The advent of EV/HEV technology has acted as a catalyst for innovation, leading to an acceleration in applications for power module related patents since 2010. Who are the main IP players? How do they address the new challenges? Who are the new players and IP challengers taking the big opportunities arising from the emerging EV/HEV market?

Publication January 2021

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with > 300 slides

- Excel file > 7,000 patent families

- IP trends, including time-evolution of patent publications, countries

- Patent segmentation:

- WBG power modules.

- Hybrid modules, IPM.

- EV/HEV applications.

- Challenges: Reduction of parasitics, heat dissipation (sub-segment double sided cooling), Thermomechanical issues, miniaturization.

- Die-attach: Silver sintering, copper sintering, TLP.

- Encapsulation (sub-segment: molding encapsulation).

- Ranking of main patent assignees.

- Established IP players and new entrants in the WBG power module patent landscape.

- IP profile of main players:

- Statistical analysis of patent portfolio including patent segmentation, legal status, time evolution, etc.

- Noteworthy patents relating new products/technologies.

- Recent IP activity.

- Excel database containing all patents analyzed in the report, including technology and application segmentations.

KnowMade works on Power electronics devices.

The definition of a patent landscape with all the information you can draw from it in your R&D strategy.

Power modules for EV/HEV applications: new requirements and new technologies have led to an acceleration in patent filings from 2010 to 2015

The last decade has seen EV/HEV applications driving packaging innovation in power electronics and creating new equations to solve for module makers, in particular further downsizing, higher power density, higher reliability and lower cost/higher manufacturability. On top of that, automotive OEMs are asking for highly standardized power modules, while most module makers focus on proprietary module designs through which they can offer more differentiating added value. In this context, automotive OEMs and Tiers-1 are expected to become more and more intrusive in the power module area.

Furthermore, EV/HEV applications are also pushing the adoption of new wideband gap (WBG) semiconductor technologies, especially SiC-MOSFETs whose commercial availability has continuously increased. However, to fully benefit from power SiC technology, it is crucial to enable high-temperature operation in SiC modules (200-300°C), e.g. through new packaging materials, as well as high-speed operation, by minimizing parasitic inductance.

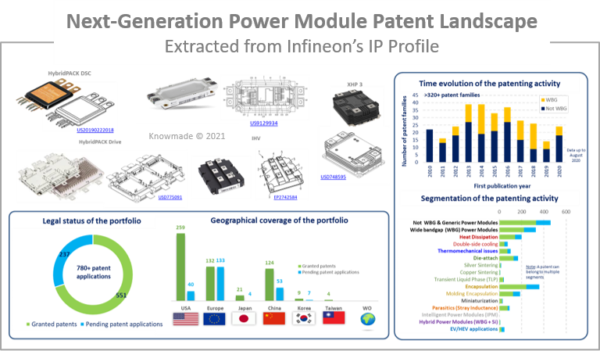

As a result, the last decade was marked by extensive innovation in power module design and packaging, leading to a very high volume of patent publications: more than 7,000 inventions were disclosed, and more than 16,000 applications were filed. In this context, Knowmade has analyzed the recent patenting activity to identify the main IP players active in the next generation power module patent landscape and their IP dynamics.

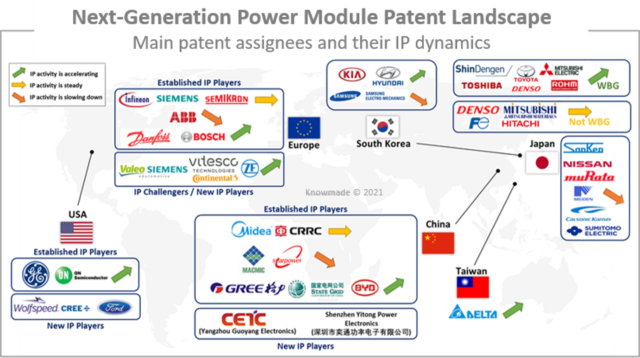

The IP competition is becoming more global and module makers have been progressively joined by competitors from the EV/HEV supply chain

Top module makers in Europe (Infineon, Semikron) and Japan (Mitsubishi Electric, Fuji Electric, Hitachi) have been very active to keep their leadership in the power module patent landscape since 2010. Interestingly, major foreign module makers are increasingly competing with their counterparts in Europe, by filing more and more European patent applications. Certain automotive OEMs (Toyota Motor, Hyundai Motor) and Tiers-1 (Denso, Bosch) are now well-established patent assignees. In addition, several notable players from the EV/HEV supply chain have joined the IP competition: semiconductor manufacturers (Cree/Wolfspeed), OEMs (Ford, BYD), and Tiers-1 (Valeo, Continental, ZF).

For EV/HEV applications, the difficult challenges have led to several IP collaborations between module makers/automotive Tiers-1 and automotive OEMs (Hyundai Motor/Infineon, ABB/Audi, Toyota Motor/Denso, Valeo/Siemens, etc. In China, major modules makers (CRRC, Macmic, Starpower) have demonstrated moderate patenting activity as of 2020, while new IP players have stepped up (CETC).

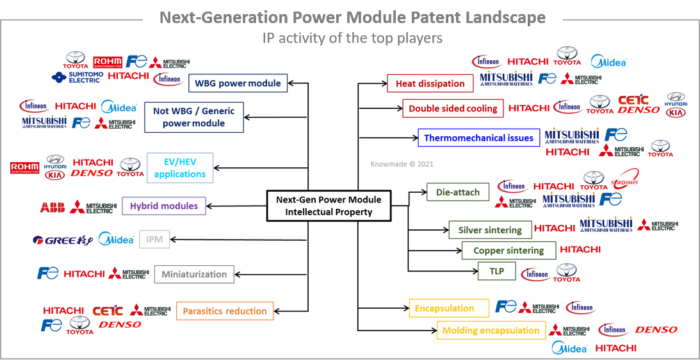

The WBG power module patent landscape dominated by leading SiC MOSFET IP players

Numerous IP players in the power module patent landscape have built up a significant portfolio of patent related to SiC MOSFET technologies, especially trench MOSFET technology (Rohm, Infineon, Fuji Electric, Toyota Motor, etc.) targeting automotive applications. Accordingly, they now develop their own technology for full-SiC power modules. Most of them already had a foot in power module technology, except Cree / Wolfspeed, which started from APEI’s acquisition filing patents specifically for SiC power modules. Knowmade expects the number of patents for SiC power modules to continue growing in the next five years, as development is still on-going for many module makers (at die and module levels). According to the present segmentation, IP players such as Hitachi, Mitsubishi Electric and Toyota Motor are also developing key technologies (reduction of stray inductance, silver and copper sintering, TLP for die-attach) to address WBG-related challenges. Lately, Knowmade has identified several newcomers to the WBG power module patent landscape, including Audi, On Semiconductor, Danfoss & Shindengen Electric Manufacturing.

IP profiles: Focus on the top IP players’ patent portfolios

The patent portfolio of nearly 40 leading players is statistically analyzed to provide an overview of its strength (number granted per segment), its potential for reinforcement (pending applications per segment) and the player’s IP dynamics (number of new inventions per year for WBG and for non WBG/generic power modules). The 2010-2020 IP activity of the player is then reviewed in light of recent announcements related to WBG, EV/HEV and related challenges (new product, new package, new technology, new partnership, new project, etc.). Finally, the analysis focuses on the very latest patent publications.

Useful Excel patent database

This report also includes an extensive Excel database with the 7,000+ patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority date, title, abstract, patent assignees, patent’s current legal status, and technological and application segments.

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Fuji Electric, Midea, Mitsubishi Materials, Infineon Technologies, Toyota Motor, Denso, Hitachi, Samsung Electro Mechanics, Semikron Elektronik, Rohm, Siemens, Delta Electronics, Toshiba, Sumitomo Electric Industries, Yangzhou Guoyang Electronic, Starpower Semiconductor, Robert Bosch, Hyundai Motor, Gree Electric Appliances, Nissan Motor, Danfoss Silicon Power, Abb, Shindengen Electric Manufacturing, CRRC Times Electric, Toyota Central Research & Development Labs, Macmic Science & Technology, BYD, General Electric, Sanken Electric, State Grid Corporation Of China (SGCC), Panasonic, Murata Manufacturing, Showa Denko, Kia Motors, Ford Global Technologies, Calsonic Kansei, Meidensha Electric Manufacturing, On Semiconductor, ZF Friedrichshafen, Zhejiang University, Industrial Technology Research Institute (ITRI), Hitachi Metals, Delta Electronic, Renesas Electronics, Samsung Electronics, Cree Wolfspeed, Valeo, Audi, Hyundai, Renault, Waseda University, University of Sheffield, University of Cambridge, Virginia Tech, Fraunhofer, Kyocera, Dowa, University of Maryland, Tohoku University BMW, Honda Motor…