SOPHIA ANTIPOLIS, France, November 25, 2025 │ According to KnowMade’s upcoming LiDAR for Automotive (ADAS and Robotic Vehicles) Patent Landscape Analysis 2025, the global patent landscape for automotive LiDAR has reached a new level of intensity. As of October 2025, the field contains more than 36,000 patent families and over 62,000 individual patents. Since 2020, patent activity has increased at an estimated 27% CAGR (compound annual growth rate), which marks the transition of LiDAR into a phase of fast and broad intellectual property (IP) expansion.

This surge reflects a fundamental shift in the industry. KnowMade’s earlier dataset from 2021 counted roughly 11,900 patent families. The growth from that level to more than 36,000 patent families within four years shows that LiDAR innovation has become extremely competitive and increasingly multi-layered. Patent filings now cover almost every element of the technology, including emitters, receivers, scanning architectures, optical subsystems, packaging, calibration, interference mitigation and system-level integration. A wide range of players are participating, including Tier-1 suppliers, LiDAR pure players, automakers, autonomous driving companies and academic institutions. The diversity of patent applicants demonstrates that the technology has reached a pivotal moment, where multiple routes are being explored and protected.

Market expectations help explain this acceleration. Yole Group forecasts that the global automotive LiDAR market will grow to 3.56 billion US dollars by 2030. The growth is supported by wider adoption of L2 and L3 driver assistance functions and the increasing need for reliable perception in mass-market vehicles. The similarity between the market CAGR and the patent CAGR demonstrates a clear industry signal:

“The race to control LiDAR’s IP is directly tied to the race for future market dominance.”

LiDAR Pure Players and the Shift in IP Leadership

The rapid expansion of the automotive LiDAR patent landscape has also reshaped the structure of competition. One of the clearest trends emerging from KnowMade’s earlier 2022 analysis and the new 2025 dataset is the rising influence of LiDAR pure players. These companies focus almost entirely on LiDAR technology rather than spreading their R&D across a broader sensing portfolio. As a result, they often demonstrate deeper technical specialization, faster iteration cycles and more deliberate intellectual property strategies.

Back in the 2022 edition of KnowMade’s LiDAR for Automotive patent report, the field was still strongly shaped by established Tier-1 suppliers and a group of early LiDAR innovators. At that time, the distribution of patent ownership followed a relatively traditional hierarchy. However, when we compare the IP leadership landscape of 2021 with the newly updated 2025 data, the change is striking. Pure players have moved from secondary positions to the center of the competitive landscape. Their patent portfolios have expanded rapidly in both scale and diversity, with strengthened positions in areas such as solid-state architectures, beam steering, optical assemblies, semiconductor receivers, packaging and system-level integration.

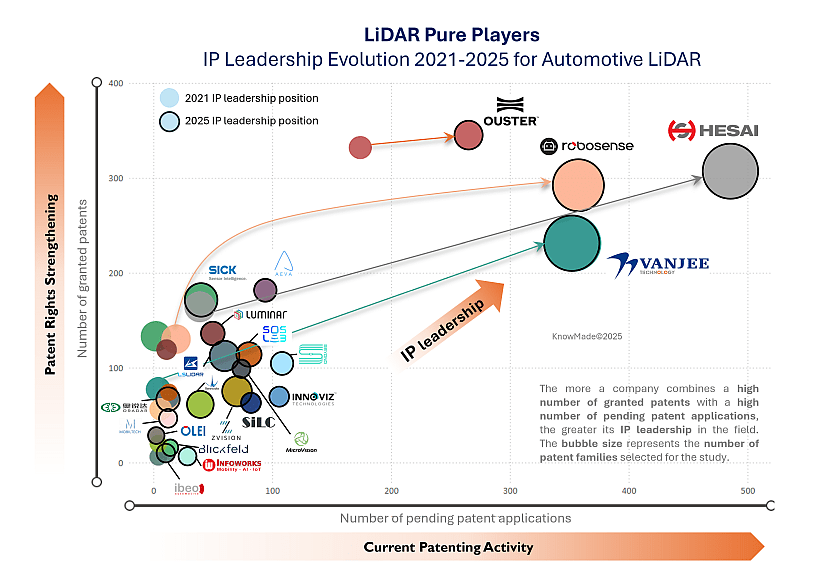

This shift is especially clear when isolating pure players. The IP leadership map (Figure 1) shows many companies moving upward and to the right, indicating stronger granted portfolios and higher volumes of active applications.

Figure 1: Evolution of IP leadership of LiDAR pure players from 2021 to 2025 for Automotive LiDAR

The most notable trend in the 2025 IP landscape is the rapid rise of several Chinese pure players. Hesai, Robosense and Vanjee all show pronounced upward and rightward movement. This indicates that they have strengthened their core patent assets while expanding their ongoing innovation pipelines. Their rate of progress surpasses that of most other pure players in the chart and reflects the accelerating innovation capability emerging from China’s LiDAR industry.

This shift is especially visible when compared with Ouster (including Sense Photonics and Velodyne LiDAR). In 2021, Ouster held one of the leading IP positions among pure players, supported by a large and active patent portfolio. By 2025, however, its relative IP position is overtaken by the faster-growing Chinese companies. Hesai now clearly occupies the upper IP leadership zone with large patent family scale among pure players, while Robosense and Vanjee also advance into stronger positions. This shows that Chinese companies are now among the most rapidly advancing innovators in the global pure-player segment.

Among LiDAR pure players, Hesai shows a clear and decisive advancement in its IP position. In the 2021 landscape, it appeared within the general cluster of emerging innovators. By 2025, it has moved into the leadership quadrant, supported by a substantially expanded patent portfolio and a strong combination of granted patents and active filings. The size and placement of Hesai’s bubble on the chart indicate both scale and depth, positioning it as a mature and influential LiDAR technology holder within the pure-player group.

Hesai’s IP Portfolio: Broad, Structured and Technically Diverse

Hesai Technology is a Shanghai-based LiDAR company founded in 2014. In addition to its earlier listing on Nasdaq (HSAI), the company further strengthened its capital market presence by successfully listing on the Hong Kong Stock Exchange (02525.HK) on 16 September 2025, marking an important step in its expansion as a global LiDAR supplier. The dual-listing structure reflects Hesai’s ambition to serve both international and domestic automotive markets while maintaining strong access to global capital.

Hesai’s portfolio covers several product families, including the AT series for long-range automotive ADAS, the ET and FT solid-state platforms, and XT, OT and JT series for robotics and non-automotive uses. Independent market studies and recent press releases describe Hesai as holding a leading share of global LiDAR revenue and as the first LiDAR company to reach one million units of cumulative production, with large-scale contracts in both ADAS passenger cars and robotaxis. Technically, the company is investing heavily in next-generation architectures. It began research on SPAD digital LiDAR in 2016 and strengthened this direction through the acquisition of Swiss company Fastree3D and its SPAD patent portfolio, which is now part of Hesai’s solid-state FTX platform.

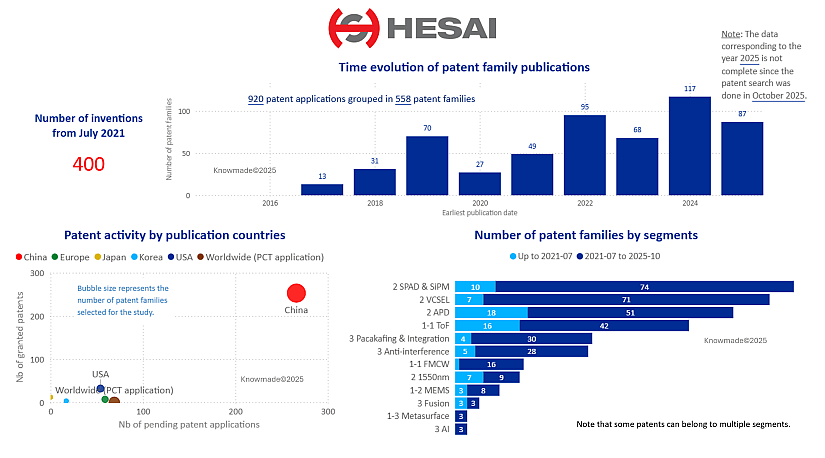

Figure 2: Overview of Hesai’s IP portfolio related to automotive LiDAR

The IP profile (Figure 2) gives a detailed view of Hesai’s patent activity. KnowMade identified 920 patent applications grouped into 558 patent families relating to automotive LiDAR. Notably, 400 inventions since July 2021 represent over 70% of all filings, indicating exceptionally intense activity in the past four years. The time-evolution chart also shows strong publication peaks in 2022 and 2024 and a still high level in 2025, even though data for 2025 is not complete. This pattern is consistent with Hesai’s move from technology development into large-scale automotive programs, where patent protection around core designs becomes critical.

Geographically, China represents Hesai’s core patent base, with strong portfolios also present in the United States, followed by Europe, Japan and Korea. A visible share of patent filings through PCT (Patent Cooperation Treaty) procedure indicates a global IP strategy with optionality for later international extensions.

The bar chart on the right illustrates the breadth of Hesai’s technical exploration. The largest patent segments lie in SPAD and SiPM, VCSEL and APD, which form the foundation of next-generation solid-state and hybrid LiDAR systems. Hesai’s commitment to this direction is further reinforced by its late-2023 acquisition of Fastree3D, a Swiss pioneer in SPAD technology with academic roots in EPFL. Additional investments span 1550-nm architectures, MEMS, metasurface optics, packaging and integration, interference management, sensor fusion and AI-based processing. The diversity of patent filings since 2021 shows consistent growth across nearly all technological segments, reflecting a deliberate effort to build a comprehensive and future-ready IP portfolio.

Representative Innovations in Hesai’s SPAD and SiPM Technology Pathway

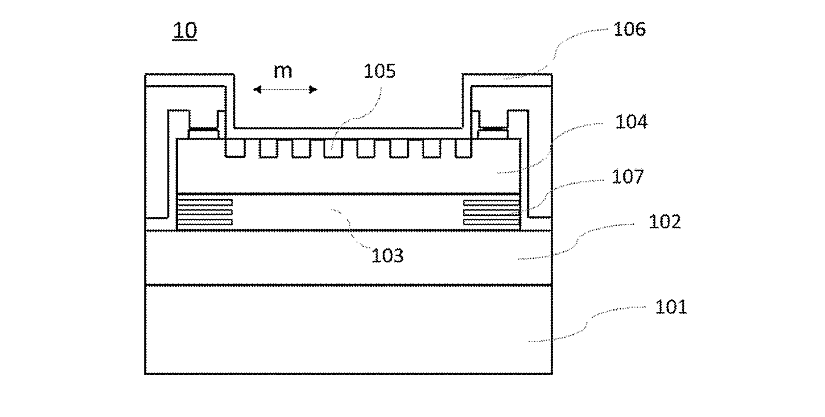

Hesai has also made clear progress in SPAD and SiPM–based detection technologies, as reflected in several recent patents. One example is the patent application US20250306173, which introduces a multi-emission SPAD signal-fusion mechanism that aggregates outputs from different pixels across consecutive laser shots to improve signal-to-noise ratio and enhance long-range detection. Another example, US20240192339, focuses on SiPM receivers and proposes dynamic bias-voltage control that adapts to echo strength and detection timing, allowing the LiDAR to maintain high sensitivity while avoiding saturation. A third representative patent, CN114167431, presents an ambient-light-adaptive SPAD/SiPM region-selection strategy that adjusts which sub-arrays are activated under different lighting conditions to preserve SNR and stability. Together, these inventions show that Hesai is not only investing broadly in SPAD and SiPM hardware, but also advancing the associated signal processing, adaptive control and environmental-robustness mechanisms that are essential for next-generation solid-state LiDAR.

Figure 3: A detection unit consistent a plurality of pixels and each pixel includes a plurality SPAD (Hesai, US20250306173).

Hesai’s Advancements Across Key LiDAR Technology Pathways

In addition to progress in SPAD and SiPM detection technologies, Hesai is also advancing along several other core LiDAR architecture routes. A recent VCSEL-related patent application (WO2025/140349) describes a polarization-controlled VCSEL structure that achieves higher mode selectivity through an external grating, improving emission stability at 1150 nm and supporting more efficient solid-state transmitter designs. In long-wavelength architectures, the granted patent US10901074 introduces a 1550 nm eye-safe LiDAR system that converts long-wavelength echoes into shorter wavelengths detectable by SiPMs, combining high-range detection with detector compatibility and safety advantages. Hesai is also exploring novel optical components, as shown in patent CN119644296, which proposes a metasurface-based transmitter lens design that enables flexible beam shaping, wider field-of-view options and compact packaging. In addition, the company strengthens system robustness through interference-mitigation techniques. The PTC application WO2021/169714 outlines a method that distinguishes true echoes from external interference by correlating pulse-width characteristics, thereby improving detection reliability in multi-sensor or multi-LiDAR environments. Together, these patents show that Hesai is not only investing in photon-counting receivers but advancing a broad set of next-generation technologies spanning transmitters, optics, wavelength architectures and system-level interference resistance.

Figure 4: A schematic diagram of a vertical-cavity surface-emitting laser (VCSEL) (Hesai, WO2025/140349)

Recent Litigation Activities Involving Hesai

Hesai has recently been involved in high-profile IP litigation on both defensive and offensive fronts, highlighting the strategic value of LiDAR patents.

- Being sued (Ouster vs Hesai): On May 19, 2025, Ouster filed a complaint at the US Court of Appeals for the Federal Circuit. The case concerns Ouster’s patent US11175405, which relates to spinning LiDAR units with micro-optics aligned behind a stationary window. The accused products are Hesai’s rotating LiDAR units, and the case remains open.

- Filing suit (Hesai vs Seyond): On October 28, 2025, Hesai filed a patent-infringement case against Seyond at the Ningbo Intermediate People’s Court in China, asserting that Seyond’s Lingque E1X solid-state LiDAR exhibited core overlaps with Hesai’s AT-series technologies. The case has been officially accepted.

These parallel actions show that Hesai is both defending itself in major international IP disputes and actively asserting its own patent rights, reinforcing the strategic importance of LiDAR intellectual property as the technology becomes increasingly competitive and commercially significant.

About the Upcoming LiDAR for Automotive – Patent Landscape Analysis 2025

As the LiDAR industry enters a phase of rapid technological consolidation and intensified IP competition, the upcoming LiDAR for Automotive – Patent Landscape Analysis 2025 delivers a complete, data-driven view of global IP trends. It reveals which companies are shaping future architectures, where innovation is accelerating and how patent strategies influence competitive positioning. It is designed for companies seeking clear visibility into IP dynamics, competitor positioning and long-term innovation pathways.

Key Highlights

Report Package

- 150+ slide PDF report

- Methodology, executive summary and full patent landscape analysis

- One-hour online presentation with the report’s author (results + Q&A)

Patent Landscape Overview

- Global IP trends and publication time-evolution

- Geographic distribution of patent filings

- Major patent assignees and IP player timeline

- Newcomers driving recent innovation

- IP leadership evolution: 2021 vs 2025

- Geographic coverage of top players

- High-impact patent assignees

- Co-owned IP and collaboration patterns

- US litigations

Technology Segmentation

- Patents classified across all major LiDAR approaches, including: ToF, FMCW, Phase Shift, MEMS, Hybrid Scanning, OPA, Flash, Metasurface / Nanophotonics, Photonic-Integrated LiDAR, 1550 nm, VCSEL, SPAD / SiPM, APD, Packaging & Integration, Calibration, Fusion, AI, Anti-interference

- Analysis of representative patents in each segment

IP Strength & Player Profiles

- Comparative strength of leading patent portfolios

- Detailed IP profiles of selected companies across the ecosystem (with Hesai used as an example in this article), including: LiDAR pure players; Tier-1 suppliers; Autonomous driving / robotic vehicle companies; Car makers

- Portfolio size, growth, legal status, technical segmentation and notable patents

Excel Database

- Complete dataset of 36,200+ patent families

- Focus set of 24,300+ families from the last four years

- Segmentation fields and direct hyperlinks to the updated online database

Why This Report Matters

This upcoming report serves as a strategic tool for companies operating anywhere along the automotive LiDAR value chain. By consolidating more than a decade of global patent activity, the report helps readers identify which technologies are becoming dominant, which players are gaining or losing momentum and where future competition is likely to concentrate. It provides actionable insights for R&D planning, competitive benchmarking, technology roadmapping, risk assessment and partnership or licensing strategies. For organizations navigating the rapid shift toward solid-state LiDAR, sensor fusion and next-generation optical architectures, this report offers a clear and evidence-based understanding of how intellectual property will shape the industry’s next phase.

For more information or quotation inquiries, please feel free to contact us.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni Zhou, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on RF front-end systems and advanced sensing technologies. Her expertise also includes the design of radar sensing systems, enabling precise detection in complex and dynamic environments. She is the inventor of over 20 patents and has authored more than 10 scientific publications in the field.

Nicolas Baron, PhD., CEO and co-founder of KnowMade. He manages the development and strategic orientations of the company and personally leads the Semiconductor department. He holds a PhD in Physics from the University of Nice Sophia-Antipolis, and a Master of Intellectual Property Strategies and Innovation from the European Institute for Enterprise and Intellectual Property (IEEPI) in Strasbourg, France.

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.