SOPHIA ANTIPOLIS, France – April 14, 2025 │ Subtle yet transformative, reconfigurable intelligent surfaces (RIS) are quietly rewriting the rules of radio frequency (RF) communication. As we stand at the threshold of the 6G era, RIS is no longer just a promising concept in academic papers, it has become an intellectual property (IP) battleground where telecom giants, research institutions, and disruptive startups are all vying for dominance.

By intelligently manipulating electromagnetic wave behavior, RIS has the potential to revolutionize signal transmission, reception, and optimization, enabling stronger, cleaner, and more efficient wireless communication. Knowmade provides a comprehensive analysis of the IP landscape related to RIS and metasurfaces used for RF communications. In this article, the term RIS is used broadly to include both RIS-specific and metasurfaces-based innovations in RF. Positioned as key enablers in next-generation RF systems, these technologies are examined through the lens of patent activity, leading stakeholders, academic contributions, regional trends, and strategic collaborations. The study offers valuable insights into the R&D priorities and IP strategies shaping this dynamic and rapidly advancing field.

The Evolution of RIS Technology: Recent Surge in IP Activity

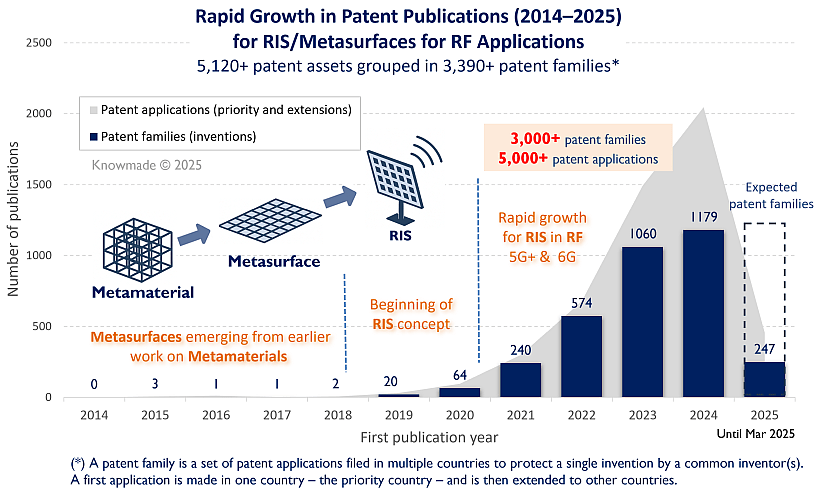

As shown in Figure 1, RIS patents related to RF applications began emerging around 2015, driven by the rise of metamaterials, engineered materials with unique electromagnetic properties. The concept gained significant momentum in 2017 with metasurfaces, leading to a steady increase in patent applications. By 2018, RIS had fully formed and rapidly advanced, propelled by the progress of 5G and the upcoming 6G technologies. RIS technology has evolved from passive, static designs to active, software-controlled surfaces with dynamic tuning capabilities, reshaping the wireless infrastructure landscape.

Since 2020, patent publications have surged, reaching over 1,000 patent families published in 2023 and more than 1,100 in 2024, reflecting increasing interest of RF players for RIS technology. By 2025, RIS patent filings are expected to continue rising, further solidifying their role in the future of wireless communication. According to IDTechEx, the global market for electromagnetic metamaterials is projected to reach US$14.9 billion by 2043, growing at a 72% CAGR from 2024 to 2034. RF applications, particularly RIS, are expected to capture a significant share of this growth.

Figure 1: Time evolution of patent publications related to reconfigurable intelligent surfaces (RIS) technology until March 2025.

Key IP players: Qualcomm Leads in Industry, Chinese Universities Dominate Academia

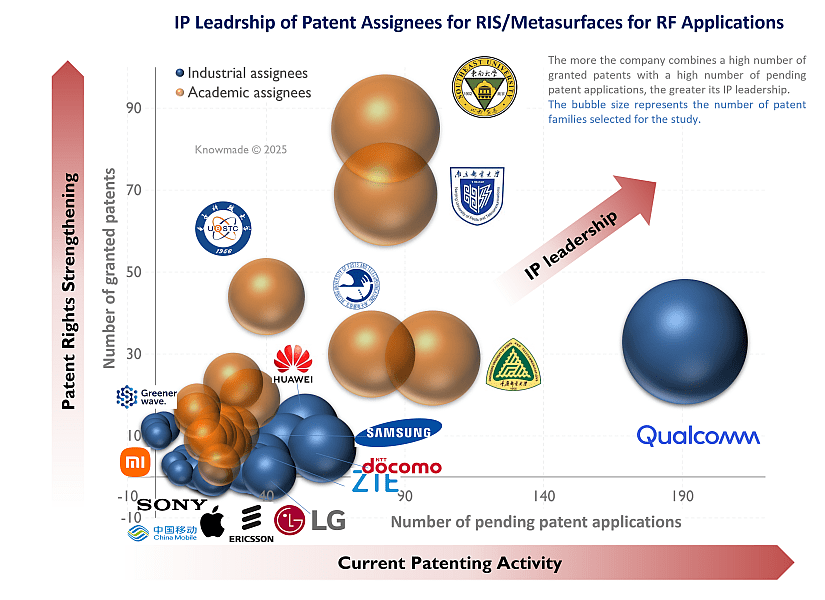

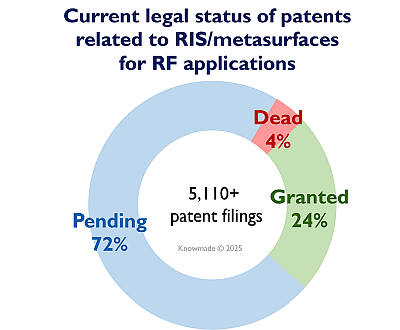

The rise of RIS technology in recent years results in most patent applications still being in a pending status, with 24% of patents already granted. Despite this, the current patent activity offers insights into the potential competitive IP landscape for RIS. Overall, Qualcomm leads the industrial sector by a significant margin, while Chinese universities are making strong strides in the academic sector.

Figure 2: IP leadership of patent assignees for reconfigurable intelligent surfaces (RIS) technology.

Figure 3: Current legal status of patent applications related to reconfigurable intelligent surfaces (RIS) technology.

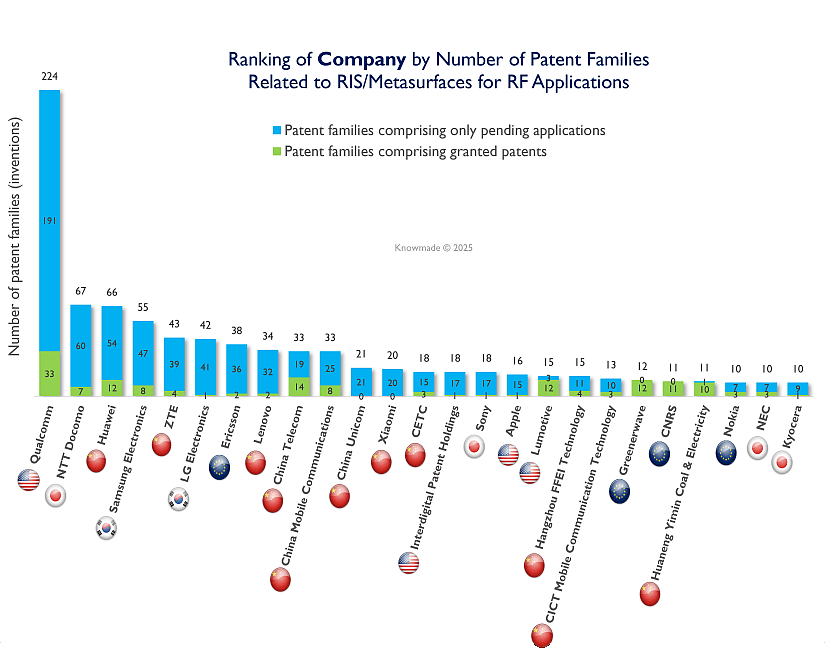

In the RIS patent race, Qualcomm stands ahead, maintaining a significant lead over its competitors in the industrial sector. However, the patent landscape remains highly fragmented, with strong players emerging from various regions. Leading companies include telecom operators like NTT DoCoMo and China Mobile Communications (CMCC), alongside network equipment manufacturers such as Huawei, Samsung Electronics, and ZTE. The surge in patent filings since 2023 reflects growing industry investment in RIS technology, driven by the demand for more efficient, high-capacity communication networks. As companies advance, attention will likely turn to Standard Essential Patents (SEPs), which will not only guide technological development but also shape strategic positioning for the companies holding them. These patents will define leadership in an increasingly complex and competitive market. The fragmentation of patent ownership highlights the critical need for ongoing innovation, as companies compete to secure their place in the rapidly evolving RF communication landscape.

Figure 4: Ranking of industrial patent assignees according to the number of their patent families (inventions) related to reconfigurable intelligent surfaces (RIS) technology, classified by granted and pending status.

Figure 5: Ranking of industrial patent assignees according to the number of their patent families (inventions) related to reconfigurable intelligent surfaces (RIS) technology, classified by recent and non-recent publications.

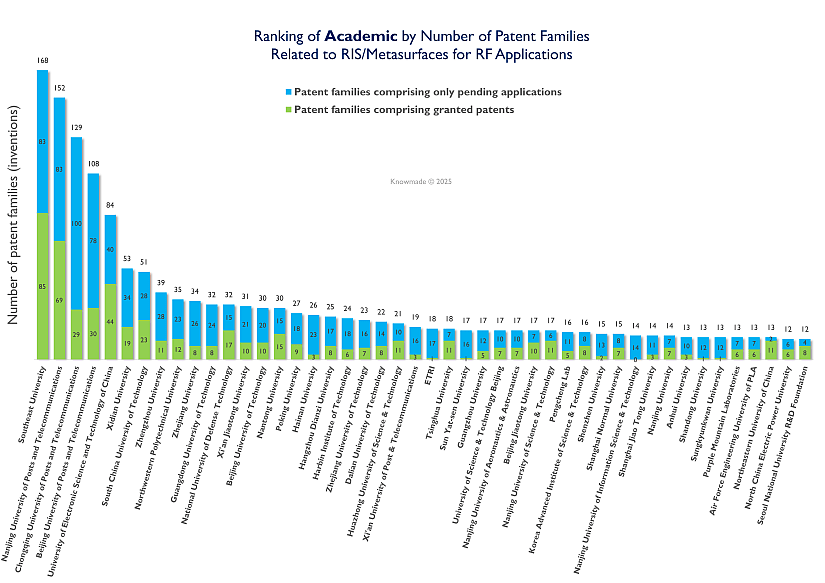

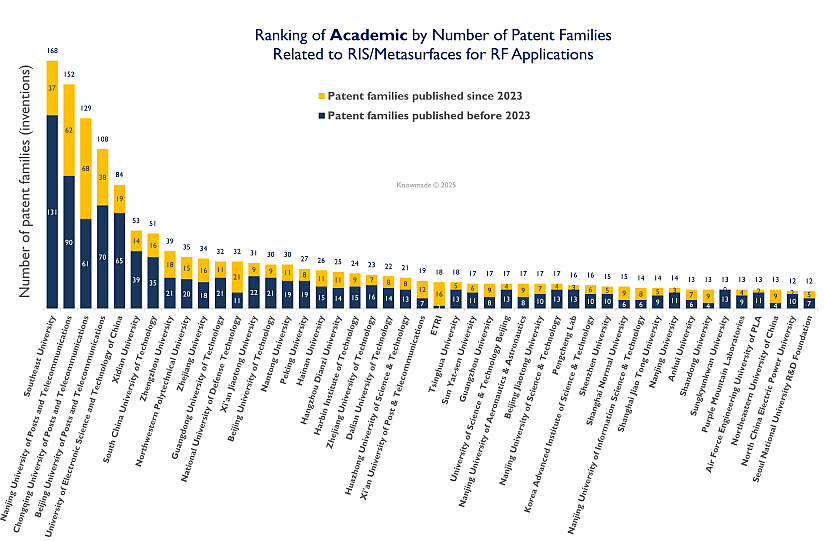

The RIS patent race in academia is led by Chinese universities, with Southeast University at the forefront due to its extensive RIS research. These universities primarily focus on filing patent applications in China, targeting the domestic market, a trend unique to China. Recently, other Chinese institutions have intensified their efforts, particularly since 2023, increasing IP competition. ETRI, a Korean research organization, is one of the few non-Chinese patent applicant. This growing focus on RIS is part of China’s broader strategy to dominate 5G/6G technologies, although these Chinese patents have yet to be fully explored in international markets.

Figure 6: Ranking of academic patent assignees according to the number of their patent families (inventions) related to reconfigurable intelligent surfaces (RIS) technology, classified by granted and pending status.

Figure 7: Ranking of academic patent assignees according to the number of their patent families (inventions) related to reconfigurable intelligent surfaces (RIS) technology, classified by recent and non-recent publications.

Global Landscape of RIS Patent Filings: A Competitive and Fragmented IP Race

The global distribution of RIS patent filings reveals a highly competitive and fragmented landscape, with China emerging as the dominant player, particularly through the contributions of Chinese universities. Almost half of the global patent activity comes from China, reflecting the country’s strong academic involvement in RIS technology as part of its broader strategy to lead in 5G/6G technologies. Qualcomm, the clear leader in the industrial sector, has a substantial presence across multiple regions, with patent filings in the USA, Europe, China, India, Japan, and South Korea, showcasing its global reach and strategic IP positioning. Other major players like NTT Docomo, ZTE, and Huawei have also made significant patent filings in various countries, indicating their intent to secure their innovations in key markets. Several companies are using the PCT system to submit patents internationally, reflecting their ambition to protect their RIS-related inventions across multiple jurisdictions. The USA and Europe remain key competitive regions, with strong patent activity from both Qualcomm and other companies such as ZTE, Ericsson, and NTT Docomo. This widespread activity across regions underscores the global significance of RIS technology and highlights the fierce competition as companies strive to lead the future of wireless communication by mastering the manipulation of electromagnetic waves.

Figure 8: Filing countries of patent applications on reconfigurable intelligent surfaces (RIS) technology, and main patent applicants.

Strategic Outlook: Hot Topics and Ecosystem

Qualcomm, Samsung, Huawei, NTT Docomo, and Southeast University (SEU) are at the forefront of Reconfigurable Intelligent Surfaces (RIS) technology, each contributing uniquely to its development across industry and academia.

Qualcomm, an industry leader, focuses its IP on optimizing wireless signals, reducing interference, and enhancing energy efficiency, particularly through beamforming and dynamic spectrum management. They are also exploring RIS integration for precise positioning and sensing in complex environments like smart cities and autonomous systems. Samsung’s patents emphasize multi-RIS collaboration, beam optimization, and passive RF metasurfaces to extend coverage in areas obstructed from direct line-of-sight, such as in high-frequency and high-density environments. Huawei, focusing on 5G and 6G networks, holds patents advancing multi-RIS systems to increase network capacity and coverage, alongside positioning and sensing applications. NTT Docomo, a key telecom operator, is investigating the virtualization of RIS, aiming to integrate it into existing networks to enable flexible resource management and optimize high-frequency systems. On the academic side, SEU is a leader in RIS theory, with patents contributing to channel modeling, adaptive beamforming algorithms, and machine learning integration, all of which enhance network efficiency in IoT and smart networks.

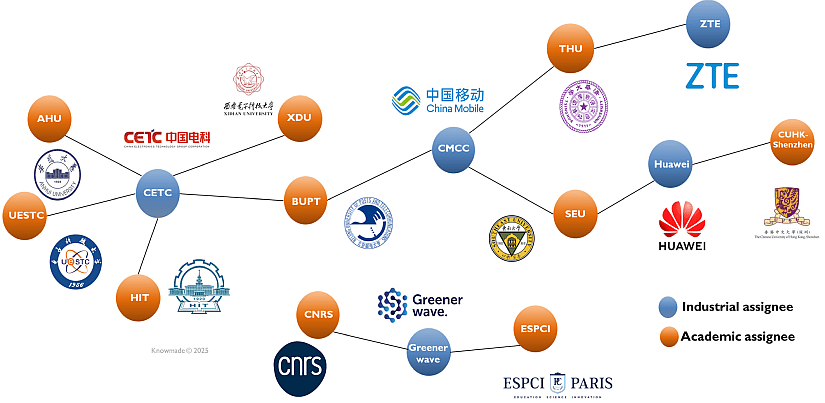

Figure 9: IP collaboration relationships between industry and academic patent assignees on reconfigurable intelligent surfaces (RIS) technology. Links represent patent co-ownerships

An interesting trend we’ve observed is the strong IP collaboration between Chinese universities and leading industry players like CETC, Huawei, China Mobile, and ZTE. These universities, such as SEU, have pioneered much of the theoretical research on RIS, and these strategic partnerships are accelerating the commercialization of cutting-edge technologies. This synergy between academia and industry is not unique to China. Greenerwave in Europe, for example, is collaborating with CNRS and ESPCI Paris to push RIS technology forward. These academic-industry collaborations are vital for developing scalable and efficient RIS solutions that can meet the demands of future wireless networks. Such partnerships are key to advancing RIS technology, expanding IP portfolios, and driving the evolution of 5G, 6G, and beyond, offering a competitive edge in an increasingly dynamic market.

In conclusion, RIS technology is transforming the manipulation of electromagnetic waves in RF communication, with Qualcomm leading the industrial sector and Chinese universities driving RIS theory in academia. The surge in patent filings reflects intense global competition, while academic-industry collaborations help transition research into practical, scalable solutions. These innovations are crucial for optimizing electromagnetic wave behavior, improving network efficiency, and positioning key players to lead in the future of wireless networks.

For a more in-depth look at RIS and metasurfaces technologies, including its technological trends and competitive environment, feel free to contact us.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni ZHOU, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on 5G/6G and RF front-end systems. She developed innovative RF solutions effectively integrated into communication and radar systems. Her work also includes designing advanced radar sensing and imaging systems for accurate detection in complex environments.

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand the competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.