What is driving recent MEMS IP activities ?

Publication July 2020

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with > 80 slides

- Excel file > 4,350 patents

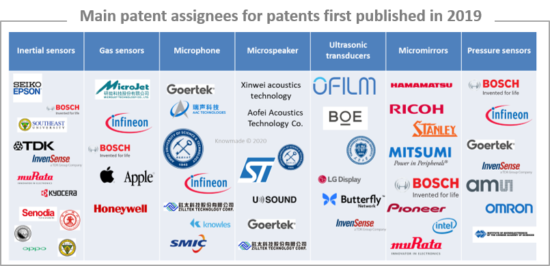

- Overview of the most recent patents published in 2019 by MEMS players.

- Main patent applicants.

- Main MEMS technologies and devices analyzed:

- Inertial sensors (accelerometers, gyroscopes, IMUs)

- Microphones

- Microspeakers

- Ultrasonic sensors

- Gas sensors

- Pressure sensors

- Micromirrors

- MEMS Packaging

- IP dynamics and trends of the different MEMS devices.

- Comparison of recent IP and market activities.

- Noticeable 2019 patents from main players.

- Excel database containing all patents analyzed in the report, including technology and application segmentation.

Related MEMS technology patent reports. In-depth patent landscape and customized studies for strategic decision making.

A stable IP landscape with new opportunities and increasing competition

MEMS sensors and actuators are key components in numerous applications. Indeed, electronic devices need to be more and more connected to the real world in order to provide better experiences to the customer. Sensing and interacting with the environment is therefore becoming critical, especially in the automotive, consumer and industrial markets. Indeed, autonomous vehicles, AR/VR and industry 4.0 require the use of numerous sensors to realize their dreams.

According to Yole Développement, the market will exhibit +8.3% growth in value and +11.9% growth in units, with consumer still having the greatest share (over 60%) from 2019 to 2024. This growth rate is below previous rates, however, and the automotive and consumer markets are levelling off. As growth slows down, competition between the different players is getting tougher and tougher, since the cake is not as big. On the M&A front, MEMS-related acquisitions declined during the last year, reflecting the weaker, general semiconductor-related M&As and a consolidation of the business. Furthermore, there were no significant new entrants, and existing players struggled to compete against one another.

In this context, this MEMS Sensors & Actuators 2019 Patenting Activity report aims to decipher the recent patenting activities and related R&D developments of MEMS players. This report also tracks weak signals in order to find new applications or new R&D directions that are currently being investigated, as well as newcomers entering the landscape.

The patents published in 2019 confirm the slight decrease that we can see at market level. Indeed, even if the number of patents remains quite significant, most of the IP segments have remained stable. This is the case for inertial sensors, micro mirrors or pressure sensors. However, despite this general trend, some recent developments of MEMS for new applications seem promising. For instance, patents in 2019 confirm the strong activity related to piezoelectric MEMS dedicated to automotive (headlamp, head-up display, etc.) or consumer applications (fingerprint sensors, voice machine interface).

2019 is also marked by the strong patenting activity of Chinese players. Indeed, Chinese players filed over 60% of the patents published in 2019 and even led most of the MEMS devices. This strong activity could be a sign of the significant investments that Chinese companies have made to boost their competitiveness and challenge major European and US companies.

Who are the main IP players and what are their 2019 patenting activities?

This report provides a detailed picture of the patents published in 2019 for MEMS sensors and actuators, including inertial sensors (accelero, gyro, IMUs), microphones, microspeakers, ultrasonic sensors, pressure sensors, micromirrors, microbolometers, gas sensors, etc. We have selected and analyzed over 3,000 inventions specifically related to MEMS transducers, MEMS devices and MEMS packaging. All other patents related to materials, wafer manufacturing, driver circuits and systems have been excluded. The report provides an overview of the most recent patents published in 2019 by MEMS players for each MEMS technology and device. For each player, we highlight and provide information about their recent and future technology developments. A comparison between their 2019 market position and their 2019 patenting activity is also provided.

Analysis of main technology developments

This report provides a detailed analysis of the technologies developed by the main IP players. A detailed description of the most noticeable patents published in 2019 is also provided. Knowmade highlights any change in the players’ activities as well as an analysis of new applications/technologies and their related challenges, thus giving an understanding of the current main IP drivers and potential future markets.

Report’s main assets

Understanding the key players’ recent IP and current technology development

There are more than 1,000 patent applicants involved in the MEMS 2019 patent landscape. This report reveals the most active IP players for all types of MEMS devices. A detailed analysis of their 2019 patents and their related challenges and applications is provided.

Identifying the opportunities

This report gives an overview of the current dynamics and technologies. Opportunities and inventions linked to new applications are analyzed. It also provides a detailed analysis of the technology described in the patents. For each segment we identify the new technological approach for the different targeted markets.

Useful Excel patent database

This report also includes an Excel database of the 4,350 patents and patent applications analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority date, title, abstract, patent assignees, patent’s current legal status, and technological and application segments.

Companies mentioned in this report (non-exhaustive list)

Goertek, Bosch, Micriojet Technology, Infineon Technologies, Seiko Epson, Southeast University Nanjing, Xi’an Jiaotong University, Tsinghua University, Invensense, STMicroelectronics, Aofei Acoustic Technology, Nanjing University of Science & Technology, Northwestern University, Wuhan University, North University of China, Murata Manufacturing, Hewlett Packard Development, AAC Technologies, SMIC, Senodia Technologies, Memsensing Microsystems, Huazhong University of Science & Technology, Apple, TDK, Texas Instruments, Hamamatsu Photonics, University of Electronic Science & Technology of China, Mitsumi Electric, ZillTek Technology, CEA, TSMC, Stanley Electric, Knowles Electronics, Silan, Beijing University of Technology, Shanghai Institute of Microsystem & Information Technology Chinese Academy of Sciences, Nanjing University of Posts & Telecommunications, Analog Devices, Kyocera, Denso, and more.