SOPHIA ANTIPOLIS, France – July 18, 2022│Electromobility is increasingly recognized as the future of the automotive sector. Plus, vehicle manufacturers are speeding up the shift towards electric transportation due to new regulations on CO2 emissions. Japanese car maker Toyota, one of the global leaders of the industry, has naturally shown an interest in electric vehicles to diversify its powertrain portfolio; and especially Hydrogen-based Fuel Cell Electric Vehicles (HFCEV), considering their environmental impact, autonomy and fast and easy way of refueling compared to other types of vehicles. What’s more, to consolidate its leadership status and constantly develop its activity, the company has adopted a process of vertical integration of innovation throughout the supply chain of hydrogen, from its production to infrastructure deployment to its use in Toyota fuel cell vehicles, by willingly dedicating a part of its resources to these technologies. As such, Toyota’s activity in fuel cell-related and hydrogen-related patents has been analyzed by KnowMade to reveal a little about the Japanese firm’s strategy.

A comprehensive Toyota Patent Portfolio Analysis was performed in line with KnowMade know-how, based on patenting activity:

- Toyota’s triptych IP strategy on batteries to conquer the EV market

- The vertical innovation path: from material to power devices and their integration in electric vehicles (EV)

- Toyota Group, a leading IP player in the development of sensors and autonomous vehicles technologies

Find other related topics in KnowMade News.

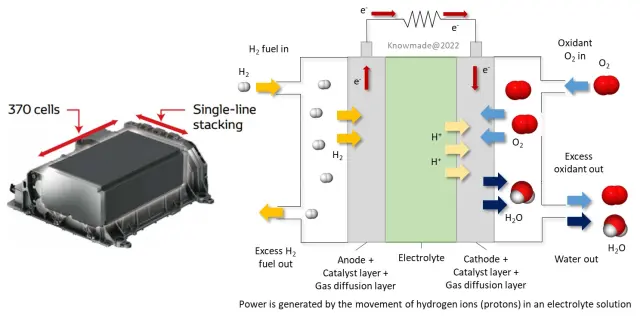

Fig.1: – Left, the new 2020 Toyota Mirai Fuel Cell Stack PDF;

– Right, a simplified diagram of a functioning single cell (polymer electrolyte fuel cell).

The emergence of Hydrogen Fuel Cell Vehicles through patenting activity

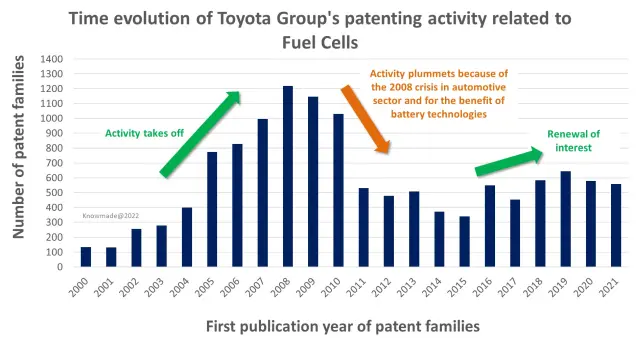

Since its first fuel-cell-related patents filed in the late 70s-early 80s, Toyota has taken a great interest in this technological field. Moreover, the commercialization of one of the first hydrogen-based fuel cell passenger vehicles, the Mirai model in 2014, followed by an improved second generation in 2020, has positioned Toyota as a trailblazing player for this type of vehicle. But some car manufacturers have also released HFCEV models, such as the Japanese Honda Clarity, the Japanese Nissan X-Trail FCV, or the Korean Hyundai NEXO. Therefore, as one way to face the competition, Toyota opted to become and remain active in fuel-cell-related patent filings, as shown in Fig. 2.

Fig. 2: Time evolution of Toyota Group’s patenting activity related to fuel cells.

Toyota, an Industrial Property (IP) leader in fuel cells, including fuel cell vehicles

Indeed, for 20 years, Toyota Group has built up a significant fuel cell-related patent portfolio with 12,000+ patented inventions – currently the largest worldwide. As the chemical energy storage sector boomed in the mid-2000s, matching its peak inventive activity in the domain, the Group took some interest in fuel cell components, such as electrocatalysts, membrane electrode assemblies and stacking arrangements. Since 2016 and the renewed increase in patent filings, the automotive conglomerate has continued to file patent applications on the aforementioned technologies. But it has also been especially focused on other topics, like the control of running parameters during fuel cell operation: pressure and temperature management, failure detection, and start/stop function management, more suited to the integration of a fuel cell in a passenger vehicle.

Collaborations to develop skills, industrial emulation and markets

Toyota Motor, representing about 75% of these patent filings, can also count on all its subsidiaries and affiliates to develop fuel cell technologies and their related patents. Thus, automotive component manufacturers Aisin Corp and Denso Corp have been prolific players and are still active today. Also, Hino Motors has shown some interest in inventions related to the fuel cell vehicle off-gas exhaust apparatus in particular. Nonetheless, the companies do not hesitate to form external partnerships to accelerate the innovative developments throughout the years, being involved in 750+ IP collaborations with about 250 players, of which most are local Japanese companies, universities and research institutes. These last few years, it is worth noting the IP partnerships between Toyota Motor and Kobe Steel on separator materials and their manufacturing methods; between Toyota Motor and Aisan Industry on fuel gas supply systems; and between car parts supplier JTEKT and Kanazawa University on fuel cell system arrangements. Likewise, Toyota has created United Fuel Cell System R&D Beijing (FCRD), a joint venture for the development of commercial vehicle fuel cell systems with five Chinese partners, China FAW Corp, Dongfeng Motor, GAC Group, BAIC Group (Beijing Automotive) and Beijing SinoHytec. What’s more, Toyota and SinoHytec established another joint company, Toyota Sinohytec Fuel Cell (FCTS), in charge of producing and selling the fuel cell system developed by FCRD. Finally, in order to popularize fuel cell vehicles and to support the development of the sector, in 2015, the Japanese automaker allowed royalty-free use of its then 5,000+ fuel cell-related patent licenses. However, the field of control & management of running parameters seems to rather benefit from internal collaborations between the firms of the Group – which represent 1,500+ patent families within the fuel cell porfolio.

Implementing a global versatile strategy for broad applications

Going further, the large majority of Toyota hydrogen patents deal with generic fuel cell technologies. In fact, only 15% of the total fuel cell portfolio mentions a specific type of system (Proton Exchange Membrane Fuel Cell PEMFC – apparently the most suitable technology for automotive applications so far, representing more than half of those patents – Solid Oxide SOFC, Phosphoric Acid PAFC, Molten Carbonate MCFC, Alkaline AFC and Methanol-type FC). This situation infers that the Japanese vehicle seller would rather file a patent application with the broadest possible claims scope and in which the described invention can be implemented in or used for any kind of fuel cell. In this perspective of adaptable systems, Toyota has developed a compact packaged fuel cell system module for a wide variety of applications. Beyond passenger vehicles, the vehicle manufacturer also develops technologies for fuel cell electric trucks with Hino Motors, and FCEV route buses with Isuzu Motors and Hino Motors.

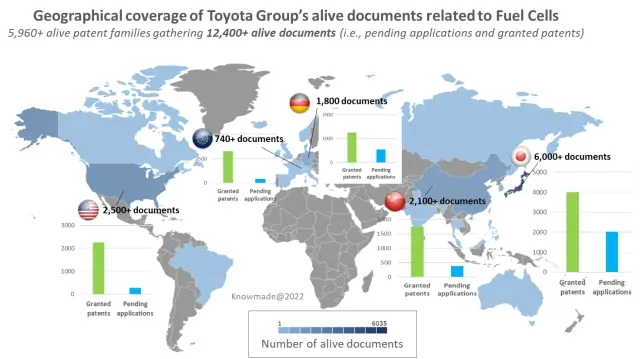

Fig. 3: Geographical coverage of Toyota Group’s alive documents, i.e. pending applications and granted patents, related to fuel cells.

As a global company in a competitive sector, one way to potentially secure their market share is to protect their innovation and inventions around the globe. As shown in Fig. 3, five territories are of interest to Toyota, with the most alive granted and enforceable patents: Japan, USA, China, Germany, and, to a lesser extent, the other European countries. These correspond both to where HFCEV production sites are and where the main profitable markets are, in a way validating the strategy selected by the car manufacturer. With 500+ granted patents in the country, Toyota is also considering South Korea as a significant country in which to protect its inventions, since one of its main competitors, Hyundai, is established there. Moreover, the number of pending applications (i.e. more recently filed documents) can indicate the most attractive emerging markets for HFCEV according to Toyota. Apart from Japan, Germany – 500+ pending applications – and China – almost 400 pending applications – are qualified as the most promising markets by the automaker, especially since several Toyota’s competitors (Daimler, Volkswagen/Audi or BMW to name a few) are increasingly building up their HFCEV-related portfolios in these countries, and Germany in particular.

Involvements throughout the hydrogen supply chain

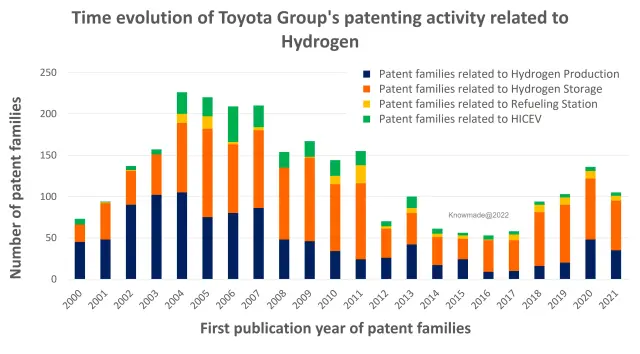

But beyond fuel cells, and as a global strategy implemented over every topic of interest related to its main business, the global car manufacturer displays patenting activity across all aspects of the hydrogen supply and value chain. Indeed, besides its patent portfolio including inventions regarding fuel cell components and systems (as seen above), Toyota hydrogen patents also cover:

- Hydrogen production – with claimed inventions concerning steam reforming (counting for more than half of the hydrogen production corpus), water electrolysis (mentioned in about 15% of the corpus) or even some documents about biomass fermentation;

- Hydrogen storage, in which the overwhelming majority of innovative developments are addressing compressed gas tanks and their management systems, with about half of alive patent families in this corpus;

- Hydrogen refueling stations – such as gas stations, filing systems or hydrogen odorization for safety issues; or

- Hydrogen as a fuel for internal combustion engine vehicles (HICEV).

Nevertheless, those last two topics seem to have lost attractiveness throughout the years as seen in Fig. 4. Yet with 58% of alive patent families, the refueling station cluster appears to still hold some value for their owner, compared to the low 25% of still alive patent families related to HICEV.

Fig. 4: Time evolution of Toyota Group’s patenting activity related to some parts of the hydrogen value chain.

Partnerships to encourage the deployment of a worldwide hydrogen ecosystem

Just as in the fuel cell patent portfolio, the car maker has been involved in 150+ IP collaborations related to the hydrogen patent portfolio with 70 entities, almost exclusively Japanese players, to profit from their skills in specific fields and to create an industrial network. Except for Toyota, Denso is the most diversified dynamic IP player of the Group. According to its recent patenting activity, the company focuses its developments on topics such as catalysts for steam reforming, water electrolysis and exhaust emission control systems for HICEV. This type of hydrogen engine has equipped a Toyota Corolla Sport participating in a race in Japan in 2021, but passenger vehicles could use this technology in the future, as the company is participating in an agreement with other Japanese vehicle makers Mazda Motor, Subaru Corp, Yamaha Motor and Kawasaki Heavy Industries to explore the viability of alternative green fuels – including hydrogen – for internal combustion engine cars. That is consistent with the company’s philosophy explained by Toyota‘s Chief Technology Officer Masahiko Maeda, thereby letting customers choose the type of vehicle that suits them most.

Over the past few years, the Japanese conglomerate has generated innovation regarding hydrogen production topics, concentrating its efforts on ammonia reforming methods and devices, along with water electrolysis systems and partial oxidation of hydrocarbons to a lesser extent. Some projects could be quite promising. The collaboration with an energy and resource recycling firm, Alhytec, on the use of aluminium and alloys recaptured in car manufacturing as a source of hydrogen generation for fuel cell electric vehicles is one good example. This collaboration led to three patent family publications in 2021. Moreover, Toyota Group seems to be a pioneer for several emerging hydrogen production technologies, such as high-performing proton exchange membrane electrolyzers, solid oxide electrolysis cells (SOECs) and photocatalytic water splitting, but also for hydrogen carriers for transport and storage, e.g. metal-organic frameworks (MOFs). Furthermore, it seems noteworthy to mention its recent partnership involving French industrial gas supply company Air Liquide and Portuguese bus manufacturer CaetanoBus, revealing a common will to accelerate hydrogen infrastructure deployment in Europe. Also, the development of a portable hydrogen cartridge with its subsidiary Woven Planet is a significant collaboration in the hydrogen storage field.

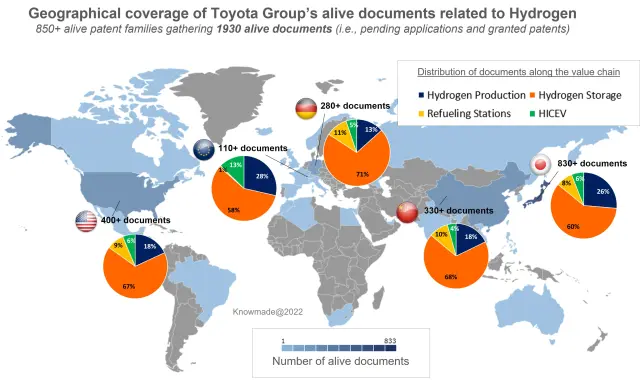

Fig. 5: Geographical coverage of Toyota Group’s alive documents, i.e. pending applications and granted patents, related to some parts of the hydrogen value chain; and distribution of these documents along the value chain for some countries.

According to Fig.5, Japan, USA, China and Germany are today the main enticing countries for Toyota Group regarding hydrogen technologies along the supply chain. The hydrogen storage-related corpus extends everywhere as well. When it comes to hydrogen production technologies and refueling stations, Toyota Group adopts a much narrower approach. Indeed, patents related to hydrogen production are mainly filed in Japan and Europe, while refueling station-related patents extend to Germany and China, signalling Toyota Group’s intent to strengthen its position in these key territories.

In conclusion, from its global IP leadership position in fuel cell technologies, the collaborations with other players in the field, and the release of HFCEV models, Toyota Group has been – and still is – very active in the development of Hydrogen-based Fuel Cell Vehicles. Moreover, the patenting activity on several hydrogen technologies and the will to create partnerships to promote hydrogen infrastructure deployments highlight a strategic diversification around the world, throughout the hydrogen supply chain. Today, Toyota’s strategy is supported by a strong vertical integration of innovation and through all the affiliates’ and subsidiaries’ market and IP activities. Will all this allow the Group to secure its market share and its status as leader in HFCEV?

More reports on fuel cells patent landscape.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Jonathan Dominici, Dipl. Ing, Jonathan works for Knowmade as a Technology and Patent Analyst in the field of Material Chemistry and Energy Storage. He holds a Master’s degree in Materials Science and Engineering from the Grenoble Institute of Technology (France) with a specialization in Technological Innovation Management. He previously worked in Competitive Intelligence and IP Strategy within a research institute and a consulting firm.

About Knowmade

Knowmade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

Knowmade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

Knowmade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.