SOPHIA ANTIPOLIS, France – January 8, 2026 │ In just a decade, China has risen from a marginal role to emerge as the undisputed leader of the LMFP patent landscape.

LMFP: a Promising Cathode Material for Next-Generation Li-ion Batteries

Lithium Manganese Iron Phosphate (LMFP) is a promising emerging cathode material for lithium-ion batteries, developed as a derivative of LFP that retains critical attributes like structural stability, low cost, high thermal stability and safety, and relatively good cycle life. LMFP offers a significant advantage over LFP by providing a 10–20% higher energy density due to the manganese substitution, along with a higher voltage platform and better low temperature performance. This material also benefits from a lower cost per kWh compared to NMC (nickel manganese cobalt) and the ability to leverage existing LFP manufacturing processes and infrastructure. Despite these advantages, LMFP still faces several challenges, notably poor electrical conductivity and slow lithium-ion diffusion. A key limitation compared to LFP is the reduced calendar and cycle life, resulting from the Jahn-Teller distortion of Mn and metal dissolution into the electrolyte, which also drives performance degradation linked to Mn³⁺. Operational and systems challenges include the difficulty of state-of-charge (SOC) estimation, like LFP, and the presence of a dual voltage plateau, which compromises cell consistency and causes mileage data fluctuations in battery management systems (BMS). To overcome these limitations and enable large-scale commercialization, current research focuses on physicochemical modifications aimed at improving electrical conductivity, lithium-ion diffusion, and overall stability. Specific research efforts include nanostructuring and morphology control, surface coating using carbon or non-carbon materials (like ion-conductive materials or metal oxides), and various ion-doping strategies applied at the Li, Mn/Fe, or anionic sites. LMFP is positioned for applications in mid-to-long range electric vehicles (EVs) and heavy-duty vehicles and also has potential to be blended with NCM materials to create high-voltage cathodes.

The LMFP Patent Landscape is Fast-Growing and Undergoing Major Shifts

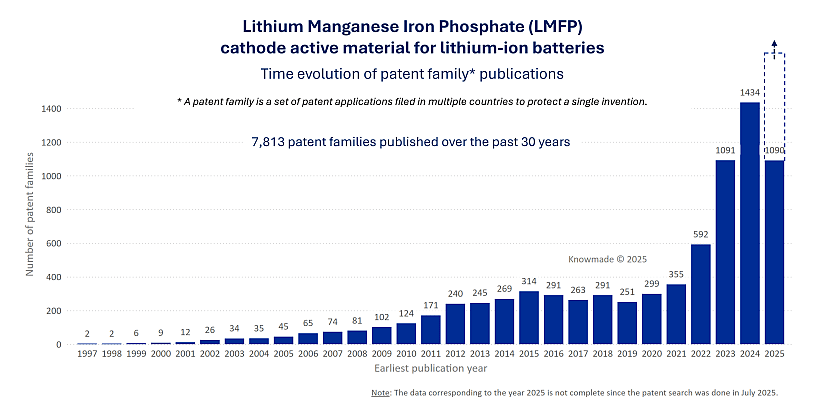

Today, the LMFP patent landscape counts over 7,810+ patent families (inventions), covering the whole supply chain, from precursors and cathode materials to their use in electrode and battery cells. In such a dense and moving landscape, it is important to be aware of its competitors’ move and secure its intellectual property (IP) position. “Patent landscape analysis is the perfect complement to market research, to fully comprehend the competitive landscape and technology roadmap, keep abreast of cutting-edge technology developments, anticipate future technology adoption, and understand the different competitors’ strategies. This kind of patent landscape report reveals the companies, technical solutions and strategies not identified through standard market analysis”, affirms Fleur Thissandier, PhD, Technology and Patent Senior Analyst Batteries & Materials at KnowMade.

Figure 1: Number of patent families related to LMFP by earliest publication years.

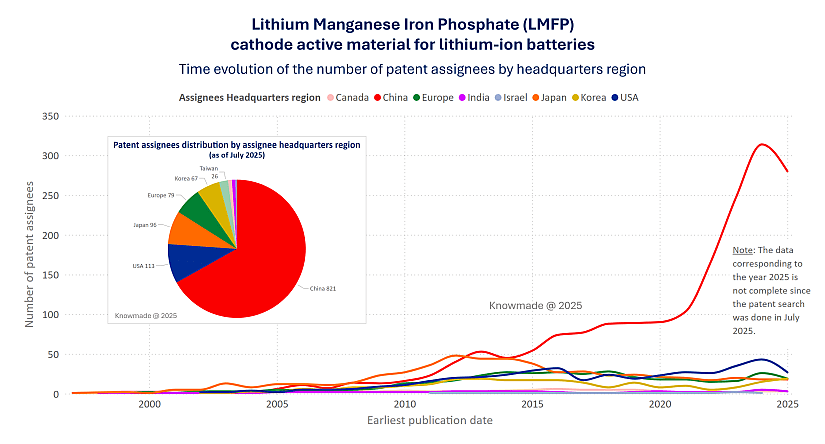

The evolution of patent publications related to LMFP cathode active material for Li-ion batteries has undergone a significant transformation, shifting from pioneer activity by Western and Japanese entities to overwhelming dominance by Chinese IP players (Figure 2). Early patenting activity was led by pioneers originating from Canada (Hydro-Québec, University of Montréal), Europe (CNRS, Valence Technology), and Japan (NTT, GS Yuasa, Murata/Sony Battery, Panasonic/Sanyo), with initial patents covering both LFP and LMFP. Until 2010, most patent filings originated from non-Chinese entities, including South Korean companies like LG Chem/LGES and Samsung, Japanese firms such as Toyota and Murata Manufacturing/Sony Battery, American entities (A123Sytems, University of Chicago, etc.), and European players like Saft/Total Energies and Johnson Matthey. However, a major inflection point occurred around 2012, when patenting activity in China began a continuous increase, ultimately overcoming patenting activity in all other countries since 2016. This upward trajectory has intensified into a sharp boom since 2022. This accelerated growth is largely attributed to the strong emergence and rapid proliferation of Chinese patent applicants, whose number soared from 20 active players in 2011 to more than 300 in 2024. Moreover, the most active IP players since 2023 have mainly been Chinese entities such as CATL, EVE Energy, Dynanonic, Gotion, BYD, SVOLT, ATL, Envision/AESC, Sunwoda, and Rongbay.

Figure 2: Time evolution of the number of patent assignees by headquarters region for patent related to LMFP cathode active material for Li-ion batteries. Insert: Breakdown of the Number of Patent Assignees by Headquarters Region in the LMFP Patent Landscape (as of July 2025).

The LMFP patent landscape also illustrates an ongoing redistribution of technological ownership, where pioneering Western IP assets are progressively absorbed by Asian industrial players. This shift underscores both the globalization and maturation of LMFP technology, positioning Asia (particularly China) as the new hub for LMFP innovation and large-scale manufacturing. The geographical polarization is clear: sellers are mostly Western historical players, while buyers are predominantly Asian industrials (mainly Chinese and Indian), seeking rapid scale-up and vertical integration. Early acquisitions (2010–2018) were mainly driven by Western chemical groups (e.g., Johnson Matthey, Clariant, Lithium Werks) acquiring specialized companies to reinforce their R&D, IP, and manufacturing capacities in phosphate-based cathode materials. In 2021–2023, a reverse trend of asset divestments appeared, with companies such as Johnson Matthey and Lithium Werks exiting the battery materials business and transferring their portfolios to new entrants from India willing to enter the phosphate cathode material landscape (e.g., Epsilon Carbon, Reliance New Energy). After 2020, there has been a clear acceleration of Chinese domestic patent transfers, often involving academic-to-industry IP migration, reflecting the maturation of China’s LMFP ecosystem.

How LMFP IP Leadership Has Been Redrawn Over the Years

“The analysis of the IP leadership on patents related to LMFP provides additional insights into the patenting activity of major players worldwide. The more the company combines a high number of granted patents with a high number of pending patent applications, the greater its IP leadership.”, explains Fleur Thissandier, PhD.

Click on the play icon in the graph below to interactively visualize the IP leadership evolution of main patent assignees in the LMFP patent landscape. Click on one or several IP players to visualize their IP leadership evolution across the years.

Click here to open Power BI.

Figure 3: Evolution of the IP leadership of main patent assignees over the years in LMFP patent landscape (interactive, non-exhaustive list of players). The more the IP player combines a high number of granted patents with a high number of pending patent applications, the greater its IP leadership.

The IP leadership of main patent assignees involved in LMFP patent landscape has evolved through several distinct phases.

Phase 1 – Foundational patent activity: Early patenting activity up to 2001 was driven by Canadian pioneers such as Hydro-Québec, the University of Montréal, alongside European players including CNRS, Valence Technology and Blue Solutions, and Japanese players such as NTT, GS Yuasa, Panasonic/Sanyo, Murata/Sony, and Denka.

Phase 2 – Emergence of clear IP leaders: By 2007, Hydro-Québec, Lithium Werks/Valence Technology, Murata/Sony, Toshiba, A123 Systems, and Johnson Matthey had established themselves as the dominant LMFP IP leaders. New patent assignees such as Samsung, Toyota, LG, BYD, Sumitomo Metal Mining, and SEL also emerged, progressively strengthening their IP positions.

Phase 3 – First turning point: Decline of a former IP leader and rise of other leaders: Around 2015–2016, Reliance/Lithium Werks began to lose its previously dominant role, while Samsung and LG witnessed a phase of rapid growth in granted patents, followed by Toshiba and Murata/Sony. In 2019, Global Graphene, BYD, and Taiheiyo Cement saw notable increases in granted patents, accompanied by a resurgence of Hydro-Québec.

Phase 4 – Second turning point: Thriving restructuration driven by new highly active players: the landscape shifted again in 2020 with the arrival of CATL, ATL, SAFT, I-TEN, General Motors, Svolt, and Dynanonic. Since 2020, CATL displayed a continuously expanding leadership IP position, surpassing other players in 2023 for pending patent applications, accelerating strongly in 2024 for granted patents, and reaching the top three by 2025. During this period, Johnson Matthey/Epsilon Carbon, SEL, Toshiba, CNRS, University of Montreal and Wanxiang A123 Systems began to decline, LG intensified its patenting activity while new Chinese challengers such as EVE, Sunwoda, Rongbay, Envison/AESC and Brunp gained visibility.

2025 Current IP Landscape – Consolidated IP leadership and accelerating IP competition: Nowadays, CATL is the front-runner with the highest number of granted patents and pending patent applications. LG Chem/LGES and Samsung also remain leaders but are at risk of being overtaken by CATL thanks to its very large pipeline of pending applications. Toshiba, Sumitomo Metal Mining, Murata/Sony, and Hydro-Québec maintain broad international patent portfolios within Top-10 in terms of number of granted patents. Toshiba and Sumitomo Metal Mining now show very few pending patent applications, reflecting a downturn in patenting over the last five years, while Murata/Sony and Hydro-Québec still keep a notable pending pipeline. In 2024, Sumitomo Metal Mining and Murata/Sony reached a phase of relative stabilization within this increasingly competitive IP landscape. Several players, including Taiheiyo Cement, Innolith/Alevo, Global Graphene, Epsilon Carbon / Johnson Matthey, Toyota, SEL, Capchem, and Wanxiang A123 Systems hold also mostly granted rights with few pending applications. BYD, ATL and I-TEN combine a notable number of granted and pending patent applications. I-TEN owns fewer families overall but with broader worldwide extensions. SVOLT, SAFT, EVE, Dynanonic, General Motors, and Brunp have more pending patent applications than granted patents, signaling their future growth. EVE and Dynanonic have sharply increased their patenting since 2023.

Domestic Strongholds vs. Worldwide Expansion in China’s LMFP Ecosystem

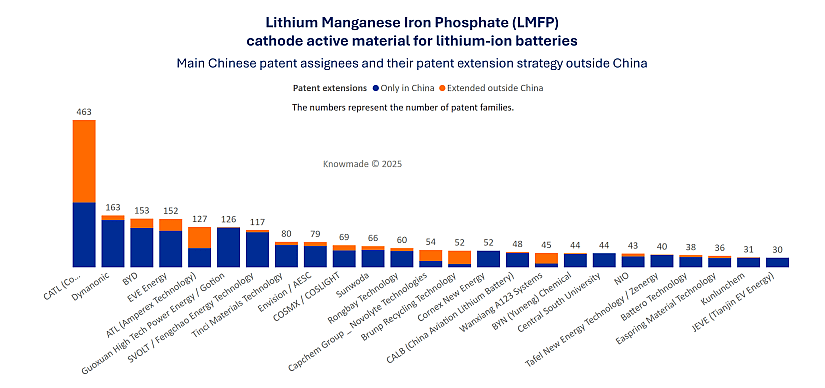

Chinese entities dominate numerically, with the largest number of active IP players in LMFP-related technologies. However, their rate of international patent extension remains limited. Only 14% of the 820 Chinese IP players extend their patents outside China to protect their inventions in key international markets. Among those that do, the proportion of patents extended abroad varies significantly. Most of Chinese entities, including Gotion, SVOLT, CALB, and Dynanonic, prioritize domestic patent filings, suggesting a strong focus on protecting their inventions in the domestic market rather than pursuing international expansion. On the contrary, some leading Chinese players, such as CATL, ATL Capchem, Wanxiang A123 Systems and Brunp, adopt an assertive global protection strategy, extending more than half of their patents outside China and covering many countries. This reflects their international ambitions. Others, including Easpring, EVE Energy, BYD and COSMX, extend a smaller share of their portfolios abroad, but when they do, these extensions target a broad geographic scope, ensuring protection in key regions such as North America, Europe, Japan and South Korea. Several Chinese companies (Hengtron, Capchem, Wanxiang A123 Systems, and Envision/AESC) have achieved wider geographic coverage indirectly, through acquisitions or integration of foreign IP portfolios.

Figure 4: Ranking of main Chinese patent assignees by number of patent families related to LMFP, split by extension strategy (China-only publications vs. extensions outside China).

Stay Up to Date by Keeping a Close Eye on the Fast-Moving Battery Landscape

The evolution of the Lithium Manganese Iron Phosphate (LMFP) patent landscape highlights a profound transformation within the battery industry. Once driven by Western, Japanese and South Korean players, LMFP has become the arena of an unprecedented surge in Chinese innovation, marked by a sharp rise in active IP players, an expansive pipeline of new patents, and rapid industrial consolidation. This geographic and technological shift signals the emergence of China as the global center of gravity for LMFP development and manufacturing. As research continues to address conductivity, stability, and scale-up challenges, competition among patent holders is intensifying, making strategic patent intelligence more critical than ever for anticipating future market leaders. The next technological breakthroughs, industrial investments, and geopolitical alignments will determine which players convert this IP potential into market dominance. Patent activity in the battery sector is thriving and remains highly attractive across all levels of the supply chain, particularly in key areas such as NMC, LFP and LMFP cathodes, silicon anodes, and solid-state batteries. In this fast-paced and competitive landscape, gaining a deep understanding of the patent ecosystem and the strategies of various industry players is becoming increasingly crucial.

To address this need, KnowMade publishes in-depth reports and provides monitoring services to track and analyze competitors’ R&D and intellectual property strategies. These insights help identify the focus areas of industry leaders, emerging players, and start-ups, offering an early perspective on their strategic direction, technological investments, and product development efforts.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Fleur Thissandier, PhD, works as Senior patent and technology analyst at KnowMade in the field of Materials Chemistry and Energy storage. She holds a PhD in Materials Chemistry and Electrochemistry from CEA/INAC, (Grenoble, France). She also holds a Chemistry Engineering Degree from the Superior National School of Chemistry (ENSCM Montpellier, France). Fleur previously worked in battery industry as R&D Engineer.

About KnowMade

KnowMade is a technology intelligence and IP strategy firm specializing in the analysis of patents and scientific publications. We assist innovative companies, investors, and research organizations in understanding the competitive landscape, anticipating technological trends, identifying opportunities and risks, improving their R&D, and shaping effective IP strategies.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to transform patent and scientific data into actionable insights to support decision-making in R&D, innovation, investment, and intellectual property.

KnowMade has solid expertise in Semiconductors and Packaging, Power Electronics, Batteries and Energy Management, RF and Wireless Communications, Photonics, MEMS, Sensing and Imaging, Medical Devices, Biotechnology, Pharmaceuticals, and Agri-Food.