SOPHIA ANTIPOLIS, France, January 5, 2025 │ The patent litigation initiated by Murata Manufacturing against Maxscend Microelectronics in 2025 is not a routine infringement dispute limited to a single jurisdiction or isolated invention. Instead, it represents a structurally significant confrontation over thin-film surface acoustic wave (TF-SAW) technology, spanning China, South Korea, and Germany, and touching nearly every critical layer of the TF-SAW technical stack.

From the selection of asserted patents to the geographical sequencing of lawsuits, the case reflects Murata’s long-established global intellectual property (IP) enforcement strategy confronting a rapidly growing Chinese RF front-end supplier whose TF-SAW capabilities have recently reached commercial maturity with its product MAX-SAW.

The Disputed Patents: A Multi-Layered TF-SAW Protection Framework

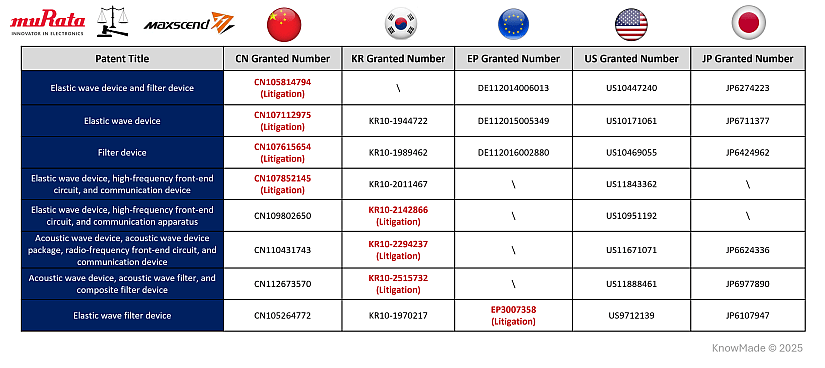

Figure 1 summarizes the eight patents asserted by Murata against Maxscend across China, South Korea, and Europe, together with their granted family members in major jurisdictions including China (CN), South Korea (KR), Europe (EP), the United States (US), and Japan (JP). What immediately stands out is not only the number of asserted patents, but their systematic distribution across different technical abstraction levels. The asserted patent portfolio does not concentrate on a single device feature or manufacturing detail; instead, it spans TF-SAW stack design, resonator-level transverse-mode engineering, and full filter-system architectures, reflecting a deliberately layered protection strategy.

Figure 1: Overview of disputed TF-SAW patents asserted by Murata against Maxscend

Timeline and geographic scope: eight patents across three jurisdictions

The dispute first emerged in China and South Korea. On April 11, 2025, Maxscend disclosed that it had received patent infringement actions initiated by Murata before the Seoul Central District Court and the Shanghai Intellectual Property Court. In South Korea, the initial disclosure identified KR10-2142866 as an asserted patent. In China, Murata asserted four granted invention patents: CN105814794, CN107112975, CN107615654, and CN107852145.

In November 2025, Murata expanded the dispute to Europe. On November 20, Maxscend disclosed that it had been served with a complaint by the Munich I Regional Court, where Murata asserted EP3007358 against a filter product sold in Germany. Murata sought injunctive relief and recall, with the claim value estimated at approximately EUR 1 million.

At the same time, Maxscend publicly identified two additional Korean patents asserted by Murata KR10-2515732 and KR10-2294237. Together with KR10-2142866, this brought the total number of explicitly named asserted Korean patents to three. At the patent level, the dispute therefore comprises four Chinese patents, three Korean patents, and one European patent, all belonging to internationally extended patent families.

A shared technical focus: transverse modes and higher-order modes in TF-SAW

Despite differences in jurisdiction and claim structure, the asserted patents share a consistent technical target. All are rooted in TF-SAW platforms based on LiTaO₃/Si stacks, often incorporating an intermediate low-acoustic-velocity layer such as SiO₂, and all aim to address two persistent challenges in high-frequency, wide-band RF applications: transverse modes and higher-order modes.

Transverse modes arise across the aperture direction and manifest as standing-wave patterns that degrade passband flatness and increase insertion loss. Higher-order modes originate from the multilayer nature of TF-SAW stacks and can produce sharp spurious responses when their resonances approach the operating band. Murata’s asserted patents collectively target these issues through structural, material, and system-level design constraints.

The Chinese patents: shaping resonators and constraining the stack

The four Chinese patents represent complementary approaches to TF-SAW design control. CN105814794 introduces a slightly tilted IDT on a LiTaO₃ thin film, using a small oblique angle to disrupt transverse standing-wave conditions. CN107112975 shapes the transverse acoustic field through piston-like electrode geometry combined with a segmented busbar, creating controlled acoustic-velocity regions across the aperture. CN107615654 extends these resonator-level techniques into complete filter architectures, integrating them within longitudinally coupled and ladder-type filter designs.

CN107852145 addresses the problem from a more fundamental perspective by imposing an explicit higher-order mode velocity constraint on the LiTaO₃/Si stack. By defining a reference silicon bulk-wave velocity derived from material constants and crystal orientation, and requiring the first higher-order mode to meet this condition, the patent establishes a calculable boundary for stack designs intended to suppress spurious responses.

The South Korean patents: from mass loading to parameterized design space

The three asserted Korean patents further refine these concepts. KR10-2142866 focuses on transverse-mode control via mass loading, defining central, low-velocity, and high-velocity regions across the IDT aperture and imposing a quantitative upper limit on the product of normalized film thickness and mass density. This transforms transverse shaping into a bounded design rule rather than an open-ended tuning exercise.

KR10-2294237 mirrors the stack-level higher-order mode velocity constraint found in CN107852145, reinforcing the same physical boundary within the Korean jurisdiction. KR10-2515732 expands this approach into a multi-parameter design framework, combining normalized thicknesses, material densities, and orientation parameters into a spurious-response index with an explicit threshold. Together, these patents narrow the allowable TF-SAW design space through increasingly formalized constraints.

European patent: system-level transverse differentiation

EP3007358, asserted in Germany, addresses TF-SAW behavior at the filter-system level. The patent focuses on ladder filters in which the widths of low-acoustic-velocity regions differ among series and shunt resonators. By deliberately varying transverse characteristics across resonators, the design spreads transverse resonances over frequency, reducing concentrated ripple and spurious responses within the passband. This approach shifts transverse-mode control from individual resonators to coordinated system-level architecture.

Maxscend’s RF and TF-SAW patent trajectory: rapid acceleration since 2021

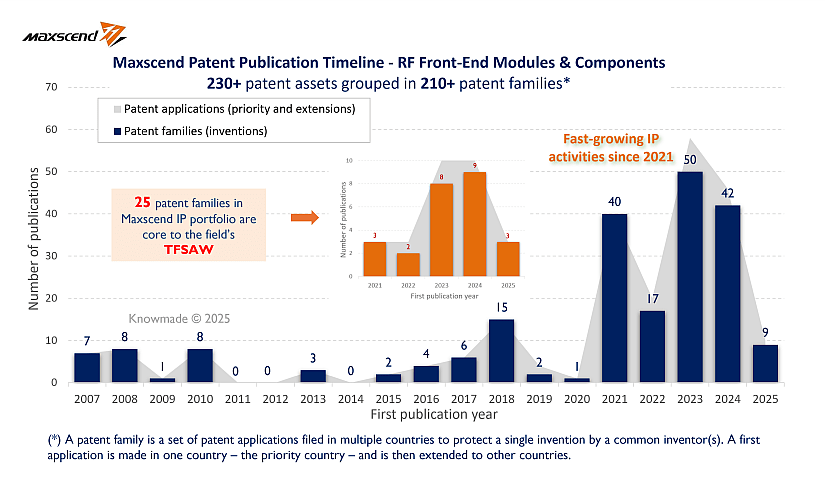

To understand the context of this litigation, it is essential to examine Maxscend’s own intellectual property development. Figure 2 illustrates Maxscend’s patent publication timeline in RF front-end modules and components.

Figure 2: Maxscend patent publication timeline in RF front-end modules and TF-SAW

The data show a clear inflection point beginning around 2021. Prior to this period, Maxscend’s patent activity was relatively modest and sporadic. Since 2021, however, the company has entered a phase of accelerated innovation, with a sharp increase in both patent applications and newly formed patent families. This surge coincides with Maxscend’s broader strategic push into more integrated RF front-end solutions and higher-frequency applications.

Knowmade’s analysis shows that, within the expanding RF portfolio of 217 patent families, 25 patent families are directly related to TF-SAW technology. This is a non-trivial number and indicates that TF-SAW is not an experimental side project, but a core technological pillar in Maxscend’s RF roadmap. Importantly, five of these TF-SAW-related families have already been granted in China, providing Maxscend with enforceable domestic IP rights in this field.

Nevertheless, when juxtaposed with Murata’s TF-SAW patent portfolio, the asymmetry becomes apparent. According to Knowmade statistics, Murata holds more than 230 TF-SAW-related patent families worldwide, exceeding not only Maxscend’s TF-SAW IP portfolio, but the total number of Maxscend’s RF-related patent families across all technologies. This difference is not merely quantitative; it reflects decades of cumulative R&D investment and early positioning in thin-film acoustic wave platforms.

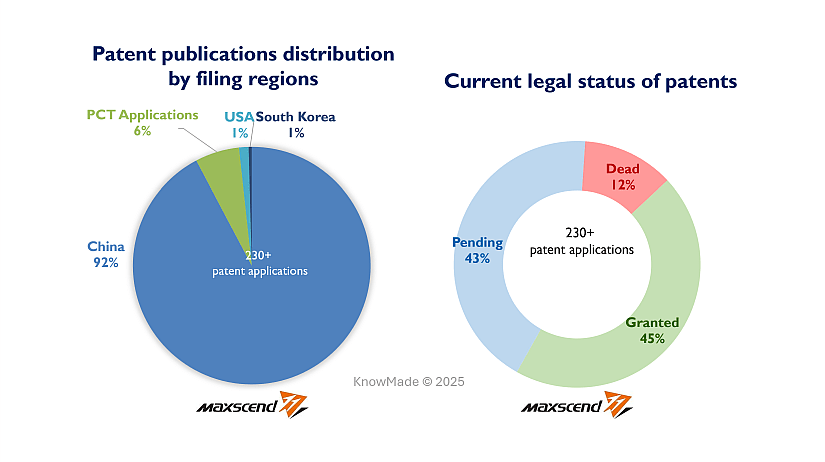

Figure 3 further contextualizes Maxscend’s IP position by examining the geographic distribution and current legal status of its patents. The patent portfolio is overwhelmingly concentrated in China, with limited filings via PCT (Patent Cooperation Treaty) routes and relatively sparse direct coverage in jurisdictions such as the United States and South Korea. In terms of legal status, the portfolio is balanced between granted patents and pending applications, reflecting a company still in the process of converting recent R&D output into enforceable IP rights.

Figure 3: Geographic distribution and legal status of Maxscend’s patent portfolio

Murata’s IP strategy stands in stark contrast. Its TF-SAW patents are broadly extended and granted across all major jurisdictions covering main RF markets, enabling coordinated enforcement actions. This geographic breadth explains why Murata can simultaneously pursue litigation in Shanghai, Seoul, and Munich, targeting manufacturing bases, regional markets, and European downstream channels in parallel.

That said, Maxscend’s IP position should not be underestimated. According to the Knowmade RF Front-End Modules & Components Patent Monitor, Murata consistently ranks among the most active RF patentees on a quarterly basis, often occupying top positions globally. Maxscend, while operating at a smaller absolute scale, has emerged as one of the most dynamic Chinese RF players. Based on the combined count of new patent families and patent families granted for the first time, Maxscend ranked within the global top 20 RF companies in patent activities in Q3 2025. This places it firmly within the global competitive IP landscape rather than on its periphery.

Structural implications of the litigation

The Murata–Maxscend dispute therefore goes beyond the immediate legal question of patent infringement or validity. Structurally, it exposes the vulnerability of late entrants to TF-SAW technology who rely on broadly accepted material systems and design paradigms. Murata’s IP portfolio effectively fences off large portions of the conventional LiTaO₃/Si TF-SAW design space, particularly for wideband, high-frequency applications.

For Maxscend, short-term responses naturally include invalidation proceedings, claim interpretation, and targeted design-around efforts. However, the longer-term implications are more strategic. As TF-SAW approaches technological saturation and patent density increases, meaningful freedom to operate may increasingly depend on differentiated routes, whether through alternative piezoelectric materials, different acoustic modes, hybrid BAW/XBAR solutions, or higher-level architectural and packaging innovations.

From an industry perspective, this litigation serves as a case study in how mature RF incumbents leverage deep, globally synchronized patent portfolios to defend technological leadership, while fast-growing challengers must balance rapid innovation with the constraints imposed by established IP landscapes.

Conclusion

The TF-SAW patent litigation between Murata and Maxscend is best understood not as an isolated legal confrontation, but as a collision between two stages of industrial maturity. Murata’s enforcement actions reflect decades of accumulated IP built around the physics, structures, and systems of thin-film acoustic waves. Maxscend’s response reflects the ambition of a new generation of RF suppliers whose innovation pace has accelerated dramatically in recent years.

As TF-SAW technology continues to underpin next-generation RF front-end modules, the outcome and the strategic lessons of this litigation will likely resonate far beyond the parties directly involved, shaping how future entrants navigate one of the most densely patented domains in RF engineering.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni Zhou, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on RF front-end systems and advanced sensing technologies. Her expertise also includes the design of radar sensing systems, enabling precise detection in complex and dynamic environments. She is the inventor of over 20 patents and has authored more than 10 scientific publications in the field.

Nicolas Baron, PhD., CEO and co-founder of KnowMade. He manages the development and strategic orientations of the company and personally leads the Semiconductor department. He holds a PhD in Physics from the University of Nice Sophia-Antipolis, and a Master of Intellectual Property Strategies and Innovation from the European Institute for Enterprise and Intellectual Property (IEEPI) in Strasbourg, France.

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.