SOPHIA ANTIPOLIS, France – 27 May 2025 │ Previous patent analyses conducted in 2022 have confirmed the emergence of a domestic SiC industry in South Korea. Driven by government-sponsored national programs, South Korean material conglomerates SK group (including SKC, SK Siltron, SK Inc., SK Innovation), Posco and LG group (including LG Chem, LG Electronics and its subsidiary LG Innotek) have built large patent portfolios. Their intellectual property (IP) activity has focused on unlocking SiC substrate technology and thereby addressed a potential bottleneck of SiC technology. As a result, South Korea has laid solid foundation for its future domestic SiC industry. Meanwhile, Hyundai Motor took the IP leadership over the research organization KERI (Korea Electrotechnology Research Institute) in developing SiC power devices, especially for electric vehicle (EV) applications.

Over the last decade, notable South Korean players from the national academic scene as well as from the local semiconductor industry have started SiC developments, entering the IP landscape and contributing to the consolidation of an emerging domestic SiC supply chain.

In late 2022, SK Inc. acquired Yes Powertechnix (now SK Powertech) – then the only South Korean firm able to design and produce SiC power management ICs. By leveraging synergies with other subsidiaries (SK Siltron, SK Hynix, etc.), SK group would have the potential to compete with leading SiC integrated device manufacturers (IDM) such as Wolfspeed, STMicroelectronics, Rohm Semiconductor, Infineon and onsemi.

Combining patent data from its SiC monitoring service with recent analyses from its latest SiC IP report, KnowMade has investigated the progress of the South Korean SiC industry from a patent perspective since 2022:

- What is the current IP status of the main South Korean IP players?

- Does any single company control IP across the entire SiC supply chain?

- What has been the trajectory of 2010’s new entrants?

- Who are the latest IP newcomers and where do they stand in the supply chain?

Six companies accounting for 66% of all South Korean inventions in the SiC patent landscape

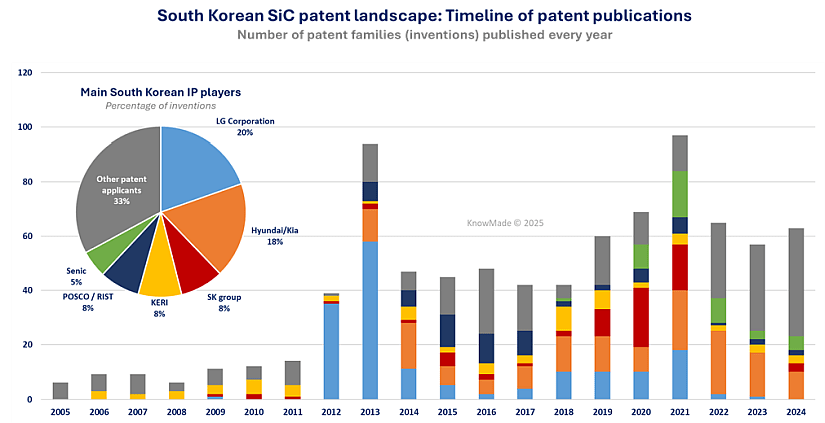

Koreans’ patenting activity surged in the 2010s, peaking in 2021 with strong contributions from SKC, LG Chem and Hyundai Mobis (Figure 1). In 2022, the number of inventions disclosed by South Korean IP players slumped, in a context of fast growth for EV, the main application driving the SiC power device market. The year seems to mark a reorganization of SiC activities among most South Korean industrial players, with SKC spinning off a SiC substrate company (Senic), LG Innotek selling key SiC patents (LX Semicon, S-tech) and SK Inc. acquiring Yes Powertechnix (YPT). Concomitantly, several material companies drastically reduced their IP activity (Posco, LG group and SK group).

Furthermore, the first signs of an expansion of IP activities into SiC devices and downward the SiC supply chain (e.g., SiC packaging) by main IP players (LG group, SK group) were not confirmed by new patent filings in these areas after 2021. A year later, Hyundai Motor started following the same trend, exhibiting a steady reduction in the number of new inventions.

Yet the IP activity in the South Korean SiC patent landscape has remained robust since 2022. This dynamism is due to the entry of many IP newcomers in the field of SiC substrates (10+), SiC devices (5) and SiC circuits (20+). As a result, a plateau is observed in the number of inventions disclosed between 2022 and 2024 (Figure 1).

Figure 1: Timeline of patent publications by South Korean players in the power SiC patent landscape and total percentage of inventions disclosed by main South Korean IP players for SiC technology.

SiC power modules: the weak link in the South Korean SiC supply chain?

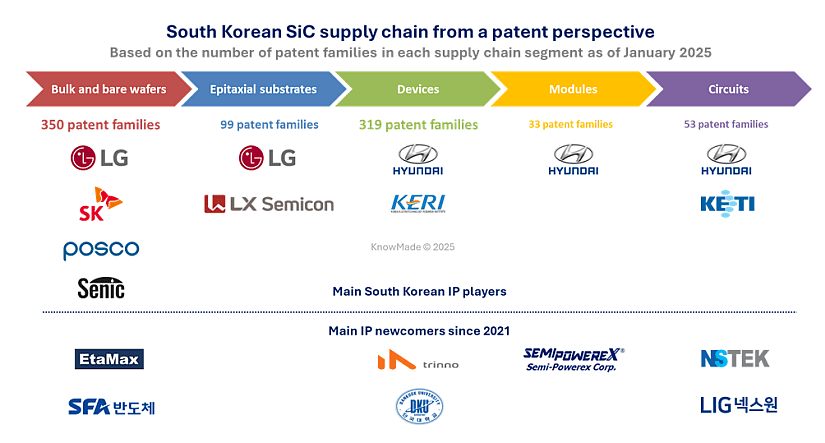

Figure 2 describes the position of main South Korean IP players across the SiC supply chain, based on the number of inventions disclosed in each segment (bulk and bare wafer, epitaxial substrates, etc.). Hyundai dominates the downward supply chain while LG group leads in the upward segments. Accordingly, no single South Korean company is currently able of controlling IP over the whole supply chain.

Although South Korean main IP players together appear to cover the whole SiC supply chain, power modules seem to remain the weakest link. Indeed, the number of inventions related to SiC packaging and SiC power modules has not progressed significantly since 2022. This stagnation reflects the limited number of firms involved in this activity (Hyundai Motor, Amosense, JMJ Korea) and the reduced number of IP new entrants since 2022 compared to the other segments of the SiC supply chain (SemiPowerex).

Spun-off from SKC in 2021, Senic has made a remarkable entry in the South Korean SiC landscape, becoming rapidly one of the main IP players for SiC substrates (Figure 2). What’s more, the startup company has rapidly moved from the status of IP challenger to the status of IP leader in this segment of the SiC supply chain (Figure 3). Filing patent applications in most of the strategic countries for the semiconductor industry, the spin-off confirms its ambition to address the global SiC substrate market in coming years.

In contrast, LX Semicon, which acquired in 2021 IP rights on more than 20 inventions related to SiC epitaxial substrates and assigned to LG Innotek, did not seek to expand its IP leadership in recent years. Instead, the company announced in June 2024 its intention to downsize its R&D operations for SiC technology, signaling a potential exit from the SiC industry.

In the SiC device patent landscape, EYEQ Lab, which entered the IP space in 2020 and is reportedly expanding from fabless design to foundry services, published four additional domestic patent applications in 2023, focusing on dicing methods and wire-bond interconnects for SiC Schottky diodes.

Figure 2: Mapping of main patent assignees and most recent IP newcomers across the SiC supply chain based on their patent filings.

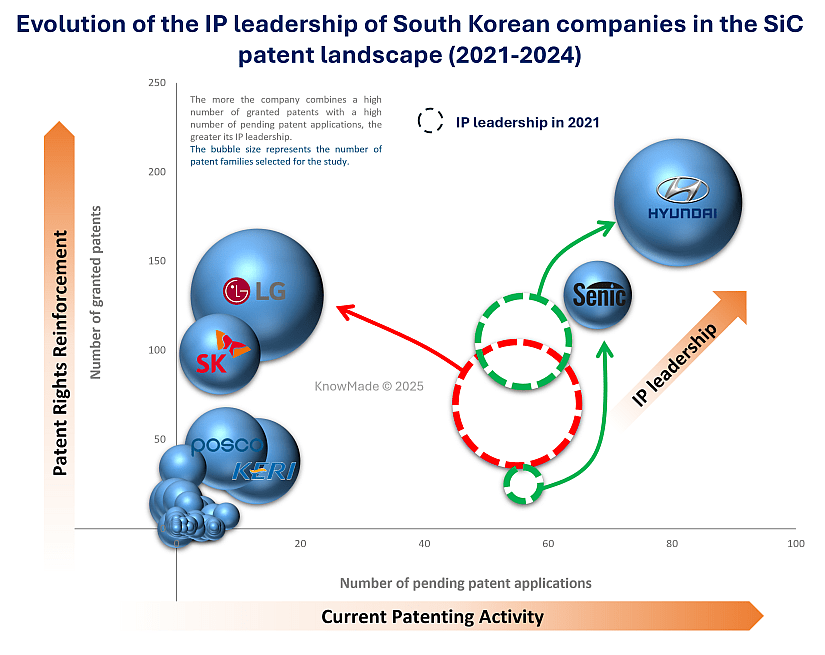

Hyundai Motor and Senic expanding their IP leadership outside South Korea

The main IP trends discussed previously can be summarized by Figure 3. The IP leadership graph compares the IP position of main IP players between 2021 and 2024 in the SiC patent landscape. Accordingly, Hyundai Motor has confirmed its IP leadership for SiC power devices while Senic now leads in SiC boules and bare wafers. Furthermore, SK group has also improved its IP position in the last three years, focusing on SiC substrates (including SiC boules, bare and epitaxial wafers).

In contrast, LG group shifted its IP position from being IP leader in 2021 to a well-established player holding a high number of granted patents but exhibiting a much-reduced patenting activity in 2024. Furthermore, Posco and KERI’s IP positions have not changed significantly in their respective fields, with IP activities largely confined to domestic filings.

Figure 3: IP leadership of South Korean patent assignees in the power SiC patent landscape.

TRinno Technology and EtaMax just joined the SiC IP competition

The main South Korean IP newcomer since 2021 has been TRinno Technology, which published its first SiC-related patents in 2022. The power semiconductor company filed 7 patent families (inventions), covering both planar and trench SiC MOSFET technologies. Interestingly, all patent families have already been granted in South Korea. However, TRinno Technology is also seeking protection of 4 inventions abroad, in China, USA and Europe.

Another notable IP newcomer is EtaMax which entered the SiC substrate patent landscape in 2022, focusing on defect identification and die division, to minimize the influence of a wafer defect on the final semiconductor chip. EtaMax is assigned to several SiC patent applications in the US.

Are Samsung and DB Hitek re-entering the SiC (IP) arena?

Several major South Korean semiconductor companies in the global semiconductor landscape have announced plans to enter the SiC semiconductor market. These include Samsung Electronics which has had a limiting patenting activity in the SiC device patent landscape so far. Its most recent patent application was published in 2023 and describes a gate trench SiC MOSFET structure having source trenches and a pair of shielding regions.

Likewise, DB Hitek resumed its patenting activity last year after a 15-years break in the SiC patent landscape. The South Korean foundry disclosed three inventions describing both planar and trench gate MOSFET designs, including a planar SiC MOSFET integrated with a SiC Schottky diode.

Eventually, KEC, a power semiconductor company with capabilities to design and produce SiC power devices, resumed its patenting activities in 2024, after its last patent filings in 2017. Four domestic patent applications have been filed in South Korea, covering SiC trench Schottky diodes, SiC planar MOSFET and SiC trench MOSFET.

KnowMade’s Value Proposition

The present case study illustrates the complementarity of KnowMade’s solutions to get access to the most comprehensive picture of the SiC competitive IP landscape at any time. The monitoring service allows to track in real-time the patenting activity of key players in the semiconductor industry, regardless of their level of patenting activity in the SiC patent landscape and whatever is their position in the SiC supply chain. On the other hand, the IP report provides in-depth patent analyses of global IP trends. Together, they empower customers to capture the big picture across 20,000+ patents and to detect emerging, high-value signals from even the smallest pool of filings.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Rémi Comyn, PhD. Rémi works at KnowMade as Senior Analyst in the field of Compound Semiconductors and Electronics. He holds a PhD in Physics from the University of Nice Sophia-Antipolis (France) in partnership with CRHEA-CNRS (Sophia-Antipolis, France) and the University of Sherbrooke (Québec, Canada). Rémi previously worked in compound semiconductors research laboratory as Research Engineer.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.