent publications and granted patents, spotlighting the top players, emerging technologies, and regional trends shaping the future of RNA-based therapeutics.

Surge in New Patent Publications Highlights Global Momentum

In Q3 2025, 190 new patent applications were published in the therapeutic mRNA domain, confirming the field’s dynamic expansion and sustained global investment. This represents a moderate decrease from Q1 2025, which recorded 257 new patent applications, a figure previously noted as a historical peak. Despite the slight decline, Q2 continues to reflect high innovation output, particularly in RNA delivery, optimization, and formulation.

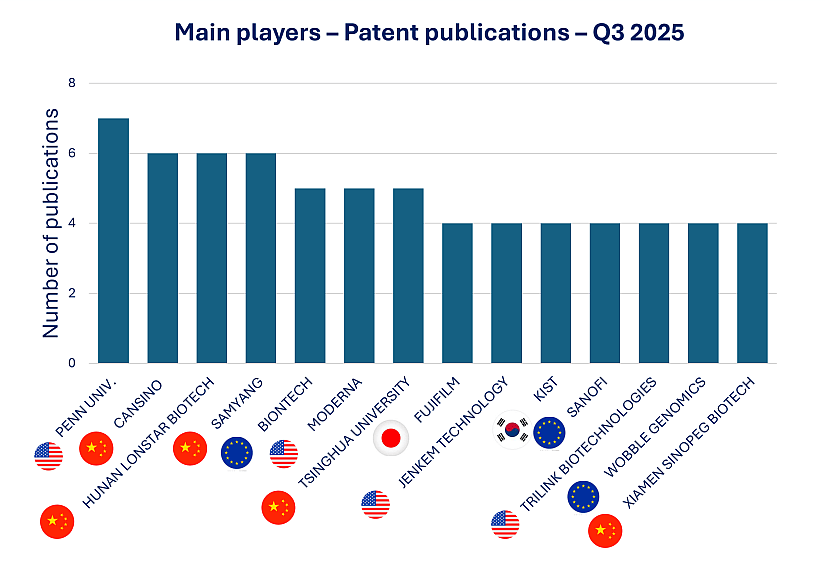

Importantly, 20% of Q2 publications were attributed to the top ten assignees, highlighting the strategic efforts of leading organizations to secure intellectual property. An in-depth analysis of the most active contributors, defined as those with four or more patent publications during the quarter, revealed 14 major players from five countries: five based in China, four in the United States, three in Europe, one in Japan, and one in South Korea. This international distribution reflects the increasing globalization of mRNA R&D activities, echoing trends highlighted in both Q4 2024 and Q1 2025 press release of KnowMade patent monitoring service.

Figure 1: Q3 2025 Patent Filings by Key mRNA Therapeutics Innovators

The University of Pennsylvania (Penn) leads this quarter with 7 newly published applications. As previously emphasized in our Q1 2025 report, Penn has emerged as a key academic driver of therapeutic mRNA innovation. Its leadership underscores the central role of U.S. academic institutions in IP generation, particularly in mRNA design.

BioNTech (Germany) and Moderna (USA) follow with 5 patent applications each, tying for fifth place. These two companies remain anchor players in the mRNA ecosystem, as consistently highlighted across KnowMade IP monitoring service.

Sanofi, with 4 new publications, demonstrates steady growth in its RNA-related portfolio. Following its acquisition of Translate Bio, Sanofi has gained a recurring presence in top rankings, as noted in both Q1 and Q2 2025. This signals its rising position in the competitive landscape of RNA therapeutics, supported by a clear integration of Translate Bio’s platform into Sanofi’s global R&D strategy.

CanSino Biologics, the leading Chinese contributor this quarter, also maintains its visibility in the mRNA innovation space. First noted for its adenovirus-based COVID-19 vaccine, CanSino has since expanded into mRNA research and delivery systems, contributing to China’s growing share of mRNA patent filings, a trend already identified in previous quarterly reports.

These trends in Q3 2025 reaffirm the strong momentum in therapeutic mRNA innovation, led by a mix of academic pioneers and industrial frontrunners. While established players like Penn, BioNTech, Moderna, and Sanofi continue to anchor the field, the growing presence of Asian assignees marks a significant shift in the global innovation landscape. With five of the top 14 contributors now based in China, and CanSino Biologics emerging as a leading applicant, Asia is increasingly shaping the future of RNA-based therapies. This evolution underscores the importance of global IP monitoring to anticipate emerging technologies, competitive dynamics, and regional investment strategies in the mRNA therapeutics space.

Strategic Growth in Granted Patents: Q3 2025 Highlights

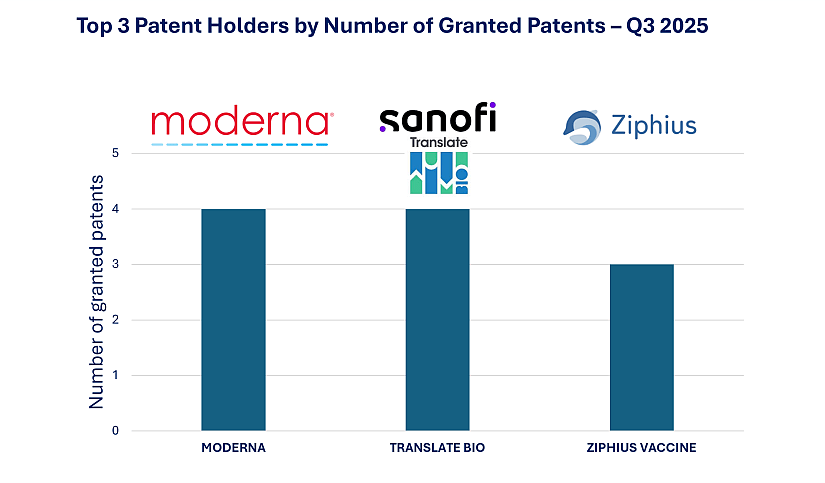

The second quarter of 2025 reflects the continued consolidation of intellectual property among leading innovators in the mRNA therapeutics field, with 50 newly granted patents identified. This press release highlights the top three assignees, Moderna, Translate Bio (Sanofi), and Ziphius Vaccines (see Figure 2 below), who secured the highest number of new patent grants this quarter. Their intellectual property portfolios cover major jurisdictions and reinforce their strategic leadership in delivery technologies, formulation methods, and therapeutic mRNA platforms.

Figure 2: Top 3 Patent Holders by Number of Granted Patents – Q3 2025

The second quarter of 2025 saw continued strengthening of intellectual property positions across key players in the mRNA therapeutics landscape. Moderna, a U.S.-based leader in mRNA-based vaccines and therapeutics, secured 4 new granted patents stemming from 4 distinct patent families. These include two U.S. patents, one Japanese patent, and one U.S. grant co-owned with the Fundación para la Investigación Médica Aplicada (FIMA) in Pamplona, Spain. This latest activity builds on the company’s momentum from Q4 2024, where Moderna was already recognized for expanding its enforceable rights across major jurisdictions.

Also advancing its IP strategy, Translate Bio (a Sanofi-acquired company specializing in mRNA therapeutics) was granted 4 patents during Q2, with three in Japan and one in the United States. Two of the Japanese newly granted patents focus on processes for preparing mRNA-loaded nanoparticles. This recent wave of granted patents confirms the strategic value of Sanofi’s acquisition, which has positioned the French pharmaceutical giant as a frontrunner in the mRNA therapeutics field. In previous quarters, Sanofi had already emerged among the top filers, most notably in Q1 2025 with 12 new mRNA-related patent applications, demonstrating its consistent investment in RNA technologies. The successful integration of Translate Bio’s proprietary platforms and Sanofi’s global R&D capabilities is now yielding enforceable IP assets, strengthening Sanofi’s competitive edge in both vaccine development and therapeutic applications.

Ziphius Vaccines, a Belgian biotech founded in 2019, focuses on self-amplifying RNA (saRNA) vaccine and therapeutic platforms delivered via proprietary lipid nanoparticle (LNP) systems. In Q3 2025, Ziphius secured 3 European patents from separate families, all related to LNP technologies. These additions reinforce its specialization in delivery systems. Further underscoring its commitment to translational success, Ziphius partnered with UZ Ghent to establish one of Europe’s first public-private GMP manufacturing platforms for saRNA vaccines, ensuring scalability and regulatory alignment of its pipeline. These new IP grants not only affirm technological leadership but also signal growing global ambitions. Whether through cross-border co-ownership, public-private manufacturing initiatives, or advanced delivery platforms, the field of mRNA therapeutics is moving rapidly toward mature, protected, and scalable solutions.

Why subscribe to this monitor?

With 190 new patent publications and 50 granted patents recorded in Q3 2025 alone, the therapeutic mRNA sector continues to demonstrate fast-paced innovation and growing global competition. In this rapidly evolving environment, having real-time visibility into the intellectual property landscape is essential.

KnowMade’s Therapeutic mRNA Patent Monitor delivers actionable insights into key players, emerging technologies, and global IP trends—as shown by the rise of Asian assignees, the continued leadership of institutions like Penn and BioNTech, and strategic moves by companies such as Sanofi and Ziphius. Our tailored patent intelligence services help you:

- Track new mRNA-related patent filings and grants across major jurisdictions

- Identify potential collaboration or licensing opportunities

- Protect your innovations and navigate IP challenges with confidence

Whether you’re monitoring competitors, shaping R&D strategy, or entering the mRNA space, our expert-driven reports provide the clarity and depth needed to make informed decisions and stay ahead in a competitive field.

Contact us to learn how KnowMade’s monitoring can support your innovation and IP strategy.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.