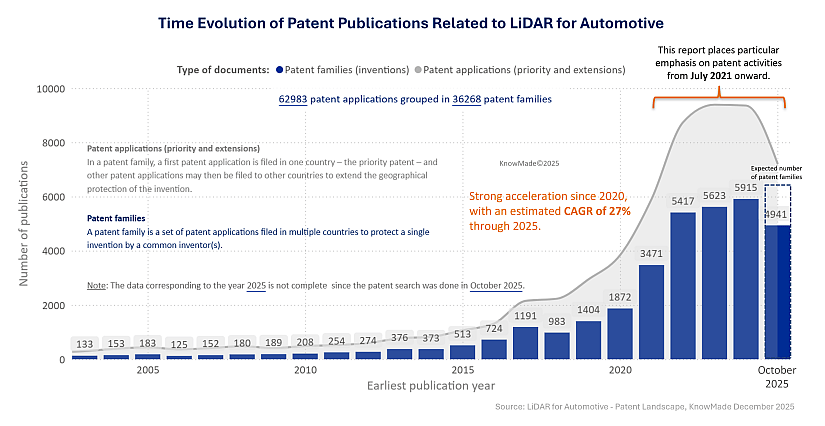

SOPHIA ANTIPOLIS, France, December 11, 2025 │ KnowMade announces the release of its latest patent landscape report, LiDAR for Automotive – Patent Landscape Analysis 2025, a comprehensive study capturing how global innovation and intellectual property (IP) strategies are shaping the future of LiDAR technologies for ADAS and autonomous vehicles. As LiDAR transitions from an advanced sensor option to a core enabler of vehicle perception, patenting activity has accelerated at unprecedented speed. As of October 2025, the global patent landscape for automotive LiDAR includes more than 36,200 patent families (inventions) and over 62,900 individual patents. LiDAR patent filings have tripled since 2021, underscoring the sector’s rapid move from initial research to full-scale industrial deployment. Between 2020 and 2025, patent activity shows an estimated CAGR of 27%, reflecting the strong and accelerating pace of innovation in this field.

Figure 1: Time evolution of patent publications related to LiDAR for automotive until October 2025.

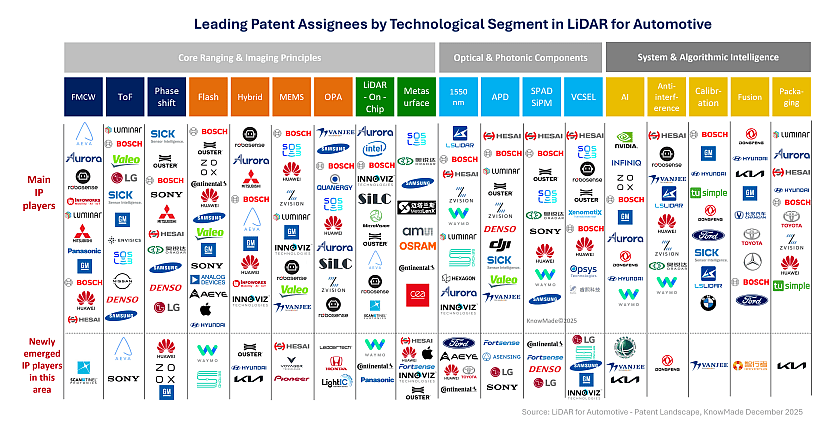

Innovation now spans all layers of the LiDAR technology stack: ranging principles (ToF, FMCW), beam-steering architectures (MEMS, hybrid scanning, OPA, flash), photonic integration, advanced detectors (1550 nm, VCSEL, SPAD/SiPM, APD), packaging, calibration and increasingly AI-driven perception and fusion. This broadening of technical domains demonstrates a transition from early research toward large-scale IP consolidation, with companies striving to secure strategic positions in high-growth segments such as FMCW, integrated photonics and solid-state architectures.

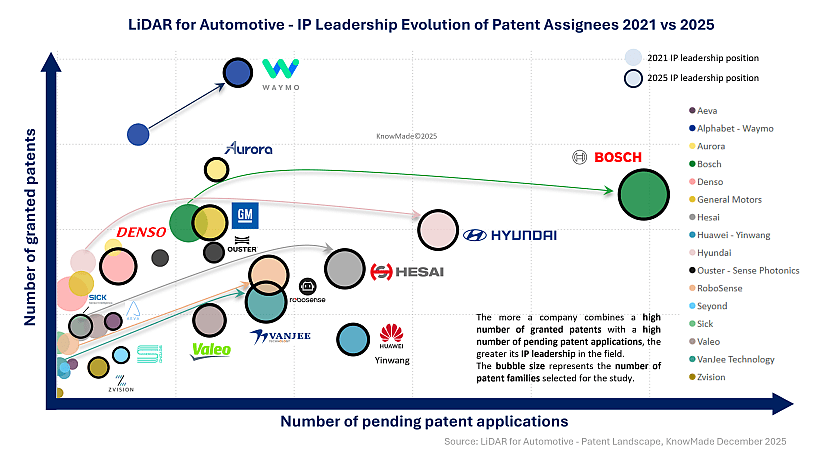

The expansion also reflects a rapidly diversifying ecosystem comprising LiDAR pure players, Tier-1 suppliers, automotive OEMs, autonomous-driving developers, semiconductor companies and research institutes. Their collective activity highlights the growing maturity of LiDAR technologies and a stronger alignment between IP strategies and long-term technological roadmaps. LiDAR pure players in particular are reshaping competitive dynamics. Chinese companies such as Hesai, RoboSense, Huawei Yinwang, VanJee, Zvision, Benewake and Leishen Intelligent remain active across all major LiDAR technology domains and show significant momentum from 2021 to 2025, with marked increases in granted patents and recent filings. In parallel, the United States continue to play a central role through General Motors, Alphabet-Waymo, Aurora, Ouster, Seyond and Aeva. Europe contributes substantial IP activity through its automotive and photonics sectors, driven by Bosch, Continental, Valeo and several OEMs focusing on components, packaging, calibration and vehicle-grade LiDAR integration. Japan and South Korea maintain consistent participation through Sony, Denso, Toyota, Samsung, Infoworks and Hyundai-Kia.

Figure 2: IP leadership evolution of patent assignees in automotive LiDAR between 2021 and 2025.

Report Highlights

Report Package

- 160+ slide PDF report

- Methodology, executive summary and full patent landscape analysis

- Extensive Excel database with all patent families analyzed in this study

- One-hour online presentation with the report’s author (results + Q&A)

Patent Landscape Overview

- Global IP trends and publication time-evolution

- Geographic distribution of patent filings

- Major patent assignees and ecosystem timeline

- Newcomers driving recent innovation

- IP leadership evolution (2021 vs 2025)

- Geographic coverage of top players’ patent portfolio

- High-impact patent assignees and notable IP portfolios

- IP ecosystems including co-owned patent, including group-internal and external collaboration, etc.

- U.S. litigations and legal status insights

Technology Segmentation & Innovation Layers

The report provides a detailed segmentation of patents across all major LiDAR approaches, including:

- Core Ranging & Imaging Principles: Pulsed ToF, FMCW, phase-shift ranging, MEMS and hybrid scanning, OPA and flash architectures, metasurface and nanophotonic beam steering, photonic-integrated LiDAR

- Optical & Photonic Components: 1550 nm laser sources, VCSEL arrays, SPAD/SiPM detectors and APDs

- System & Algorithmic Intelligence: Solid-state packaging, calibration, interference mitigation, AI, perception and multi-sensor fusion

Each segment is analyzed through a consistent framework: segment definition, portfolio overview, leading assignees and representative patented inventions.

The report also includes a cross-layer comparison revealing where innovation is concentrated and where competition is intensifying across the LiDAR ecosystem.

Figure 3: Leading patent assignees by technological segment in automotive LiDAR.

IP Evolution & Players IP Profiles

The study offers a data-driven view of how LiDAR IP leadership has shifted over the last four years, analyzing competitive dynamics using patent volume, growth rate, legal status, geography and technology coverage. A structured and comparable IP profile analysis covers 30 influential LiDAR patent assignees, reflecting the structure of the global ecosystem:

- LiDAR Pure Players:

Hesai, RoboSense, Ouster (Sense Photonics), VanJee, Seyond, Zvision, Aeva

Additional pure players with portfolio overview: Leishen Intelligent, Sick, Benewake, SOSLAB, Oradar, Luminar, SiLC Technologies, Innoviz, MicroVision, Ibeo Automotive, Mobiltech, Infoworks, Blickfeld, OLEI, LiangDao, Aeye

- Tier-1 Suppliers: Bosch, Huawei-Yinwang, Valeo

- Autonomous-Driving / Vehicle Companies: Aurora, Alphabet-Waymo

- Car Makers: Hyundai, General Motors

Each profile includes 2021-2025 IP leadership evolution, IP dynamics, geographical footprint, technical segmentation and recent patent activities, offering a clear and consistent view of how different categories of players shape the global LiDAR innovation landscape.

Excel Patent Database

- Complete dataset of 36,200+ patent families

- Focus set of 24,300+ families added in the last four years

- Segmentation fields and direct hyperlinks to the updated online database

Strategic Insights

This report equips executives, R&D teams, and IP professionals with the tools to:

- Align innovation strategies with patent and innovations dynamics.

- Strengthen competitive positioning by identifying both IP leaders and fast-moving IP newcomers.

- Secure freedom-to-operate through in-depth portfolio benchmarking and ecosystem mapping.

- Anticipate technological trajectories in one of the most competitive IP battlefields in autonomy.

Companies mentioned in the report (non-exhaustive)

Bosch, VanJee Technology, Hesai, RoboSense, Huawei – Yinwang, Hyundai, Idriverplus, Kia, General Motors, Dongfeng Motor, State Grid Corporation of China, Alphabet – Waymo, LG, Zvision, Valeo, FAW Group, Sony, Samsung, Amazon – Zoox, Mercedes-Benz, Toyota, Ford, BMW, Aurora, ICAN Technology, Leishen Intelligent System, Volkswagen, Glas Trust, Benewake, Geely – Volvo Cars, Continental, Baidu – Apollo, Denso, Changan Automobile, NIO, Honda, Aeva, Mando, SOSLAB, Ouster – Sense Photonics, ZF, Motional, Seyond, Minth Group – Ningbo Xintai, China Southern Power Grid, Panasonic, Zhidao Network Technology, Qualcomm, Sick, Mobiltech, Aptiv, BYD, INFINIQ, ASENSING, DJI Technology, Innoviz, LiangDao, SiLC Technologies, Youdao Zhitu, Infoworks, TuSimple, Neolix, WeRide, CAIC, Intel, Jingwei Hirain, Fortsense, GAC Group, Koito Manufacturing, Leike Zhitu, Shanghai Westwell Technology, KETI – Korea Electronics Technology Institute, Ningbo Sunny Automotive Optech, UISEE, Voyah Automobile Technology, Pioneer, Chery Automobile, Dspace – Digital Signal Processing & Control Engineering, Luminar, Nvidia (W/ Deepmap), Tanway, & E Hub Armenia, Hefei Jijia Guangda Technology, Pony.Ai, Shenzhen Camsense Technologies, STMicroelectronics, Dji Technology, Mercedes-Benz, Momo Zhixing Technology, Zhejiang Huaray Technology, Changzhou Xingyu Automotive Lighting Systems, Cowa Technology, Elmos Semiconductor, and more.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni Zhou, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on RF front-end systems and advanced sensing technologies. Her expertise also includes the design of radar sensing systems, enabling precise detection in complex and dynamic environments. She is the inventor of over 20 patents and has authored more than 10 scientific publications in the field.

Nicolas Baron, PhD., CEO and co-founder of KnowMade. He manages the development and strategic orientations of the company and personally leads the Semiconductor department. He holds a PhD in Physics from the University of Nice Sophia-Antipolis, and a Master of Intellectual Property Strategies and Innovation from the European Institute for Enterprise and Intellectual Property (IEEPI) in Strasbourg, France.

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.