Battery domain combines major market stakes with an increasing and diversifying number of innovations and involved companies. What are the main patents, technologies and competitive trends in 2017?

Publication April 2018

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with >170 slides

- Focus on 2017 IP activity

- Excel file detailing >40,900 patent families

- Categorization of patents

- By supply chain segment (electrolyte, separator, electrode, cell, pack/system)

- By battery technology (Li-ion, Ni-MH, Redox Flow, Li-Air, Li-S, Na-ion and Mg-ion).

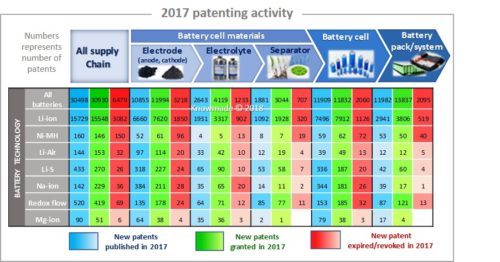

- 1997-2017 worldwide IP dynamics by supply chain segment and battery technology

- Overview of the 2017 worldwide patenting activity for each supply chain segment and each battery technology

- New patent applications

- New granted patents

- Expired or revoked patents

- Ranking of main patent applicants by supply chain segment and battery technology

- For 1997-2017 period

- For patents published in 2017

- For patents granted in 2017

- For patent expired in 2017

- Noticeable patents newly published, granted or expired in 2017

- For battery cells morphology (microbatteries, flexible batteries, solid-state batteries)

- For battery technologies (Li-ion, Ni-MH, Redox Flow, Li-Air, Li-S, Na-ion, Mg-ion)

- For electrode materials of Li-ion battery (lithium, silicon, LTO, graphene, NMC, LCO, LFP, NCA, LMO)

- Main development trends by battery technology

- Noteworthy 2017 news on patent litigation

- Excel database with key patents analyzed in this study, including technology segmentation.

More reports on battery technology patents. KnowMade is a scientific analytics company capable of producing patent landscape reports and a range of patent analytics for technology companies.

Battery IP activity is booming along with the market

Worldwide demand for energy storage devices is booming since 2000’s, leading to a very dynamic battery market. The number of battery applications is diversifying and growing (portable consumer devices, electronic devices, electric vehicles, smart grids, etc.), and each of them requires specific performances (capacity, energy density, power density, selfdischarge, stability, operating temperatures), morphologies/weight, safety, and cost constraints. Thus, battery has attracted significant research attention at all supply chain level (electrode, electrolyte, separator, cell, pack and system) over the last 10 years, resulting in intensive patenting activity, with a substantial increase during the past years. More than 300,000 patent families related to batteries have been published worldwide since the early 1990s. In 2017, more than 30,400 new patent families were published, 30,900+ patents were granted, and 6,400+ patents expired. In such fast-growing and dynamic battery market, it is essential to track patents in order to anticipate changes, quickly detect business opportunities, and identify emerging research areas and cutting-edge technology developments. In this report, we reveal the main 2017 trends for battery-related intellectual property (IP). We show an overview of the recent patenting activity (new patent applications, granted patents, expired patents), the main patent applicants, the major patent litigations, and the hot technological topics of the year, for each supply chain segment (electrolyte, separator, electrode, cell, pack/system) and each battery technology (Li-ion, Ni-MH, redox flow, Li-Air, LiS, Na-ion and Mg-ion batteries). The report includes a special focus on the most interesting patents of the year.

Worldwide demand for energy storage devices is booming since 2000’s, leading to a very dynamic battery market. The number of battery applications is diversifying and growing (portable consumer devices, electronic devices, electric vehicles, smart grids, etc.), and each of them requires specific performances (capacity, energy density, power density, selfdischarge, stability, operating temperatures), morphologies/weight, safety, and cost constraints. Thus, battery has attracted significant research attention at all supply chain level (electrode, electrolyte, separator, cell, pack and system) over the last 10 years, resulting in intensive patenting activity, with a substantial increase during the past years. More than 300,000 patent families related to batteries have been published worldwide since the early 1990s. In 2017, more than 30,400 new patent families were published, 30,900+ patents were granted, and 6,400+ patents expired. In such fast-growing and dynamic battery market, it is essential to track patents in order to anticipate changes, quickly detect business opportunities, and identify emerging research areas and cutting-edge technology developments. In this report, we reveal the main 2017 trends for battery-related intellectual property (IP). We show an overview of the recent patenting activity (new patent applications, granted patents, expired patents), the main patent applicants, the major patent litigations, and the hot technological topics of the year, for each supply chain segment (electrolyte, separator, electrode, cell, pack/system) and each battery technology (Li-ion, Ni-MH, redox flow, Li-Air, LiS, Na-ion and Mg-ion batteries). The report includes a special focus on the most interesting patents of the year.

This report details the two ways envisioned by R&D players to meet market performances expectations: improve existing battery technologies and develop new battery technologies. Nowadays, lead-acid batteries and Li-ion Batteries are leading battery market. Li-ion battery is a mature technology but its performances can still be improved and its costs reduced, leading to a thriving IP activity. Other technologies are commercialized for automotive and consumer applications (Ni-MH battery), stationary applications (Redox flow, aqueous Na-ion and Na-S batteries) and medical devices (Zn-air batteries). Within last years, new battery technologies have been developed (organic Na-ion, Li-S, Li-Air, Mg-ion and Al-ion batteries) and could be commercialized within next 20 years. Patenting activity on all these technologies is detailed in the report.

Useful patent database (>40,900 patent families)

The report also includes an Excel database containing >40,900 patent families of the main patent assignees and related to the key battery technologies. This useful patent database allows multi-criteria searches, including patent numbers, priority/publication dates, patent assignees, titles, abstracts, claims, legal status of patents, hyperlinks to original documents, and technical segmentation (electrode, electrolyte, separator, battery cell, battery pack/system, Li-ion, Ni-MH, Redox flow, Lead, Li-Air, Li-S, Na-ion, Mg-ion, solid-state).

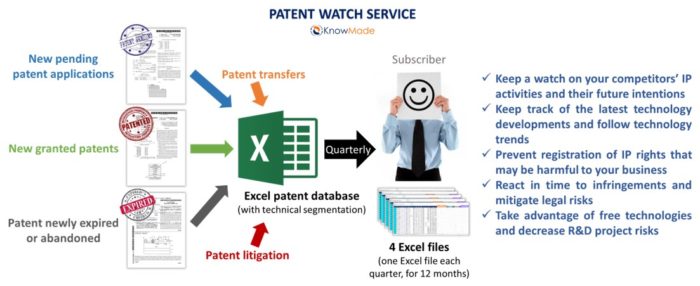

2018 battery patent watch service: get updated data on battery patent activity

With the booming number of companies involved in battery IP and the proliferation of battery technologies, take advantage of quarterly updated Excel file including the patents newly published, granted or expired during the past 3 months, plus the latest patent transfers and noteworthy news on patent litigation. The patents will be categorized by supply chain segments (electrode, electrolyte, separator, battery cell, battery pack/system) and battery technologies (Li-ion, Ni-MH, Redox flow, Lead, Li Air, Li-S, Na-ion, Mg-ion, solid-state, thin film/flexible, lithium metal electrode, NMC cathode for Lithium battery, Silicon anode for Lithium battery). This useful patent database allows for multi-criteria searches (patent numbers, priority dates, patent assignees, titles, abstracts, claims, legal status of patents, hyperlinks to original documents), and also includes several charts highlighting the main IP trends of the past 3 months for each technical segment (patent applicants, etc.).

Keep a watch on your competitors’ IP activities and their future intentions

With the help of the patent watch service, you will be aware of your competitors’ current patenting activities, their IP dynamics, patent transfers including acquisitions and licenses, patent litigation, technology development and R&D strategies. You will also be able to rapidly detect new entrants in your business area.

Keep track of the latest technology developments and follow technology trends

By keeping note of any recent patent filings, you can track the newest innovations in the battery field. You will get details on claimed inventions and you can follow technology developments. New technical solutions could inspire and improve your R&D activity.

Prevent registration of IP rights that may be harmful to your business

You will obtain information on patent applications filed even before exclusive rights have been granted and you can react in time to prevent registration of IP rights that may be harmful to your business.

React in time to infringements and mitigate legal risks

Monitoring both newly-issued patents and patent litigation allows you to regularly assess your freedom-to-operate, ensuring your products or processes are not covered by granted patents and thus they can be manufactured, sold or used safely without infringing valid IP rights owned by others.

Take advantage of free technologies and decrease R&D project risks

By tracking both expired patents and abandoned patents, you will be able to identify inventions entering the public domain that you can use safely for your development.

Companies mentioned in this report (non-exhaustive list)

3M, A123 Systems, AGC, Amperex, Automotive Energy Supply, Bak, BASF, BMW, Boston Power, BYD, Chery Automobile, FAW Automobile, Denki Kogyo/Denka, Denso, Donguan Kaixin Battery Material, DuPont, Easpring Material Technology, Ecopro, Envia, General Motors, GS Yuasa, Hitachi, Honda, Huawei, Jinhe New Materials, Johnson Controls Technology, JX Nippon Mining Metals, Kokam, L&F, Leneng Battery, Leyden Energy, LG Chem, Li-Tec Battery, Mitsubishi, Mitsui Mining & Smelting, Murata Manufacturing, Nano One Materials, Nec, Nippon Chemical Industrial, Nissan, Panasonic, Posco, Renault, Reshine New Material, Robert Bosch, SAFT, Samsung SDI, Sanyo Electric, Seeo, SEL, SK Innovation, Solvay, Sony, Sumitomo, Tanaka Chemical, Techelios, Toda Kogyo, Toray Industries, Toshiba, Toyota, University of Chicago, Umicore, etc.