RF and Wireless Communications: At the Core of Future Connectivity

RF technologies are at the heart of next-generation wireless communication systems. As 5G continues global deployment and early-stage 6G research accelerates, the demand for high-performance, energy-efficient, and spectrum-agile RF components is growing across mobile, infrastructure, and emerging verticals such as automotive, industrial automation, and healthcare.

Key components, including power amplifiers, low-noise amplifiers, switches, tuners, and filters, must operate across increasingly wide and complex frequency bands, from traditional sub-6 GHz ranges to millimeter-wave and emerging sub-terahertz bands. These components are now expected to deliver higher linearity, wider bandwidth, and lower noise, while fitting into compact system-in-package configurations suitable for mobile and edge applications.

Wireless innovation is no longer limited to traditional communication. Emerging paradigms such as Integrated Sensing and Communication (ISAC), Reconfigurable Intelligent Surfaces (RIS), and joint localization and communication are reshaping RF architecture. These systems rely on advanced RF hardware capable of reconfigurable signal paths, precise spatial control, and highly dynamic operation across time and frequency domains.

Artificial intelligence is also becoming integral to RF system design. AI-enhanced architectures can optimize antenna tuning, power distribution, and signal integrity in real time, unlocking performance gains in dynamically changing environments. Together, these trends are driving convergence between RF design, system intelligence, and advanced materials research, opening new directions for innovation and intellectual property creation.

Challenges for RF Technologies and Components

As fifth-generation networks continue to expand and sixth-generation research progresses, RF front-end components must support a broader range of frequencies, from sub-6 GHz to millimeter wave, across increasingly complex device and infrastructure architectures. Designers must meet demanding requirements for output power, linearity, noise figure, integration, and thermal performance, all within compact physical footprints.

Modern RF front-end modules integrate multiple essential components such as power amplifiers, low-noise amplifiers, switches, filters, and phase shifters into compact, highly integrated system-in-package designs. In millimeter-wave applications, dense phased arrays require precise layout and minimal spacing between antenna elements. Infrastructure equipment must support high-power transmission and massive multiple-input multiple-output (MIMO) configurations, while mobile devices face strict limitations on size, battery life, and the ability to support many frequency bands.

Among all RF components, filters remain some of the most technically demanding and patent-sensitive elements. As the number of supported frequency bands grows and devices must coexist with Wi-Fi, satellite, and Internet of Things protocols, filters need to provide high selectivity, low insertion loss, and strong out-of-band rejection. To meet these requirements, the industry continues to advance across a variety of technologies, including surface acoustic wave filters for low to mid-frequency bands, bulk acoustic wave filters for higher frequency and high-power applications, as well as newer approaches such as thin-film surface acoustic wave, XBAR, tunable filters, and integrated passive devices. Each solution presents trade-offs in frequency range, power handling, size, and manufacturing cost, making filter selection a key point of technological differentiation. As a result, leading players are investing heavily in advanced materials, integration techniques, and patent strategies to secure their positions in the competitive RF landscape.

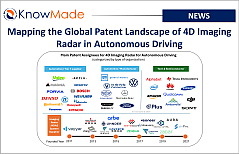

At the same time, the global RF ecosystem is evolving. Companies such as Murata, Skyworks, Qorvo, Qualcomm, and Broadcom are responding to the shift from discrete components to fully integrated modules. Meanwhile, Chinese players like Radrock, Lansus Technologies, and Newsonic Technologies are expanding quickly, backed by domestic demand and strong industrial support. Vertical integration by companies such as Apple, Huawei, Samsung, Oppo, and Vivo is also reshaping both supply chains and intellectual property strategies across the industry.

Looking ahead, sixth-generation networks will introduce new demands for flexibility, low latency, and advanced sensing capabilities. Emerging use cases such as integrated sensing and communication, and reconfigurable intelligent surfaces, will require highly adaptable and programmable RF front ends. In parallel, research is pushing toward even higher frequency bands, beyond current millimeter-wave deployments and into the sub-terahertz range, where propagation loss, power efficiency, and new device architectures will demand breakthrough innovations across the entire RF hardware stack.

KnowMade’s Purpose

As RF front-end modules grow more complex to meet the demands of 5G and beyond, understanding how technologies and intellectual property are evolving has become essential for strategic planning, innovation management, and risk mitigation.

KnowMade provides decision makers across the RF and wireless communication industry with deep, actionable insights through comprehensive analysis of patent portfolios, technology trends, and competitive positioning. Our IP landscape reports identify key players, map their innovation roadmaps, highlight emerging challengers, and assess technology directions. We also offer perspectives on litigation risks and the shifting IP landscape, particularly in the context of growing tensions between the United States and China.

Our monitoring services allow clients to track developments in RF front-end modules and components, offering timely visibility into the IP activities of both established leaders and fast-growing newcomers. We place special focus on Chinese IP actors, given the rapid expansion of China’s RF ecosystem.

We also provide tailored strategic analyses and monitoring for specific technologies, materials, or companies. These can range from wafer-level technologies (such as Si, SOI, GaAs, SiGe, and GaN) to device-level components (including filters, switches, power amplifiers, low-noise amplifiers, and antennas), up to the system and packaging level, covering technologies such as system-in-package and fan-out.

Beyond today’s component landscape, KnowMade actively tracks intellectual property trends in forward-looking wireless technologies, including integrated sensing and communication, reconfigurable intelligent surfaces, and AI-enabled RF architectures. By identifying early patent signals and disruptive innovators, we help clients anticipate technological shifts and strategically position themselves for sixth-generation networks and beyond.

In addition to competitive intelligence, we support clients with freedom-to-operate assessments, prior-art searches, and infringement investigations, enabling engineering, legal, and business teams to make informed and confident decisions in an increasingly competitive RF and IP environment.

Latest reports on RF technologies

Patent monitors on RF technologies

Latest insights about RF technologies