The global IP battlefield is heating up: who are the key players, and which technologies will shape the future of imaging radar for autonomous mobility?

Publication September 2025

| Download Flyer | Download Sample |

Key features

- PDF>150 slides

- Excel database containing all patents analyzed in the report (>10,600 patent families), including patent segmentations and hyperlinks to an updated online database.

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

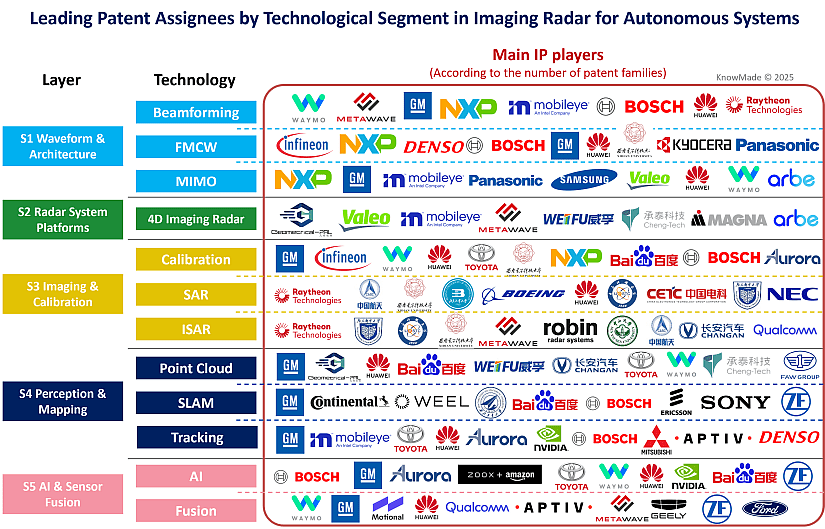

- Main patent assignees and IP newcomers in the different segments.

- Key players’ IP position and the relative strength of their patent portfolio.

- IP ecosystems including sub-brands, JV with shared IP ownership, main co-owned IP, etc.

- Patents categorized by 6 application domains (terrestrial, aerial, robotics, space, marine, defense) and 5 technology layers comprising 11 techniques (FMCW, MIMO, Beamforming, 4D imaging radar, SAR, ISAR, calibration, point cloud, SLAM, tracking, AI and sensor fusion), with a focus on terrestrial applications and 4D imaging radar.

- IP profile of key players (patent portfolio overview, technical coverage, geographical coverage, notable granted and pending patents, etc.)

KnowMade also covered this related topic:

Imaging Radar A Core Driver of High-Resolution Autonomy

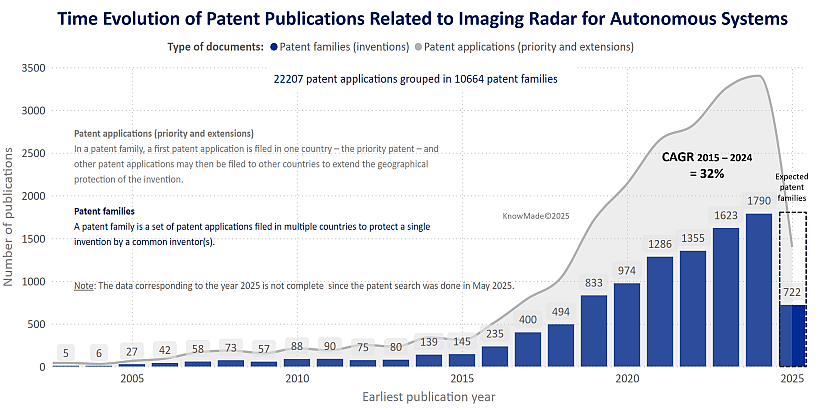

Imaging radar represents the next generation of radar sensing technologies, designed to overcome the limitations of conventional radars that provide only basic range and velocity measurements. By simultaneously capturing range, velocity, azimuth and elevation, imaging radar produces high-resolution 3D/4D perception. These dense radar point clouds enable advanced perception functions including object classification, free space detection, mapping and scene reconstruction. Thanks to its robustness in adverse weather, low light and complex operating environments, imaging radar is becoming a cornerstone for safe and reliable autonomous systems. Its deployment spans terrestrial mobility such as ADAS, L2–L4 autonomous driving and robotaxi platforms, as well as aerial drones, marine vessels, robotics, space, and defense applications. The rapid acceleration of patenting activity reflects this momentum. More than 22,200 patent applications grouped into over 10,600 patent families (inventions) have been identified worldwide, including more than 2,800 core patent families that demonstrate a high degree of relevance to the imaging radar domain. This strong intellectual property (IP) dynamic demonstrates that imaging radar is transitioning from a complementary sensor to a primary perception modality, shaping the future of autonomy and driving one of the most competitive IP battlefields in advanced sensing.

Source: Imaging Radar for Autonomous Systems – Patent Landscape, KnowMade, September 2025

Global IP Trends and Strategic Players

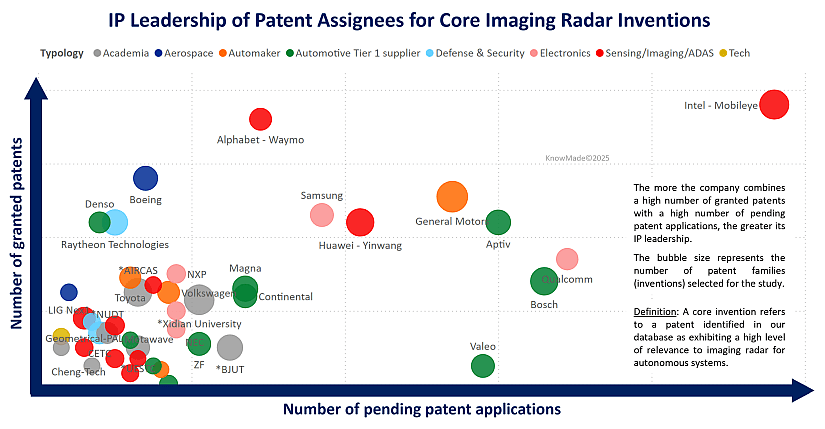

The patent landscape for imaging radar has experienced an unprecedented acceleration. From 2015 to 2024, imaging radar patent family publications grew from 145 to 1,790, an increase of over 1100% and a CAGR of 32% marking a period of explosive innovation. This surge reflects the technological transition toward 4D imaging radar, AI-driven perception and multi-sensor fusion. The United States and China dominate the field, together accounting for more than half of global filings, while Europe maintains a strong position through Tier-1 suppliers such as Bosch, ZF and Valeo. Established players including Intel-Mobileye, Bosch, General Motors, Alphabet – Waymo, Huawei-Yinwang and Magna hold diversified patent portfolios that span radar hardware, perception software and sensor fusion. At the same time, specialized innovators such as Arbe Robotics, Uhnder, Aptiv and Metawave are building targeted portfolios in 4D radar chipsets, point cloud processing and real-time environmental perception. Academic institutions, notably Xidian University, UESTC, BUAA and AIRCAS, continue to shape foundational innovation in waveforms, antenna design and beamforming. This complex interplay of industrial leaders, startups and research institutes defines one of the most competitive IP domains in advanced sensing.

IP Innovation Across Applications and Technical Layers

Imaging radar patents are classified into six main application domains: terrestrial, aerial, marine, space, robotics and defense. The patent landscape has been further structured into five technology layers encompassing 11 key enabling techniques, ranging from waveform design and system platforms to calibration, perception and sensor fusion. Our analysis indicates that terrestrial mobility is the most active and technically advanced area, driven by ADAS, Level 2 to Level 4 autonomy and robotaxi deployment. Other domains such as UAV navigation, maritime sensing and defense applications are also expanding. Across the technology stack, innovation spans from FMCW and MIMO signal processing to AI-enhanced perception and multi-sensor fusion, highlighting the central role of imaging radar in next generation autonomy.

Source: Imaging Radar for Autonomous Systems – Patent Landscape, KnowMade, September 2025

A Competitive and Rapidly Evolving IP Landscape

The imaging radar IP landscape is highly dynamic. Established OEMs and Tier-1 suppliers maintain strong positions, but new entrants are rapidly reshaping the field, with radar startups and ADAS suppliers particularly active. IP leadership now depends not only on the size of a portfolio but also on enforceability, geographic reach and technological impact. Companies such as GM, Intel-Mobileye, Bosch and Huawei-Yinwang combine extensive portfolios with a high volume of patent applications, while patent assignees like Arbe Robotics and Uhnder have demonstrated high IP strength and influence per patent.

In addition to individual patent portfolios, the IP ecosystem is shaped by sub-brands, joint ventures with shared IP ownership and co-owned patent families, all of which highlight the strategic role of IP in driving both competition and collaboration.

Source: Imaging Radar for Autonomous Systems – Patent Landscape, KnowMade, September 2025

From Key Players to the Entire IP Landscape

This report provides in-depth insights into the IP strategies of the main actors shaping the imaging radar domain. It includes detailed profiles of General Motors, Intel-Mobileye, Bosch, Huawei-Yinwang, Magna and Alphabet-Waymo, covering portfolio dynamics, notable granted and pending patents, legal status and global coverage. Beyond these key players, the report delivers a comprehensive

classification of all identified patent assignees including automakers, Tier-1 suppliers, sensing and ADAS companies, electronics manufacturers, technology firms, academia, and defense and aerospace players. Within each segment, we identify both the established IP leaders and the IP newcomers, providing a clear view of how innovation and competition are distributed across the ecosystem.

For executives, IP professionals and R&D teams, the report delivers a comprehensive overview of a fast-evolving and competitive technology space. By aligning patent intelligence with strategic planning, companies can strengthen their innovation roadmap, secure competitive advantage and position themselves at the forefront of autonomous mobility and advanced sensing.

Useful Excel patent database

This report includes an extensive Excel database with the 10,600+ patent families (inventions) analyzed in this study, including patent information (publication numbers, assignees, dates, title, abstract, etc.), hyperlinks to an updated online database (original documents, legal status, etc.), and structured classification by application segments (terrestrial, aerial, robotics, space, marine, and defense), five technology layers with 11 key technique segments (FMCW, MIMO, beamforming, 4D imaging radar, SAR, ISAR, calibration, point cloud, SLAM, tracking, AI and sensor fusion), as well as the identified core inventions. This database supports advanced multi-criteria searches and provides direct access to updated records, enabling users to benchmark portfolios, monitor competitors, identify potential partners or acquisition targets and evaluate freedom-to-operate constraints.

Companies mentioned in the report (non-exhaustive)

General Motors, Bosch, Toyota, Huawei – Yinwang, Sony, Denso, Intel – Mobileye, Aurora, Honda, Continental, Amazon – Zoox, Alphabet – Waymo, Volkswagen, Raytheon Technologies, ZF, Hyundai, Valeo, Ford, Magna, Aptiv, Mitsubishi, Baidu, Infineon, Samsung, Qualcomm, DJI Technology, Motional, LG, Mercedes-Benz, NXP, Boeing, Geely – Volvo Cars, Hitachi, HERE, Nvidia, Panasonic, BMW, Honeywell, FAW Group, Kia, Stellantis – PSA, Mando, Changan Automobile, Xaircraft (XAG), Subaru, Forvia – Hella, IBM, NEC, Pony.ai, Micron, BAE Systems, Geometrical-PAL, Metawave, Calterah Semiconductor, ICAN Technology, Kyocera, LIG Nex1, Texas Instruments, Desay SV, IAI – Israel Aerospace Industries, Nissan, Siemens, State Grid Corporation of China, SITRICK DAVID H., Apple, Xiaomi Technology, Tata Motors, Weifu, Airbus, Cheng-Tech, Dongfeng Motor, Korean Agency for Defense Development, US Navy, BYD, Great Wall Motor, Autoroad Tech, Nidec, Renault, MBDA UK, Nuro, Arbe Robotics, Lockheed Martin, Microsoft, Volvo, Beta Technologies, CAIC – China Automotive Innovation Corporation, Five AI, Thales, Bitsensing, Daihen, Fuxia hangzhou intelligent science & technology, Hawkeye, NIO, Secom, Vivo, Wuxi Tongchun New Energy Technology, China Southern Power Grid, DiDi, Mazda, Seres, Tencent, Uhnder, Yupiteru, Alibaba, Deere, dSPACE Technologies, L3Harris Technologies, Lyft, Northrop Grumman, SAAB, Sick, State Farm Insurance, TuSimple, Veoneer, Voyah, Zadar Labs, Elwha LLC, GAC Group, iRobot, Jingdong Qianshi Technology, Keysight, Novasky Electronic, NTT Docomo, Symeo, Teledyne, Toshiba, Uber, Vayyar, Ericsson, Fujitsu, Hanwha, Kodiak Robotics, Koito Manufacturing, STMicroelectronics, US Army, WHST, Ambarella – Oculii, Bayer, Chery Automobile, Chuhang Technology, Eagle Sense Technology, Furukawa Electric, XPENG, Zendar, Alps Alpine, Zongmu, and more.