ADC and Radioimmunoconjugates Ignite a New Era in Cancer Therapy

Publication December 2025

| Download Flyer | Download Sample |

Key Features

- PDF > 100 slides

- Excel file: 3761 patent families

- IP trends, including time evolution of published patents and countries of patent filings

- Ranking of main patent assignees

- Key players’ IP position and relative strength of their patent portfolios

- Segmentation: Antibody (liquid cancer, liquid cancer only, solid cancer, solid cancer only—segmentation based on claims), Linker (cleavable, uncleavable) and Payload (drugs, radioisotopes).

- Analysis of collaborations and newcomers.

- Excel database containing all patents analyzed in the report, including segmentations + hyperlink to updated online database (legal status, documents, etc.)

KnowMade investigates intellectual property in the healthcare sector:

- Bispecific Antibody & Cancer 2025

- Allogeneic CAR Patent Landscape Analysis 2023

- mRNA Cancer Therapies Patent Landscape 2022

Harnessing Antibodies for Targeted Cytotoxicity: Strategic Insights into Cancer Conjugates

Cancer antibody conjugates – encompassing antibody-drug conjugates (ADCs) and radioimmunoconjugates – are reshaping oncology by coupling the selectivity of monoclonal antibodies with the cytotoxic power of small-molecule drugs or radionuclides to achieve highly targeted tumor cell killing. Recent reviews report that around 15 ADCs are now approved worldwide for hematologic malignancies and solid tumors, while more than 200 additional ADCs are in clinical trials and over 400 are in development, underscoring the rapid expansion of this modality. In parallel, radioimmunoconjugates are experiencing renewed interest in the era of modern immuno-oncology: despite only two products historically approved for non-Hodgkin’s lymphoma, new clinical and preclinical data highlight their potential to deliver therapeutic radiation with precision, particularly when combined with other systemic or immune-targeted therapies. Together, these immunoconjugates open avenues to treat refractory disease, expand into earlier lines of therapy and enable theragnostic strategies, while still facing challenges related to toxicity, resistance mechanisms, radioisotope handling and complex manufacturing. In this highly dynamic context, understanding how key players position their intellectual property on antibodies, payloads, linkers, radionuclides, targets and conjugation technologies is critical to anticipate future competition, secure freedom-to-operate and guide strategic decisions in the cancer antibody conjugate market.

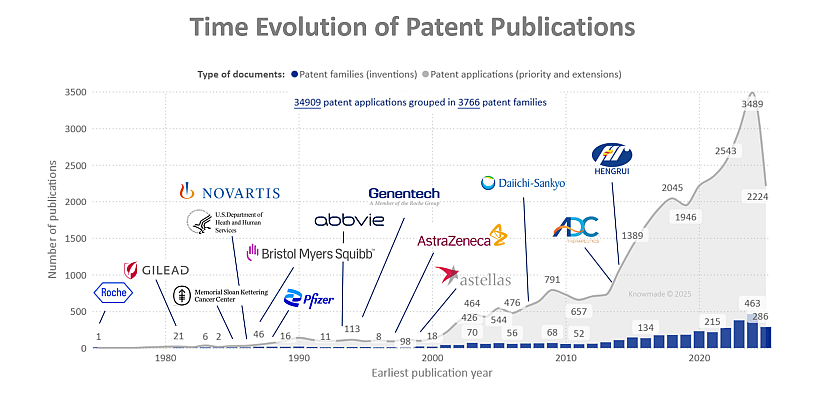

The time evolution of ADC patent publications highlights a long exploratory phase followed by a steep acceleration once the modality was clinically validated. From the late 1970s to mid-2000s, only a handful of patent families were filed each year, mainly by early pioneers such as Roche and academic cancer centers. Activity begins to rise after the first ADC approvals and wider clinical exploration in hematologic malignancies and breast cancer, and then clearly inflects after 2010, in line with the growing number of ADCs entering the clinic and the progressive approval of next-generation products (15 approved ADCs worldwide and >1500 clinical trials). Between 2018 and 2024, annual filings more than double, reaching close to 500 new patent families per year, driven by intensive R&D on highly potent topoisomerase 1 based payloads such as deruxtecan and govitecan, new linker and site-specific conjugation technologies, and expansion from hematologic cancers into solid tumors. Over this period the landscape also broadens from traditional Western pharma (Roche/Genentech, Novartis, Pfizer, BMS, AbbVie, AstraZeneca, Gilead) to include specialized ADC biotechs and fast-growing Asian players such as Daiichi Sankyo and Hengrui, reflecting intense global competition and a strong licensing/partnering dynamic in this field. The slight peak or plateau in the most recent years, combined with the large number of patent applications per family, suggests a transition from early technology build-up to portfolio consolidation and geographic extension, in a maturing but still rapidly innovating ADC market that also paves the way for related antibody–radioisotope conjugates.

Analysis by segment

To better characterize innovation trends and R&D strategies in the ADC field, the patent landscape has been segmented into three main technological components: antibody, linker, and payload. Each component plays a crucial role in defining the specificity, stability, and therapeutic profile of an ADC. This IP landscape features the following 8 types of segmentation: Antibody (liquid cancer, liquid cancer only, solid cancer, solid cancer only – segmentation based on claims), Linker (cleavable, uncleavable) and Payload (drugs, radioisotopes).

Identifying the companies that have recently emerged in the IP landscape

Among the players owning patent families related to Bispecific Ab & cancer, 147 newcomers were identified. These companies are either start-up firms or established companies developing their first technology in the field. Most IP newcomers are based in China (76). It is possible that one of these innovative companies could become one of the next healthcare unicorns that the big corporations will be tempted to acquire.

IP profile of key players

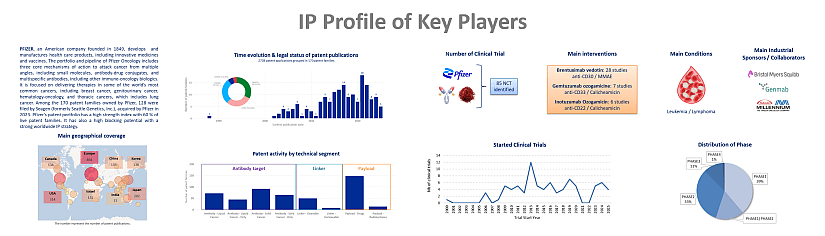

This IP study includes a selection and description of main players. The patent portfolio analysis of main players includes a description of the assignee, patent portfolio description, time evolution of patent publication, main geographical coverage and live patents by technical segment. This IP profile overview is followed by the description of the technological content of their key patents and by a table with its clinical trials.

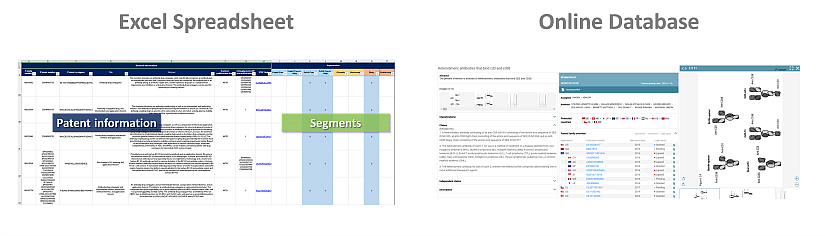

Moreover, the report includes an Excel spreadsheet with the 3761 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees, each patent’s current legal status and segmentation. The report also includes a Patent Online Database which legal status are updated for each patent document.

Companies mentioned in this report (non-exhaustive list)

PFIZER, GENENTECH-ROCHE, ABBVIE, ASTRAZENECA, GILEAD, ROCHE, DAIICHI SANKO, JIANGSU HENGRUI, ASTELLAS PHARMA, NOVARTIS, BRISTOL-MYERS SQUIBB, ADC THERAPEUTICS, etc.