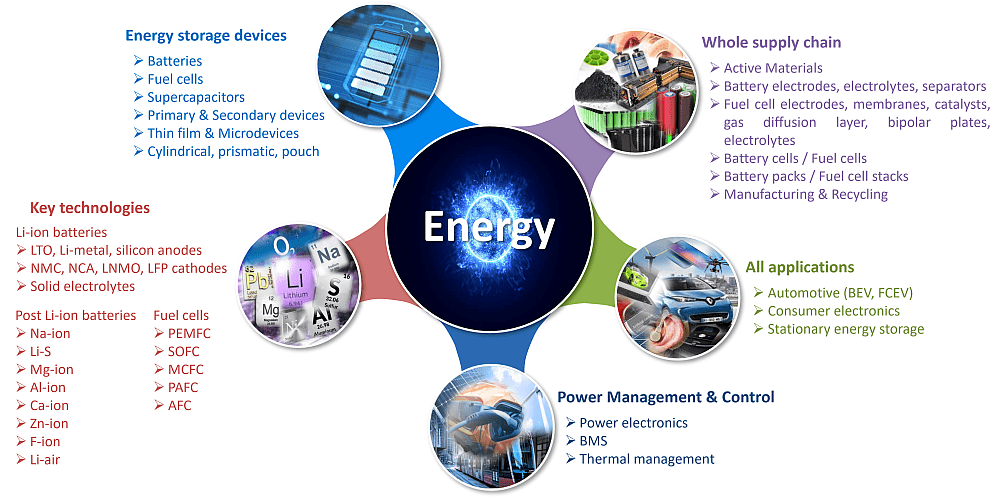

The next decade will be marked by the decarbonisation of our society to achieve carbon neutral status, i.e., net-zero carbon dioxide (CO2) and other greenhouse gas emissions. With the accelerating shift towards electric vehicles and the growing integration of renewables into our energy system, an increasingly more significant portion of our everyday life will depend on reliable energy storage and management technologies.

Electrification of the transportation industry is driving energy storage and management technologies

The transportation sector is undergoing major transformations to fulfil new fuel economy regulations and CO2 emission reduction targets from various governments. Battery electric vehicles (BEV) and hydrogen fuel cell electric vehicles (FCEV) are considered to replace current fossil-fuelled internal combustion-engine vehicles (ICEVs). The technological developments of batteries and fuel cells are driven by this transition. Hydrogen fuel cells and electric batteries are often portrayed as competing technologies (proton versus electron), but they should play complementary roles to decarbonise transportation.

Battery electric vehicles are achieving momentum, and most automakers are now committed to moving from ICEVs to BEVs in a decade. This transition creates opportunities and risks in a highly competitive battery industry where improvements and new technology developments are being made at all levels of the value chain. With some unresolved issues for electric vehicles (mileage autonomy and charging speed, to name a few), we are witnessing a revival in interest in fuel cell technology for electric transportation. Hydrogen fuel-cell passenger cars are a niche product and will likely remain insignificant in the coming years. Fuel-cell technology will fare better for long-haul freight transport. Although fuel cell is an old technology, there is still a lot of room for improvement before hydrogen can play its part in the decarbonisation of the transportation sector. The move from internal combustion engines (ICE) to an all-electric power platform is supported by electric drive development, where wide bandgap semiconductors emerge as promising candidates to enable significant efficiency improvements in power management systems.

KnowMade’s experts have responses

At KnowMade, we have both battery technology expertise and fuel cell expertise to follow and analyse R&D developments and patent activities. We track current and future challenges, the latest innovations, and emerging technologies – from cell materials and components to cells and packs – all the way to energy management systems, safety, and recycling. We cover the leading application segments: consumer electronics, e-mobility, and stationary energy storage.

Latest reports on energy storage technologies

Patent monitors on energy storage technologies

Latest insights on energy storage technologies