SOPHIA ANTIPOLIS, France, September 5, 2025 │ KnowMade has released its new study, Imaging Radar for Autonomous Systems – Patent Landscape Analysis 2025, a comprehensive report that analyzes one of the most competitive intellectual property (IP) battlefields in autonomy. The study identifies more than 22,200 patent applications, grouped into over 10,600 patent families, including about 2,800 core inventions directly related to imaging radar. It highlights how patent activity in this field has grown by more than 1,100% between 2015 and 2024, reflecting the rapid evolution of imaging radar from a complementary sensor into a central perception modality across mobility, robotics, aerospace, marine, and defense.

To map this innovation race, the report provides detailed IP profiles of leading companies and classifies all patent assignees into eight categories: academia, aerospace, automakers, Tier-1 suppliers, defense and security companies, electronics firms, sensing and ADAS specialists, and technology providers. This segmentation shows how imaging radar patents are being filed across a wide range of industries, with established leaders such as Intel-Mobileye, Bosch, General Motors, Alphabet-Waymo, Huawei-Yinwang, and Magna expanding diversified patent portfolios, while innovators like Arbe Robotics, Uhnder, Aptiv, and Metawave are securing focused IP positions in 4D imaging radar, AI-based perception, and point cloud processing.

Sensing/Imaging/ADAS Companies: Who Is Leading?

In this insight, we focus on one specific category of patent assignees highlighted in the report: sensing and ADAS specialists. Unlike automakers or Tier-1 suppliers that primarily emphasize system integration and large-scale deployment, these companies are advancing innovation at the perception and computation level while also working to build end-to-end ADAS platforms. Their patent portfolios are centered on radar architectures, perception algorithms, point-cloud generation, AI-based signal processing, and multi-sensor fusion, which represent the essential building blocks of next-generation autonomous driving stacks. To capture the true innovation drivers, we identified the core inventions within our patent database and selected this group of companies for closer analysis.

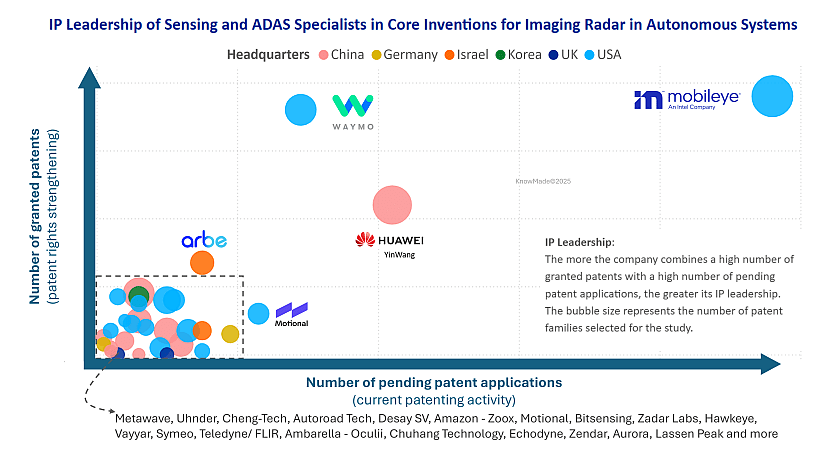

The figure 1 illustrates the IP leadership of sensing and ADAS specialists based on their core inventions in imaging radar for autonomous systems. The patent landscape reveals a clear hierarchy. Intel-Mobileye stands out as the most influential IP player, combining the highest number of granted patents with a strong pipeline of pending applications. Its patent portfolio reflects both early-stage breakthroughs and sustained R&D, consolidating its ambition to anchor radar as a cornerstone of its ADAS perception stack. Huawei-Yinwang also secures a leading position. As a rising yet leading intelligent vehicle solutions provider, Huawei-Yinwang has been advancing its proprietary ADAS platform, while the rapid growth of its radar patent filings reflects both aggressive IP expansion and a strong build-up of expertise in radar hardware and signal processing. Alphabet-Waymo maintains a balanced portfolio of granted patents and pending applications. Unlike Huawei, Waymo has concentrated more on integrating radar into a broader multi-sensor perception approach, ensuring redundancy alongside cameras and LiDAR in its self-driving platform. In contrast, smaller innovators such as Arbe Robotics, Motional, Uhnder, and Metawave appear with more compact IP portfolios, but their patents show a high degree of specialization. Arbe has been pushing high-resolution 4D imaging radar, Uhnder is pioneering digital MIMO radar chips, and Motional as a joint venture between Hyundai and Aptiv is building a radar patent portfolio that complements its robotaxi deployments.

Figure 1: IP leadership of sensing and ADAS specialists for core inventions related to imaging radar for autonomous systems (Top 30 IP players according to the number of core inventions).

This distribution demonstrates that sensing and ADAS specialists, although diverse in size and strategy, are collectively shaping the trajectory of imaging radar technologies. They are positioning themselves as platform leaders, aiming to define the perception stacks that will underpin autonomous driving. Their strategies suggest that future advantages will depend less on patent volume and more on the depth of their technologies, the quality of their innovations, and their ability to integrate these inventions at the system level. While Intel-Mobileye has become the most prominent advocate of a radar-first approach, not all companies follow this route. Many ADAS specialists are simultaneously advancing multiple perception technologies, combining radar with cameras, LiDAR, and AI-based sensor fusion to secure robustness and redundancy in their ADAS platforms. This broader perspective makes Intel-Mobileye’s leadership within this group particularly significant.

Intel-Mobileye’s Patent Landscape in Imaging Radar

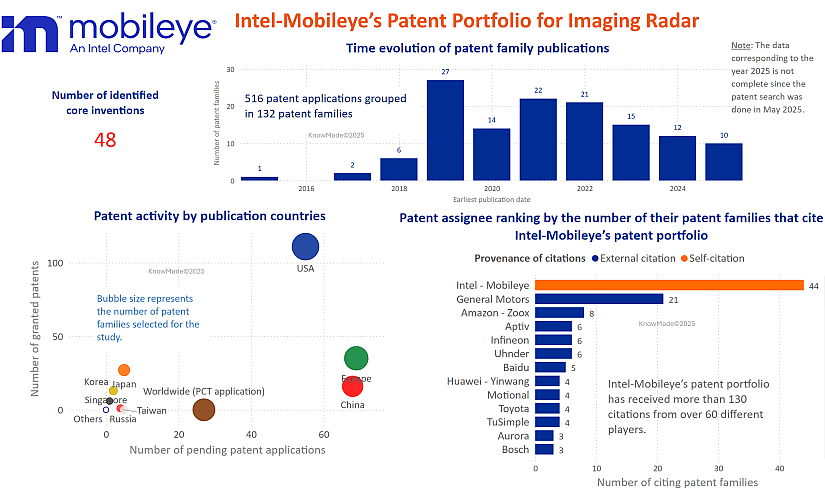

Intel-Mobileye, headquartered in Santa Clara, USA (Intel) and Jerusalem, Israel (Mobileye), has built one of the most influential IP portfolios in imaging radar for autonomous systems. Since Intel’s acquisition of Mobileye in 2017, the company has combined semiconductor expertise with perception algorithms to accelerate its expansion into radar-based ADAS platforms. Our imaging radar IP report identified 48 core inventions within Intel-Mobileye’s patent portfolio, consolidated from more than 130 patent families and over 500 patent applications. Patent activity began to rise sharply after 2018 and peaked between 2020 and 2022, reflecting an intense phase of R&D investment that transformed radar from an exploratory technology into a strategic pillar of Mobileye’s roadmap.

Figure 2: Overview of Intel-Mobileye’s IP portfolio related to imaging radar for autonomous systems

The geographical distribution of patents highlights Mobileye’s global ambitions. Most filings are concentrated in the United States, with Europe and China also representing key territories, securing protection in the world’s most important automotive markets. The patent portfolio is not only extensive but also highly influential, as evidenced by the number of external citations it has received. Companies such as General Motors, Amazon-Zoox, Aptiv, Infineon, Uhnder, and Huawei-Yinwang have cited Intel–Mobileye’s patents, which confirms their role in shaping the development strategies of both established automakers and radar innovators.

Recent corporate developments further confirm this trajectory. In 2025, Mobileye announced that it would terminate its in-house FMCW lidar program and instead fully commit to advancing its own 4D imaging radar, which it has been developing since 2018. This radar is based on a proprietary RFIC design and a dedicated radar processor capable of 11 TOPS, handling over 1,500 virtual channels at 20 frames per second. With angular resolution below 0.5°, a dynamic range of 100 dB, and detection distances up to 315 meters, Mobileye’s radar delivers unprecedented robustness in challenging environments such as tunnels, construction zones, or dense urban traffic. This technology decision not only reinforces its radar-first strategy but also aligns perfectly with the strength of its patent portfolio, which spans hardware design, digital beamforming, perception pipelines, and multi-sensor fusion.

Together, the patent and product strategies reveal a coherent vision: Intel-Mobileye is consolidating a radar-first perception stack that combines strong IP, advanced hardware innovation, and system-level integration. This approach positions the company at the forefront of ADAS platforms, where imaging radar is increasingly seen as a cost-effective, scalable, and reliable complement or alternative to LiDAR and cameras.

Representative Patents Underpinning Intel–Mobileye’s Strategy

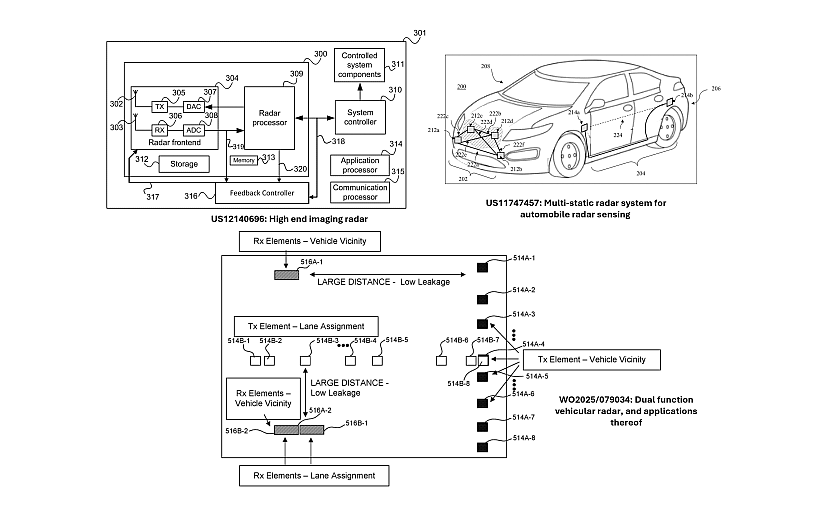

Intel-Mobileye’s granted imaging radar patents reveal a cohesive strategy that spans from scalable radar hardware to advanced perception pipelines and robust system-level coordination. At the hardware level, the patent US12123937 introduces a compact transmitter architecture with digital-to-analog converters and analog beamforming, enabling cost-efficient integration of directional beams into automotive platforms. In parallel, US11747457 discloses a multi-static radar system composed of spatially distributed units across a vehicle, which work together to synthesize a larger aperture. This configuration significantly improves angular resolution and provides resilience against occlusions, reflecting Mobileye’s focus on radar as a system-level perception tool. Moving beyond hardware, US12265150 defines a radar tracking framework based on multi-target density functions, allowing the system to classify and update trajectories for different object types with improved stability. US12140696 extends the perception pipeline by generating synthetic radar scenes to train machine learning algorithms, improving adaptability across diverse driving conditions. Fusion patents such as US10690770 combine radar with optical flow from cameras to refine motion estimation in complex environments, while US12164053 introduces a radar resource management framework to ensure stable coexistence of multiple radars in dense traffic. Together, these patents show how Mobileye is aligning its intellectual property with a radar-first vision that integrates hardware design, AI-based perception, multimodal fusion, and large-scale deployment.

Pending patent applications further expand this vision into functional safety, configurability, and interference management. For example, the patent application US20250123358 embeds a functional safety detector directly into the radar processing pipeline to support ISO 26262 compliance and strengthen trust in radar for safety-critical decisions. The patent application WO2025/079034, filed under the Patent Cooperation Treaty (PCT), proposes a reconfigurable radar unit capable of switching between antenna modes optimized for either wide-area awareness or lane-level localization, a capability particularly relevant for highway autonomy. WO2024/209368 introduces methods to detect and suppress interference by analyzing 2D range–angle maps in real time, securing perception reliability even in radar-dense urban environments.

Altogether, these granted patents and pending patent applications demonstrate that Intel–Mobileye is not simply scaling radar to achieve higher resolution. Instead, the company is reinforcing the integrity, adaptability, and robustness of radar perception as a whole. This dual emphasis on technological fidelity and system reliability underscores its ambition to deliver a production-ready radar perception stack that can serve as the backbone of future autonomous driving platforms.

Figure 3: Examples of Intel-Mobileye’s inventions related to imaging radar for autonomous systems

Discover More in the Full Report

To explore the broader information in greater depth, KnowMade’s Imaging Radar for Autonomous Systems – Patent Landscape Analysis 2025 provides in-depth profiles and portfolio benchmarking across all categories of assignees. The report covers both established leaders and fast-moving newcomers, offering insights into how innovation is distributed across the global landscape. Companies mentioned in the study include General Motors, Bosch, Toyota, Huawei – Yinwang, Sony, Denso, Intel – Mobileye, Aurora, Honda, Continental, Amazon – Zoox, Alphabet – Waymo, Volkswagen, Raytheon Technologies, ZF, Hyundai, Valeo, Ford, Magna, Aptiv, Mitsubishi, Baidu, Infineon, Samsung, Qualcomm, DJI Technology, Motional, LG, Mercedes-Benz, NXP, Boeing, Geely – Volvo Cars, Hitachi, HERE, Nvidia, Panasonic, BMW, Honeywell, FAW Group, Kia, Stellantis – PSA, Mando, Changan Automobile, Xaircraft (XAG), Subaru, Forvia – Hella, IBM, NEC, Pony.ai, Micron, BAE Systems, Geometrical-PAL, Metawave, Calterah Semiconductor, ICAN Technology, Kyocera, LIG Nex1, Texas Instruments, Desay SV, IAI – Israel Aerospace Industries, Nissan, Siemens, State Grid Corporation of China, Apple, Xiaomi Technology, Tata Motors, Weifu, Airbus, Cheng-Tech, Dongfeng Motor, Korean Agency for Defense Development, US Navy, BYD, Great Wall Motor, Autoroad Tech, Nidec, Renault, MBDA UK, Nuro, Arbe Robotics, Lockheed Martin, Microsoft, Volvo, Beta Technologies, CAIC – China Automotive Innovation Corporation, Five AI, Thales, Bitsensing, Daihen, Fuxia hangzhou intelligent science & technology, Hawkeye, NIO, Secom, Vivo, Wuxi Tongchun New Energy Technology, China Southern Power Grid, DiDi, Mazda, Seres, Tencent, Uhnder, Yupiteru, Alibaba, Deere, dSPACE Technologies, L3Harris Technologies, Lyft, Northrop Grumman, SAAB, Sick, State Farm Insurance, TuSimple, Veoneer, Voyah, Zadar Labs, Elwha LLC, GAC Group, iRobot, Jingdong Qianshi Technology, Keysight, Novasky Electronic, NTT Docomo, Symeo, Teledyne, Toshiba, Uber, Vayyar, Ericsson, Fujitsu, Hanwha, Kodiak Robotics, Koito Manufacturing, STMicroelectronics, US Army, WHST, Ambarella – Oculii, Bayer, Chery Automobile, Chuhang Technology, Eagle Sense Technology, Furukawa Electric, XPENG, Zendar, Alps Alpine, Zongmu, and more.

By providing a comprehensive view of patenting trends, competitive strategies, and core technologies, the report equips executives, R&D teams, and IP professionals with actionable intelligence to secure a competitive advantage in one of the most dynamic technology races of the decade. More information available here.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni Zhou, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on 5G/6G and RF front-end systems. She developed innovative RF solutions effectively integrated into communication and radar systems. Her work also includes designing advanced radar sensing and imaging systems for accurate detection in complex environments.

Nicolas Baron, PhD., CEO and co-founder of KnowMade. He manages the development and strategic orientations of the company and personally leads the Semiconductor department. He holds a PhD in Physics from the University of Nice Sophia-Antipolis, and a Master of Intellectual Property Strategies and Innovation from the European Institute for Enterprise and Intellectual Property (IEEPI) in Strasbourg, France.

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.