GaN-on-Silicon activity is now driven by micro-LED, GaN Power and GaN RF applications. Who is leading the IP competition in these different areas? Who are the emerging players?

Publication January 2020

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with > 200 slides

- Excel file > 2,500 patents

- IP trends, including time-evolution of published patents, countries of patent filings, etc.

- Patent segmentation per application: Optoelectronics and Photonics, Power, RF, PV and Sensors

- Ranking of main patent assignees

- Key players’ IP position and relative strength of their patent portfolios

- Established players and new entrants

- IP profile of key players, their key patents and their recent IP activity

- Patents recently expired and patents near expiration date

- Excel database containing all patents analyzed in the report, including technology and application segmentations

Our other semiconductor materials and substrate patent landscapes can benefit business managers and R&D managers because they are patent analyses rich in relevant information — technological, scientific and legal. KnowMade specializes in driving the patent landscape to make patent information usable.

GaN-on-Si intellectual property (IP): Historical players step back, leading to a substantial reconfiguration of the patent landscape.

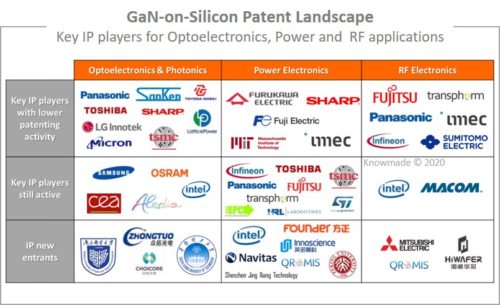

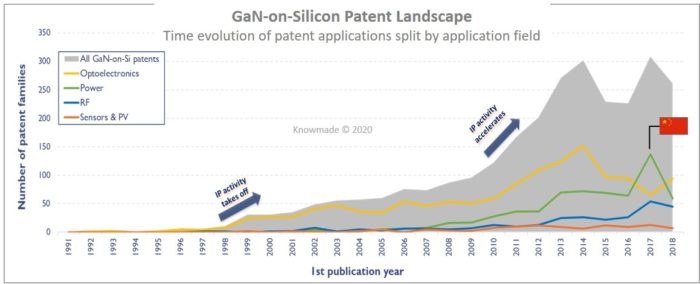

The 2015-2020 period has shown tremendous and decisive changes regarding the strategy of players in the GaN-on-Si landscape, beginning with Toshiba’s withdrawal from the white LED market and the acquisition of International Rectifier (IR) by Infineon in 2015. At that time, Toshiba and IR were already leading the GaN-on-Si patent landscape, while several historical IP players including Panasonic, Sanken Electric and Toyoda Gosei had already slowed down their patenting activity in the field. Furthermore, after IR, Transphorm, Panasonic and GaNSystems started sampling and commercializing their first GaN-on-Si power devices in 2010-2015, a second wave of companies has entered the playground in the last few years, including ON Semiconductor, Dialog, Navitas, VisIC. More companies, such as STMicroelectronics, are expected soon, demonstrating the growing interest for GaN-on-Si technology from players in the power electronics business.

In this report, Knowmade has thoroughly investigated the patent landscape related to GaN-on-Si based optoelectronics and photonics, power electronics, radio frequency (RF) electronics, sensors and photovoltaics (PV) covering the whole GaN-on-Si supply chain. Today, interestingly, the GaN-on-Si patent landscape exhibits strategies differing substantially between the numerous IP players currently aiming at consolidating their IP position.

Optoelectronics and Photonics: Emerging applications driving IP activity

Starting in the late 1990s, GaN-on-Si patenting activity was driven by LED applications. The competition for GaN-on-Si LED intellectual property used to be a very Japanese affair, until the late 2000s when US players like Bridgelux and Micron Technology and Chinese players like Lattice Power emerged. At the same time, Japanese IP leaders sharply decreased their IP activity in the field, even shrinking the size of their portfolios, except for Toshiba, who remarkably accelerated patent filings in 2010-2015, while acquiring Bridgelux-related assets in 2013. Since Toshiba eventually stepped back from LEDs in 2015, the main IP players remaining active in the field are Samsung, Osram and a new entrant, Zhongtuo Optoelectronics. However, patenting activity is now powered by a new range of applications, related to displays, which involves micro-LEDs, including nanowire-based technologies, and smart lighting, moving towards a More than Moore market.

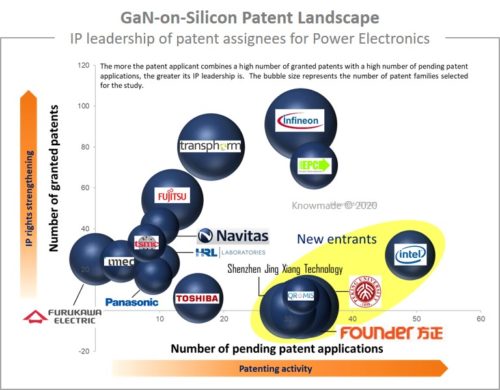

Power Electronics: US and European IP leaders backed by patent portfolios of Japanese historical players

Infineon made a giant step in the GaN-on-Si landscape by acquiring IR in 2015 but had to consolidate the move by licensing Panasonic’s patented HD-GIT technology and by further strengthening its own portfolio as attested by significant IP activity since then. The next IP leader behind Infineon is Transphorm, which has taken several shortcuts as well, by establishing strong partnerships, including IP transfers, with Fujitsu and Furukawa Electric in 2010-2015. Likewise, multiple startups were established to develop GaN power technology based on GaN-on-Si, backed by academic and established industrial IP players in the patent landscape, such as Qromis, Navitas, EpiGaN and ExaGaN.

Patenting activity in the field of power electronics remarkably peaked in 2017, due to the entry of several Chinese new entrants in the patent landscape, including FMIC, Innoscience, Peking University, Shenzhen Jing Xiang Technologies and South China University of Technology, focusing on different aspects of GaN-on-Si technology, and filing patents in China mainly.

RF electronics: Macom and Intel have taken the lead on GaN-on-Si RF technology

There is a large discrepancy between the RF GaN-on-Si patent landscape and the overall RF GaN patent landscape, described in our report “RF GaN Patent Landscape Analysis 2019”. Macom, which managed to keep IP rights on part of IR’s GaN-on-Si portfolio after its acquisition by Infineon, is the main player continuing the development of RF GaN-on-Si technology. Fujitsu, an historical GaN-on-Si IP player, has strongly reduced its related IP activity.

The next leading patent applicant in the field is Intel, which is particularly interested in novel approaches towards monolithic integration with Si CMOS for RF electronics for More-than-Moore systems-on-chips.

Useful Excel patent database

This report also includes an Excel database with the over 2,800 patents and patent applications analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority date, title, abstract, patent assignees, patent’s current legal status, and technological and application segments.

Companies mentioned in the report (non-exhaustive)

Toshiba, Sharp, Panasonic, Sanken Electric, Infineon/International Rectifier, Intel, Samsung, University Beijing, Transphorm, Fujitsu, Lattice Power, FMIC – Founder Microelectronics, imec, South China University of Technology, Toyoda Gosei, cea – French Alternatives Energies And Atomic Energy Commission, Furukawa Electric, Macom/Nitronex, IQE, TSMC, Osram Opto Semiconductors, CETC – China Electronics Technology Group Corporation, Nanjing University of Posts & Telecommunications, Zhongtuo Optoelectronics Technology, Innoscience, Shenzhen Jing Xiang Technology, Showa Denko, Aledia, Fuji Electric, LG Innotek, Coorstek, Qromis, glo, Institute of Semiconductors (CAS), Corning, Sumitomo Electric, HRL Laboratories, EPC – Efficient Power Conversion, MIT – Massachusetts Institute of Technology, Allos Semiconductors, Nagoya Institute of Technology, Navitas Semiconductor, NGK Insulators, NTT – Nippon Telegraph & Telephone, Micron Technology, Hitachi, Toyota Central R&D Labs, STmicroelectronics, SK Siltron, Enkris Semiconductor, Shin-Etsu, Bridgelux, Rohm, Epistar, Oki Electric Industry , Tsing Hua University, ITRI – Industrial Technology Research Institute, Samsung Electro Mechanics, CNRS – French National Research Center, Exagan, IBM, ETRI – Electronics & Telecommunications Research Institute, VisIC Technologies, Mitsubishi Electric, Renesas Electronics, Texas Instruments, Nanchang University, HiWafer, Sino Nitride Semiconductor, National Sun Yat Sen University, Soitec/EpiGaN.