SOPHIA ANTIPOLIS, France – November 3, 2022 │ Today, KnowMade is releasing its Q3 2022 quarterly report from its RF Front End Module & Components Patent Monitor, covering PA/LNA, RF filters (SAW, BAW, XBAR), RF switch, RF tuner, and the RF Front End module.

Strong acceleration of IP activities from Chinese players

For the last ten years, 5G has been the driver of numerous developments in the RF industry. This new standard needed new devices operating on new frequency bands but also better integration at the module level to deal with all the bands and ensure good isolation. Therefore, 5G was a unique opportunity for new players to enter the market and compete with well-established companies, such as Broadcom, Qualcomm, Skyworks, Murata, or even Qorvo. Today, 5G is no longer a dream but a reality for the smartphone industry.

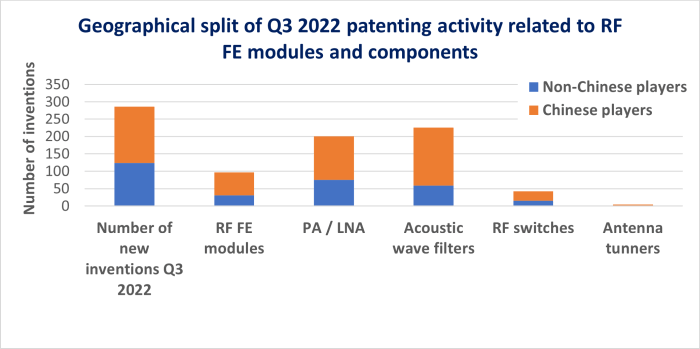

For two years, KnowMade has been monitoring the patenting activity related to RF Front End modules and their components (i.e., PA / LNA, acoustic wave filters, RF switches, and Antenna tuners). During this period, KnowMade has witnessed a strong acceleration in patenting activity from Chinese players. Indeed, in 2022, more than half of the new patent applications were filed by Chinese entities, including established IP players, with many new companies entering the patent landscape every quarter.

Today, KnowMade is releasing its latest quarterly RF Front End Module & Components monitoring report (see more here). In Q3 2022, patent analysts identified more than 100 active Chinese entities with more than 260 new inventions.

Figure 1: New patent families (inventions) related to RF Front End modules and components published in Q3 2022 from Chinese and non-Chinese patent applicants.

The last two years were a perfect opportunity for Chinese newcomers to enter the patent landscape

The acoustic wave filter segment is the most prominent example of Chinese patenting acceleration. Indeed, many developments were needed at the filter level to ensure good isolation between bands and achieve filtering operation in sub-6 GHz bands.

This is especially true for commercializing filters that operate in high bands, which give providers a unique position in the RF industry, and has become a goal for many companies. As a result, fierce competition has started, and IP could play a huge role in protecting access to critical technologies. Indeed, historical players have adopted different strategies to develop, provide, and defend devices operating in high bands. For instance, Murata acquired Resonant to integrate its XBAR technology. Skyworks, on the other hand, has started the development and related IP of BAW filters and laterally excited bulk acoustic wave filters. This period was also the perfect opportunity for newcomers to enter the landscape, and numerous Chinese players did not miss it. While only two new non-Chinese patent applicants – Akoustis and Samsung Electro Mechanics – came out in the last three years, KnowMade has identified more than 40 new IP players from China. These include ROFS Microsystem, XS Semi, Shoulder Electronics, NSI Corp, SIMIT, CETC, Maxscend Microelectronics, Jibao Electronics, Huntersun, and more.

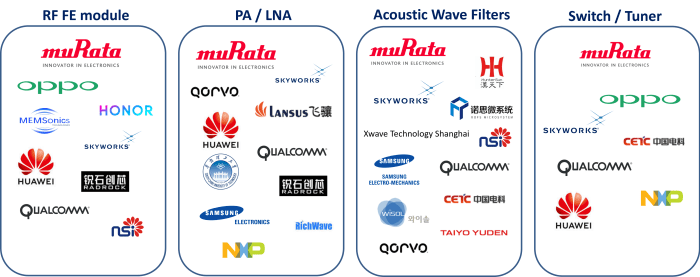

Figure 2: Main patent applicants in Q3 2022 per RF Front End segment.

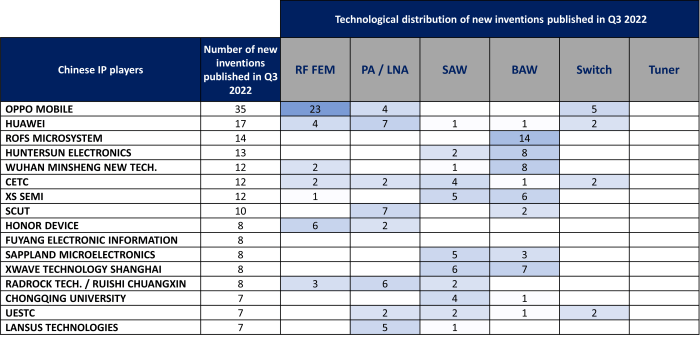

Chinese patent applicants are not only active on SAW/BAW filters and PA/LNA but also on the RF Front End module

At first, Chinese players were mainly active on the acoustic wave filters and PA/LNA segments, but increasingly Chinese players are now filing patent applications related to the RF Front End module. For instance, after developing their patent portfolio pertaining to PA/LNA, Lansus Technology (130+ new inventions published since 2020) and Radrock Technology (70+ new inventions published since 2020) have started to file patent applications related to the RF Front End module. In addition to the rise of specialized players and IP newcomers, Chinese patenting activity is driven by the three OEM giants Huawei, Oppo Mobile, and Vivo Mobile. They are now among the five most active players in the RF Front End module segment, along with Qualcomm, Skyworks, and Murata.

Figure 3: Main Chinese IP players in Q3 2022 and technological distribution of their new inventions.

China is accelerating its patenting activity to support the emergence of a complete domestic supply chain

In less than two years, Chinese players have successfully entered the patent landscape related to key RF Front End components and are now broadening their IP activity to RF Front End modules. In the meantime, leading Chinese OEMs have created and expanded their IP position for the RF Front End module and transceiver. Today, the analysis of the patent activity shows that the Chinese players have been able to cover the full RF supply chain with enforceable patents that could contribute to creating a national ecosystem. Government incentives and protectionist policies undeniably created a big advantage for local companies to grow. In the context of the US-China trade war, such IP dynamics may pave the way for a domestic RF industry in China that would modify the whole RF industry balance and challenge well-established US and Japanese companies.

Find our related RF patent landscape analysis.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About our analyst

Paul Leclaire works for KnowMade as a Patent Analyst in the fields of RF technologies, Wireless communications and MEMS sensors. He holds a PhD in Micro and Nanotechnology from the University of Lille (France), in partnership with IEMN in Villeneuve-d’Ascq and CRHEA-CNRS in Sophia Antipolis (France). Paul previously worked in innovation strategy consulting firm as Consultant.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand their competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.