SOPHIA ANTIPOLIS, France – Juin 12, 2025 │ Autonomous driving is no longer just a matter of adding more sensors. It now demands systems that can truly interpret and respond to their environment. Imaging radar has emerged as one of the core technologies enabling this transition.

Unlike conventional millimeter-wave radar, imaging radar is not simply about better resolution. Its objective is to give radar the capability to perceive the world in a visual-like way. Using large-scale multiple-input multiple-output (MIMO) antenna arrays, advanced beamforming, and AI-driven signal processing, imaging radar generates dense point clouds that reveal object contours and environmental structure. It performs reliably in adverse weather, low-light conditions, and complex traffic scenarios. In some applications, it already serves as a cost-effective complement or alternative to LiDAR and camera.

Among the various technological directions within imaging radar, 4D imaging radar is currently among the fastest growing and commercialized. It simultaneously captures four essential parameters: distance, velocity, azimuth, and elevation. This allows radar to evolve from a simple detector into a system capable of spatial perception.

From Technical Evolution to IP Competition: A Focus on 4D Imaging Radar

In KnowMade’s upcoming report, “Imaging Radar for Autonomous Systems Patent Landscape 2025”, we have analyzed more than 10,000 patent families, including innovations in frequency-modulated continuous-wave (FMCW) radar, synthetic-aperture radar (SAR), AI-enhanced imaging, multi-sensor fusion, and more. The report provides a focused analysis of the intellectual property (IP) landscape, highlighting competition, technology trends, and strategic risks and opportunities across primarily land-based automotive perception applications, while also covering aerospace, maritime, and defense domains.

This insight article focuses on one strategic segment of that patent landscape: 4D imaging radar for autonomous driving. We have reviewed more than 1,100 patent families and identified over 600 core inventions that form the foundation of this technology. These patents reflect ongoing innovations in signal processing, chip design, antenna integration, and system-level implementation.

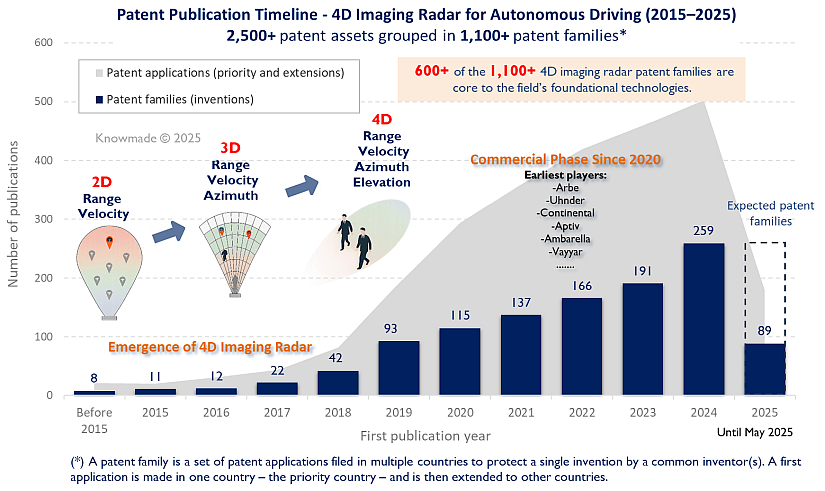

As illustrated in Figure 1, patent activity in 4D imaging radar has grown significantly over the past decade. Before 2015, patent publications were scarce and resulted from exploratory technology developments. A clear inflection point occurred around 2018, driven by progress in FMCW and MIMO technologies, along with AI-based signal enhancement. These developments helped transition 4D imaging radar from proof-of-concept to scalable integration. Since 2020, the field has entered a phase of commercial momentum. Companies such as Arbe Robotics, Uhnder, Continental, Aptiv, Ambarella, and Vayyar have accelerated their R&D and filed patent applications extensively.

Figure 1: Time evolution of patent publications related to 4D imaging radar for autonomous driving until May 2025.

By 2024, the total number of patent families had climbed to 1,056, nearly a sixfold increase since 2019.

This upward trend reflects two key dynamics:

- A shift from technical feasibility to system-level performance. Many patents focus on beamforming precision, angular resolution, integration efficiency, and multi-sensor fusion.

- A growing use of patents as strategic tools. With more than 600 core patent families already published, early movers are shaping a competitive IP landscape that presents significant barriers to new entrants.

Who Controls the Core IP of 4D Imaging Radar?

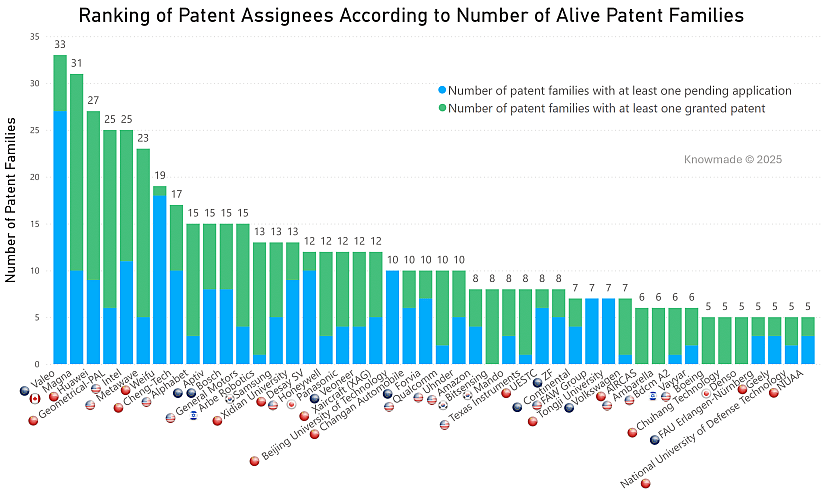

The global competition over 4D imaging radar patents has evolved from early-stage technological exploration to a phase of strategic deployment. As shown in Figure 2, the leading patent holders are concentrated in five key regions: North America, China, Europe, Israel, and South Korea.

The ranking of patent assignees based on the number of alive patent families reveals:

- Valeo (France) ranks first with over 30 active patent families, reflecting its early investment in system-level integration as a Tier 1 supplier.

- Chinese applicants are rapidly gaining ground, with companies such as G-PAL (Geometry Partner), Changan Automobile, Weifu, and Cheng-Tech showing high patenting activity.

- Israeli (Arbe, Vayyar), American (Metawave, Intel, Uhnder), and South-Korean (Bitsensing, Samsung) companies are also emerging as key patent owners.

The chart distinguishes between granted patents (green) and pending patent applications (blue), highlighting that while some startups may not lead in volume, they demonstrate strong innovation and rapid patent filing momentum.

Figure 2: Ranking of patent assignees according to the number of their patent families (inventions) related to 4D imaging radar for automotive applications, classified by granted and pending status.

A patent family is a set of patent applications filed in various countries in relation to a single invention.

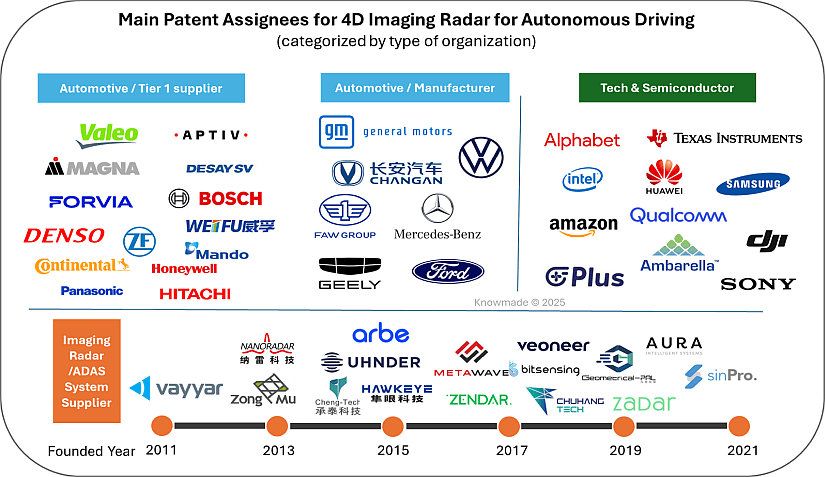

Figure 3 classifies the key players by company type, revealing four dominant categories in the imaging radar ecosystem:

- Automotive Manufacturers (e.g., Changan, Mercedes-Benz, SAIC, GM, Geely)

- Typically engage in imaging radar through partnerships or in-house integration.

- Their patents often target system architecture and driving decision layers.

- Tier 1 Suppliers (e.g., Valeo, Magna, Continental, Bosch, ZF, Forvia, Desay SV)

- Focus on integrated sensing platforms, sensor fusion, and mass production readiness.

- Commonly collaborate with chip and ADAS platform providers (e.g., Valeo + Mobileye).

- Tech & Semiconductor Companies (e.g., Intel, Qualcomm, TI, Samsung)

- Develop radar computing platforms, with patents centered on SoC design, AI-based processing, and power optimization.

- Typically act as enabling layers in the ADAS supply chain.

- Radar-Focused & ADAS Startups (e.g., Arbe, Uhnder, Metawave, Bitsensing, G-PAL)

- “Tech-native” players, often offering full-stack radar systems.

- Focus areas include high-density MIMO, AI point cloud processing, and real-time object tracking.

- These companies have high patent density, strong innovation concentration, and rapid commercial progress.

Figure 3 : Classification of patent assignees by organization type in the 4D imaging radar patent landscape for autonomous driving.

Strategic partnerships, acquisitions, and commercial agreements are increasingly shaping the IP landscape. Notable examples include:

- Intel acquired Mobileye in 2017, integrating EyeQ chips with perception algorithms into an end-to-end ADAS platform.

- Waymo, a subsidiary of Alphabet, is developing integrated sensor and compute systems for autonomous driving.

- G-PAL (Geometry Partner), exclusively funded by Bosch’s venture platform Boyuan Capital, offers L2–L4 machine-perception-driven software-hardware integrated systems.

- Arbe Robotics secured a multimillion-dollar order from Chinese Tier 1 supplier Weifu, accelerating commercial deployment.

- Valeo, Volkswagen and Mobileye launched the partnership to enhance ADAS functionality.

These collaborations often lead to joint patent filings, co-inventorships, and platform co-developments, creating a compounded IP advantage and forming hidden entry barriers for new players.

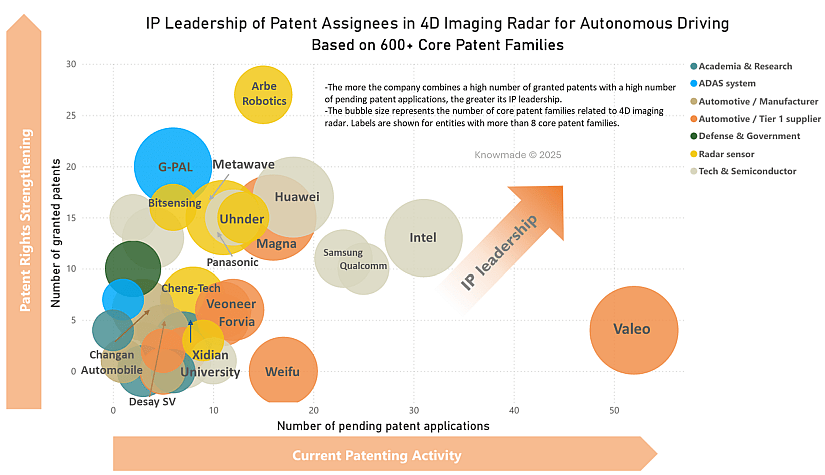

Figure 4 highlights the positioning of key patent assignees across 600+ core patent families, categorized into seven types of organizations. Several notable patterns emerge:

- G-PAL, founded in 2018, leads in total core patents related to 4D imaging radar for autonomous driving. Its patents focus on adverse weather point cloud processing and multi-modal perception system integration.

- Valeo appears in the lower-right quadrant, suggesting that the company is currently in an active expansion phase, focusing on forward-looking innovation.

- Arbe Robotics holds the most granted patents in this space, underscoring its leadership in patent quality and early market readiness.

- Intel, thanks to Mobileye’s patents acquisition, has entered the top tier of 4D imaging radar patent owners.

- Uhnder and Metawave show IP strength in chip integration and product-grade radar solutions.

- Samsung and Qualcomm, while less concentrated in this specific niche, exert long-tail influence through platform standardization and sensor integration support.

Figure 4 : IP leadership of patent assignees in 4D imaging radar for autonomous driving based on 600+ core patent families identified.

Competition in 4D imaging radar for autonomous driving now extends far beyond the sensor itself. It encompasses chip architecture, system integration, algorithm leadership, and platform compatibility. In this rapidly evolving domain, leadership will not belong solely to the fastest innovators, but to those who master the interplay between patent strategy, technology convergence, and ecosystem control.

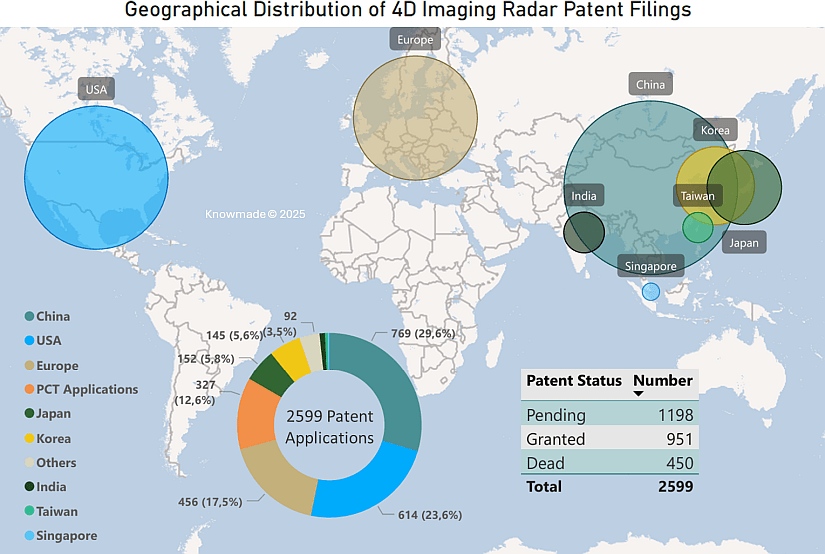

Global Distribution of 4D Imaging Radar Patents

As shown in Figure 5, the global patent filing distribution for 4D imaging radar demonstrates a clear concentration in specific territories, reflecting applicants’ market prioritization and protection strategies.

China leads as the top filing country, accounting for nearly 30% of all patent applications. This highlights the country’s importance as both a manufacturing and deployment market for autonomous driving. While many patent filings originate from local players such as G-PAL, Changan, and Cheng-Tech, foreign companies are also actively seeking protection in China due to its growing relevance.

The United States and Europe follow closely in filing volume, indicating their continued strategic importance in global IP portfolios, especially for technologies involving radar-chip integration and system-level design. Japan, South Korea, and Taiwan also maintain a steady interest for patent applicants.

A significant share of patents, over 12%, are filed via the PCT route, indicating strong global IP strategy ambitions from both traditional suppliers and emerging radar startups.

From a legal status perspective, nearly 46% of patent applications are still pending, indicating that the field remains highly dynamic in terms of R&D. The relatively high grant rate (36%) suggests that foundational technologies have reached a level of maturity suitable for commercial deployment, while the large number of applications still under examination reflects continued innovation.

Figure 5: Filing countries of patent applications related to 4D imaging radar for autonomous driving, and their current legal status.

4D imaging radar has evolved from a niche concept into a critical component of next-generation automotive sensing. The analysis of patents filed by key players in the field shows that the technology is advancing on multiple fronts: hardware integration, signal processing, software-defined architecture, and AI-enhanced perception.

Patent activity across more than 2,500 patent assets grouped in over 1,100 patent families reveals not only rapid innovation but also intensifying global competition. From G-PAL’s rise in China to Arbe’s dominance in enforceable core patents, from Valeo’s system-level consistency to Intel’s Mobileye-powered ecosystem, it is clear that the battle for IP leadership is already reshaping the 4D imaging radar competitive landscape.

Yet success in this field won’t be determined by patent volume alone. It will depend on patent strength and quality, how effectively companies align their IP strategies with deployment realities, cross-sector collaboration, and imaging radar ecosystem influence over the long term.

🧭 Looking Ahead

For a deeper and more complete view of this emerging sector, including company-level intelligence, technology segmentation, and territorial filing strategies, we invite you to explore our upcoming report:

📘 Imaging Radar for Autonomous Systems Patent Landscape 2025

The report covers more than 10,000 patent families, with insights into key technology domains, sensor fusion, and application-specific innovations across ground vehicles, aerial platforms, robotics, and defense. It offers actionable intelligence for R&D, legal, and business development teams seeking to navigate and lead in the next wave of automotive perception.

For more information about the report, or to explore other sensing and imaging technologies, feel free to contact us.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni ZHOU, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on 5G/6G and RF front-end systems. She developed innovative RF solutions effectively integrated into communication and radar systems. Her work also includes designing advanced radar sensing and imaging systems for accurate detection in complex environments.

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand the competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.