SOPHIA ANTIPOLIS, France – June 18, 2025 │ The European lithium-ion battery landscape is undergoing a transformative evolution, driven by the ambition to build and improve a domestic industrial environment to counter foreign dominance. This shift has catalysed a wave of investment in battery production, recycling infrastructure, and supply chain localization across the region.

Battery recycling has also become a strategic priority. The European Green Deal and associated regulations mandate materials recovery and high recycling rates, encouraging the development of a circular battery economy. Companies like Umicore, Veolia, Cylib, Eramet & Suez, HydroVolt, SNAM, and Mecaware are involved in advanced recycling facilities to extract critical materials such as lithium, cobalt, manganese and nickel from spent batteries.

While the European lithium-ion battery ecosystem is still in its formative years compared to established East Asian producers, it is rapidly gaining momentum. A combination of regulatory support, technological innovation, and industrial collaboration is positioning Europe as a developing market in the global battery industry, with a focus on sustainability, circularity, and strategic autonomy.

The next five years will be critical as gigafactories come online, supply chains mature, and recycling infrastructure scales to meet the demands of the green energy transition. This time will be critical in determining whether Europe’s IP ecosystem can fully support its ambitions to lead in the global battery economy.

Since Europe has become a developing market, attracting interest and investments from Chinese companies (mainly Materials, Batteries and Vehicles manufacturers). European entities that already have a strategic intellectual property (IP) position (Bosch, Volkswagen, BMW, Umicore, CEA, BASF) are being challenged, and in some cases overcome, by both established and emerging Chinese players eager to expand their presence in the Western markets. Patents can serve as strategic assets, enabling European players to preserve and strengthen their market presence, and allowing Chinese players to establish their relevance. Only time will tell how the story unfolds. In this article we offer a glimpse into the European patent landscape of Li-ion batteries, considering alive patents in Europe. We then take a closer look at one technological segment of interest, Li-ion battery recycling, and highlight the position of a particularly relevant IP player in this context, Brunp Recycling Technology.

Overview of the Li-ion battery European patent landscape

Given the growing importance of the Li-ion battery developing market on European territory, it is not surprising that the related IP landscape is evolving as well.

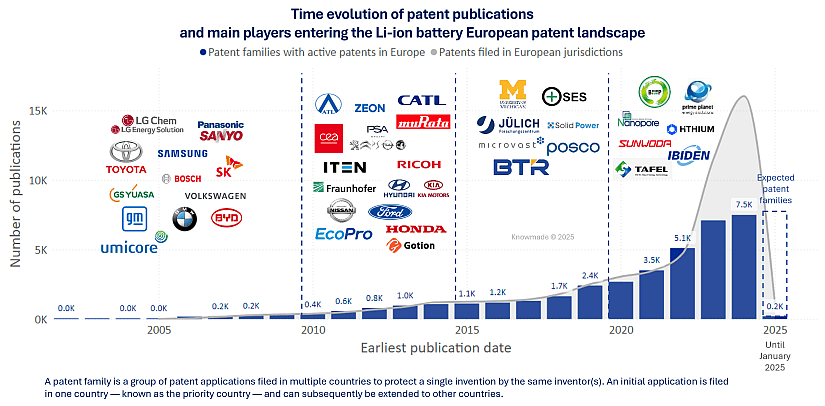

Considering alive patents in Europe (i.e., pending applications or granted patents in European jurisdictions), Japanese and South Korean companies (LG Chem/LGES, Samsung, Toyota) have been historically present alongside native and Western entities (Bosch, Volkswagen, BMW, Umicore), protecting their inventions in European countries since the 1990s. During the 2010s, various other entities have been expanding their IP rights; some from the previously mentioned areas (Nissan, Hyundai-Kia, Posco, CEA, Murata Manufacturing), while the majority is mostly from China (CATL, ATL, BTR, Brunp, Sunwoda, Hithium, Tafel).

Figure 1: Time evolution of patent publications in Europe related to Li-ion battery (both patent families and individual patents currently alive). Logos highlight the key patent applicants entering the European Li-ion battery patent landscape during each 5-year period. Note that the data corresponding to the year 2025 is not complete since the patent search was done in January 2025.

This marks a shift in the tide: while Chinese entities have historically focused on securing IP rights domestically, recent years have seen a surge in patent applications filed outside of China. This trend is granting Chinese entities greater presence and pushing other IP players further toward the margins of the landscape. This underlines, once again, that the European market is a strategic focus for Chinese IP players as they strive to establish and expand their dominance in the Li-ion battery sector.

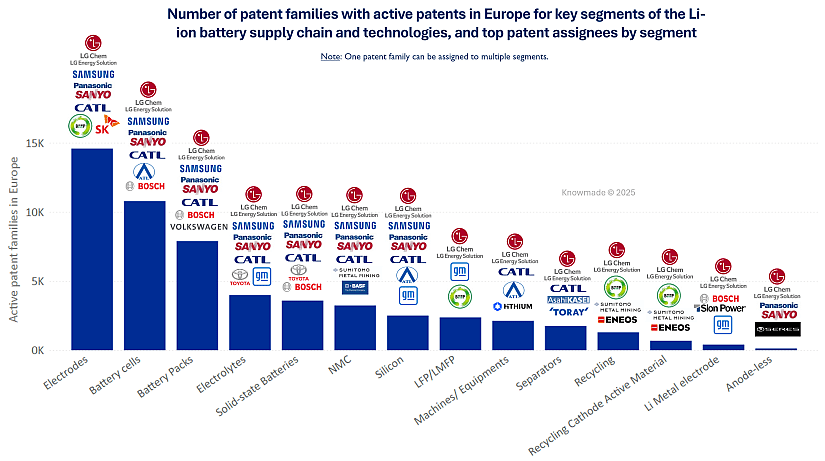

Figure 2: Number of patent families with active patents in Europe for key segments of the Li-ion battery supply chain and technologies. Logos highlight the main patent assignees for each segment. Note: a patent family can belong to multiple segments.

Figure 2 provides a comprehensive overview of the distribution of patent families across key segments of the Li-ion battery supply chain and technologies. The graphic highlights how Chinese, South Korean, Japanese and European players are shaping the European IP landscape in different ways. The presence of automakers like Volkswagen, Toyota, and General Motors signals the vertical integration trend, with increasingly investments in battery technology IP to secure strategic autonomy.

LG Chem/LGES is the only entity appearing among the top 3 patent assignees in all segments, showcasing its broad technological coverage and IP leadership across the battery value chain. CATL, Panasonic/Sanyo, and Samsung also demonstrate cross-segment strength, albeit slightly more focused.

The “Electrodes” segment stands out as the most patenting-intensive and IP competitive in Europe, leading by LG Chem/LGES, CATL, Panasonic/Sanyo, Samsung, Brunp Recycling Technology, and SK. “Battery cells” and “Battery packs” segments follow, with Bosch and Volkswagen being key patent assignees in addition to LG Chem/LGES, CATL, ATL, Panasonic/Sanyo and Samsung, indicating strong engagement from European automakers.

In solid-state batteries, European patent filings are important, with Toyota and Bosch carrying weight, highlighting the strategic race to commercialize this next-generation technology. For NMC and LFP/LMFP cathode technologies, Sumitomo Metal Mining, BASF, General Motors, and Brunp appear prominently. Silicon anodes and recycling show significant patent activity in Europe as well, marking growing interest in high-energy-density materials and sustainability. Segments like Li-metal electrodes and anode-less batteries have fewer European patents, with players such as Sion Power and SERES that mark their presence.

Figure 2: Number of patent families with active patents in Europe for key segments of the Li-ion battery supply chain and technologies. Logos highlight the main patent assignees for each segment. Note: a patent family can belong to multiple segments.

Relevant European IP players like Bosch, Volkswagen, BMW, Umicore, CEA, and BASF are present across all the supply chain, showing top patent activity in segments such as Battery Cells, Battery Packs, NMC cathodes and Solid-State Batteries.

On the other hand, while most of the top patent assignees in Europe are well-known companies in the battery ecosystem, many new interesting entities appeared on the landscape recently.

IP newcomers in Europe for Li-ion batteries

Since 2020, many IP newcomers have shown interest in expanding into the European Li-ion battery IP landscape (i.e., first Li-ion battery-related patents filed in Europe in 2020 or later).

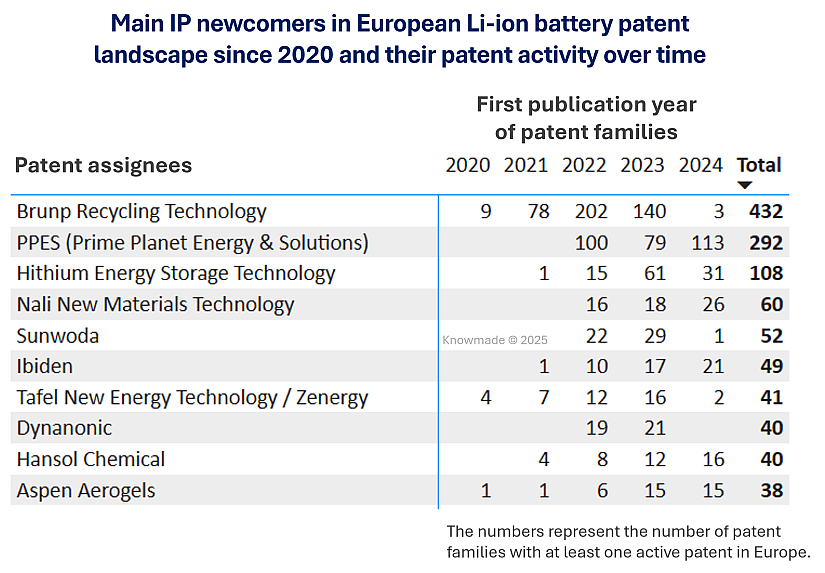

Table 1: Top 10 IP newcomers in the European Li-ion battery patent landscape since 2020 (i.e., first Li-ion battery-related patents filed in Europe in 2020 or later) and a yearly breakdown of their patent families’ publications in Europe.

While IP newcomers typically hold a limited number of patent families, Brunp Recycling Technology and PPES (Prime Planet Energy & Solutions) have been particularly active in Europe. It is surprising that Brunp, a pure player in the field of battery recycling rather than a company operating broadly across the general Li-ion battery sector, has managed to file a significant number of patents in European jurisdictions.

Overall, most of the main IP newcomers in the European Li-ion battery IP landscape are Chinese entities. This highlights a recent shift in the approach of Chinese players, reflecting a growing interest in expanding their IP protection abroad, making a notable departure from the historical IP strategy typically pursued by Chinese companies.

Focus on Li-ion battery recycling-related patent activity in Europe

Europe is currently dependent on global supply chains for raw battery materials, making it vulnerable to geopolitical risks and market fluctuations. The importance of Li-ion battery recycling is rapidly growing as Europe accelerates its transition to electric mobility and renewable energy. With the push for electric vehicles (EVs) and energy storage systems continuing, the need for critical materials like lithium, cobalt, manganese and nickel has intensified. Recycling offers a strategic solution by recovering these scarce resources from end-of-life batteries, reducing reliance on imports, shortening the supply chain, minimizing environmental impact, creating local jobs, and supporting domestic battery manufacturing.

Li-ion battery recycling is a cornerstone of Europe’s energy strategy, and it is no surprise that this field has gained significant importance in recent years in terms of European patent filings. With around 500 patent applicants active in this segment, patenting activity has sharply increased since 2015, materials manufacturers representing the most prominent category of patent holders, with most IP players originating from Asia.

The dominant IP position of Brunp Recycling Technology

Founded in 2005, Brunp Recycling Technology is a Chinese company owned for the 65% by Contemporary Amperex Technology Co. Limited (CATL), the current market leader in Li-ion batteries for electric mobility [1]. Brunp’s activity is currently focused on battery recycling in China and Indonesia, with planned operations in Africa and Europe [2]; several battery automakers (Mercedes-Benz, Volvo, BMW, FAW-Volkswagen, GAC-Toyota) are current partners of Brunp [3].

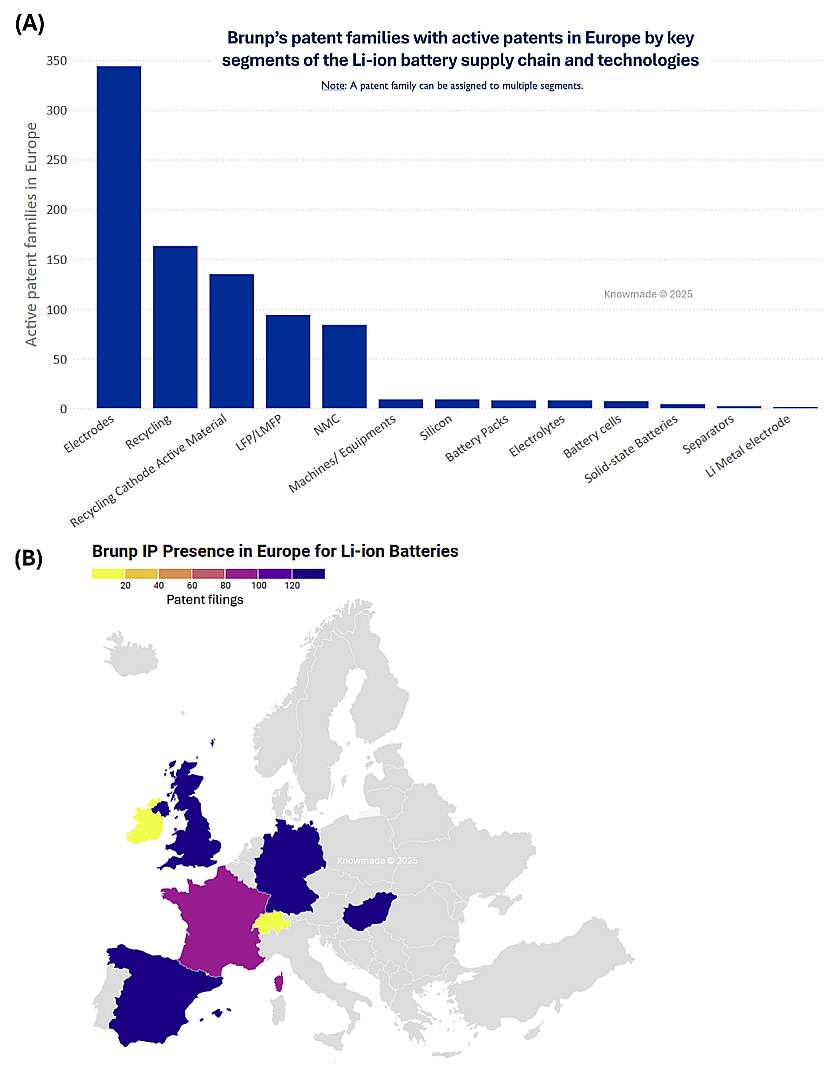

Brunp’s entry into the European Li-ion battery patent landscape has been sudden, marked by intensive patent activity between 2021 and 2023. With over 940 patents filed in Europe (8% granted and 92% pending) grouped into 430 patent families, Brunp has emerged as a serious IP challenger in the European IP arena.

Figure 3: Brunp’s patent families with active patents in Europe by key segments of the Li-ion battery supply chain and technologies (A), and geographical distribution of Brunp’s Li-ion battery alive patents portfolio in Europe (B). In addition, Brunp appears also as patent assignee for more than 300 patent applications at the European Patent Office (EP patents) and over 330 PCT patent applications (WO patents).

Brunp’s IP protection efforts in Europe are predominantly directed to strengthen its position in relevant European jurisdictions Great-Britain, Hungary, Germany, Spain and France, with a significant portion of patents filed through European Patent Office (EP patents). This heavy effort allowed Brunp to acquire a dominant IP leadership position in the segments “Recycling”, “Electrode”, and “LFP/LMFP”.

This assertive European IP strategy indicates that Brunp has clearly chosen to place a strong bet on the development of the European Li-ion battery market.

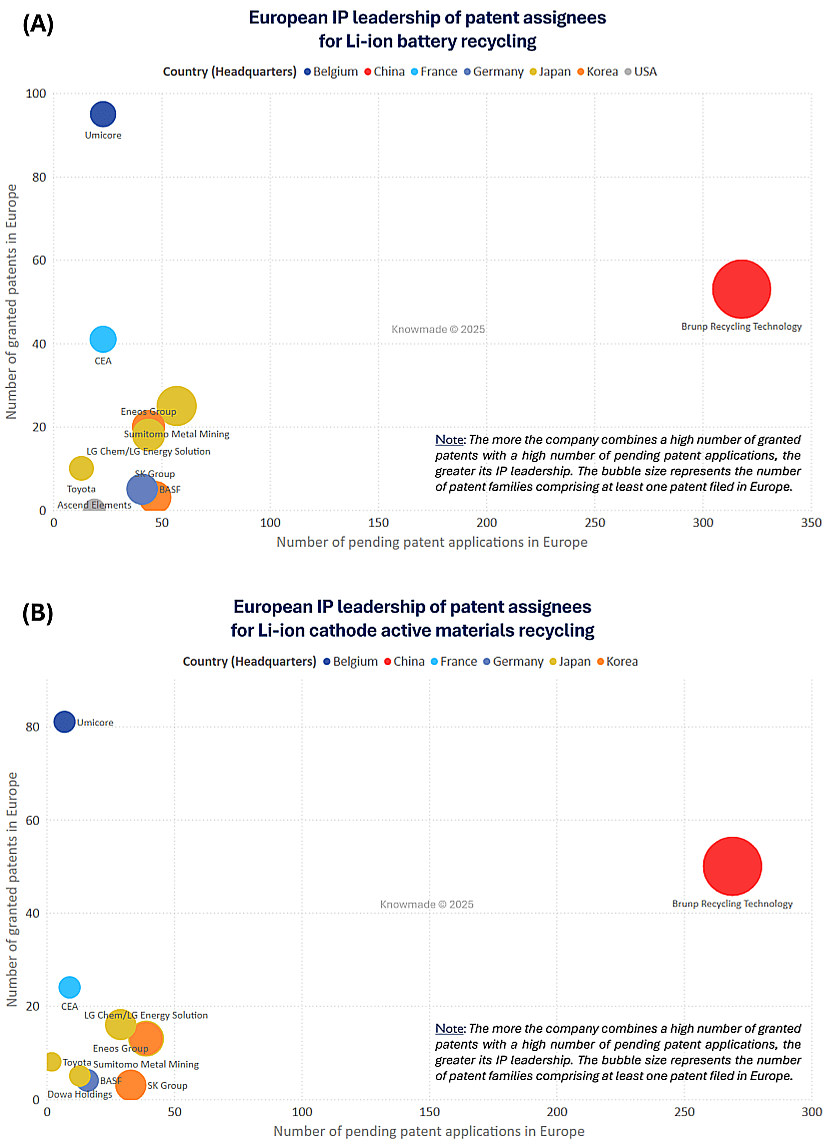

Figure 4: European IP leadership of patent assignees for Li-ion battery recycling: Number of granted patents in Europe vs. Number of pending patent applications in Europe for the top 10 patent assignees in the segment “Recycling” (A) and sub-segment “Cathode Active Materials Recycling” (B).

Thanks to its aggressive patent filing strategy in Europe in the last few years, Brunp was able to overcome longstanding and well-known IP players such as Sumitomo Metal Mining, LG Chem/LG Energy Solutions, Eneos Group, BASF and others. Its currently enforceable European patent portfolio for Li-ion battery recycling is expected to strengthen further over time thanks to its massive amount of pending patent applications, consolidating the power leverage position it acquired in a remarkably short time span.

Brunp’s IP leadership gain places it at the forefront of innovation and underscores the tremendous effort Chinese companies are now investing in expanding into high-potential markets beyond China, a clear difference from the trends observed in previous years.

Key European patents from Brunp’s portfolio

Focusing mainly on the recovery of strategic metals from black mass, electrodes, battery cells, and modules, Brunp has established its strong IP position through a series of relevant patents across the value chain. By covering all the main cathode chemistries for Li-ion batteries, this outstanding IP player has managed to overcome other companies in the field. Moreover, Brunp’s diversified IP portfolio is not only limited to recycling methods alone but also extends to manufacturing.

Many of Brunp’s Li-ion battery-related patents have been filed in major European countries such as Germany, UK, France, and Spain, with a particular focus on Hungary, which is gradually becoming a strategic hub for battery manufacturers, especially those from China [4].

To gain insight into Brunp’s Li-ion battery IP portfolio, let’s take a closer look at three European patents, each addressing a different aspect of battery technology.

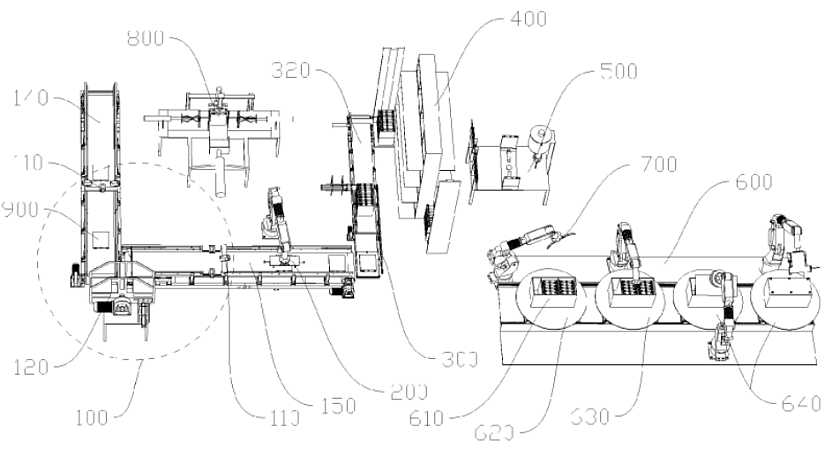

- EP4199163 – Automatic Production Line for Cascade Utilization of Power Batteries (filed in 2021 and granted in Germany, Spain, Switzerland, and Ireland).

This patent claims a fully automated production line for reusing retired power batteries. The main innovations are:

- Integration of scanning, mechanical flipping, voltage detection

- Introduction of a robotic arm-driven tab installation and welding system

- Grouping and packaging battery cells into reusable modules

The fully integrated automation from inspection to reassembly minimizes human intervention while improving efficiency, safety, and consistency in second-life battery module production compared to partially automated processes. Recycling is not only a pure matter of materials recovery and reuse in manufacturing, but it also means to adopt a circular approach, ensuring a fully valid second life to existing devices.

Figure 5: Schematic diagram of the manufacturing line structure in patent EP4199163.

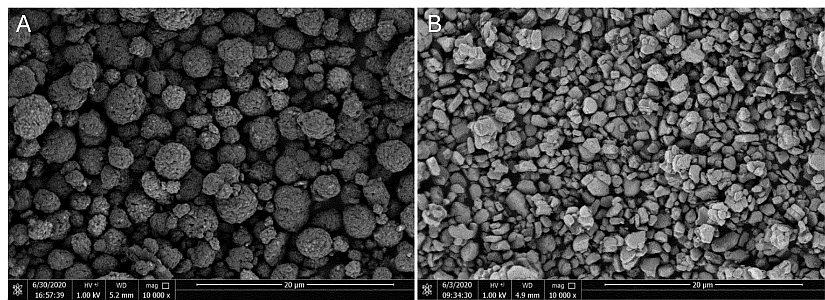

- EP4202089 – Ternary Single Crystal Positive Electrode Material (filed in 2021 and granted in Germany, Great-Britain, Switzerland, and Ireland).

This invention introduces a resource-efficient upcycling process that turns production waste into high-performance single-crystal cathodes, improving ion conductivity, structural stability, and capacity retention at high voltages.

The innovative method allows to transform waste NMC polycrystalline micropowder into single-crystal cathode material (LiNixCoyMnzO2) via:

- Controlled primary sintering

- Jet pulverization and water washing

- Coating and secondary sintering with specific additives (oxides or fluorides)

This invention relates to a core recycling method, but this is not merely a refinement. It is a novel reuse loop in the lithium battery value chain, and it stands apart from prior art by combining sustainability and electrochemical superiority in one integrated method.

Figure 6: Polycrystalline NMC used as waste source in patent EP4202089 (A) and resulting monocrystalline NMC after the recycling process (B).

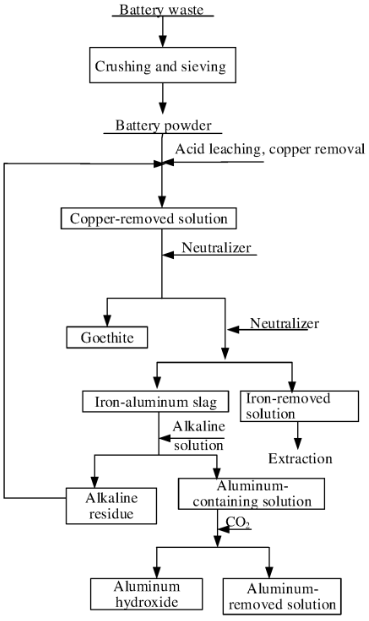

- EP4194572 – Method for Recycling Iron and Aluminum in NCM Solution (filed in 2021 and granted in Germany, Spain, Great-Britain, Hungary, Switzerland, and Ireland).

This patent describes a multi-step hydrometallurgical method to remove and recover iron and aluminum impurities from NMC leach solutions. It includes:

- Staged pH adjustments to precipitate goethite and iron-aluminum slag

- Alkaline leaching and carbonation to separate and recover aluminum as hydroxide

- Emphasizes minimal waste and reuse of by-products as neutralizers.

This zero-waste recycling loop enables not just Fe/Al removal, but also conversion of hazardous iron-aluminum slag into commercially viable goethite and aluminum hydroxide, while retaining and recycling valuable metals. The reuse of by-products within the process marks a significant improvement over other conventional disposal-heavy hydrometallurgical method.

Figure 7: Schematic process described in patent EP4194572.

Brunp’s European patent portfolio reveals a strategic and comprehensive approach to intellectual property in the lithium-ion battery recycling space. Rather than focusing solely on core recycling processes, Brunp actively protects innovations across the entire circular value chain. As illustrated by various examples, from automated repurposing systems to advanced cathode material reengineering, and zero-waste hydrometallurgical techniques for impurity recovery, Brunp’s European IP covers different stages of the recycling operation. This demonstrates an effort to secure not only material recovery, but also value creation from waste, equipment design, and materials reintegration. Such an European IP strategy gives Brunp competitive leverage across reuse, recycling, and reintegration into new battery manufacturing. Brunp is therefore not only safeguarding its technologies in Europe but also shaping the European landscape for closed-loop battery ecosystems.

Conclusion

Brunp Recycling Technology‘s rapid ascent within the European Li-ion battery patent landscape illustrates a significant shift in the global battery industry. In just a few years, Brunp has leveraged an aggressive, IP strategy to secure European IP leadership in the critical segments of battery recycling. This trajectory is emblematic of a broader move by Chinese companies toward strategic engagement in foreign markets. No longer content to compete solely on the domestic market, Chinese players are now targeting technological and legal influence, actively shaping the framework of a future circular battery economy in Europe.

This evolution presents both a challenge and an opportunity for Europe. Maintaining technological sovereignty will require more than financial investment or regulatory support; it demands the full focus on innovation. As battery recycling becomes a foundational pillar of the continent’s energy strategy, Europe’s ability to innovate and protect its technological advancements will be critical. Brunp‘s rise is a strategic signal that underscores the urgent need for Europe to strengthen its intellectual property capabilities and assert itself as a reliable IP leader within its own territory.

[1] https://www.catl.com/en/solution/recycling/

[2] https://en.brunp.com.cn/about-us/company-overview?tp=48

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Filippo Farina, PhD. works at KnowMade as Patent & Technology Analyst in the field of Energy Storage and Conversion. He holds a PhD in Materials Chemistry from the University of Montpellier (France). After spending few years in industry (Morgan Avanced Materials, EcoLab), he has been working since 2015 on materials for batteries and fuel cells at University of Montpellier, CNRS and CEA-LITEN (France). Contact: filippo.farina@knowmade.fr .

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.