Who are the key players and newcomers in the global IP race for Li-ion batteries cathode active materials recycling?

Publication September 2025

| Download Flyer | Download Sample |

Key features

- PDF>120 slides

- Excel database containing all patents analyzed in the report (>3,900 patent families), including patent segmentations and hyperlinks to an updated online database.

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

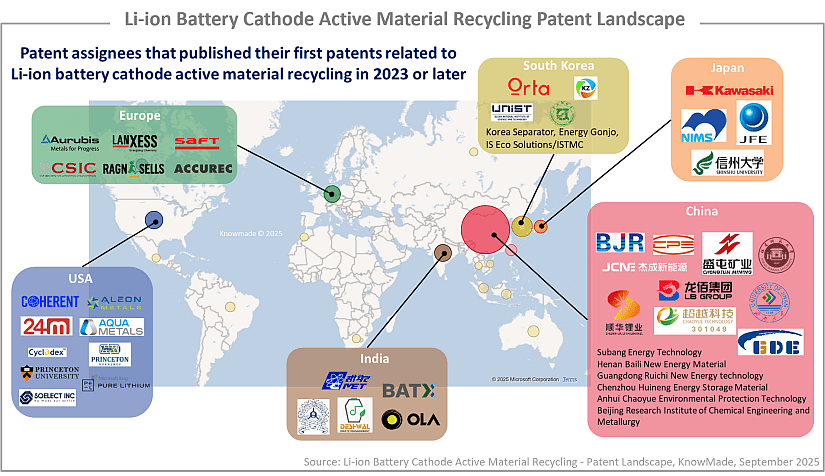

- Main patent assignees and IP newcomers grouped by geographical area.

- Focus on selected key IP players’ portfolios

- Patents categorized by type of cathode active material (Li Ternary Oxides, Li Phosphates, Other CAM, Li & Li Precursors).

KnowMade also covered this related topic:

- Silicon Anode for Li-ion Batteries Patent Landscape Analysis 2024

- Halide Solid Electrolytes for Li-ion Batteries Patent Landscape 2024

- Silicon Anode Li-ion Batteries Patent Monitoring Service

- Solid-State Batteries Patent Monitoring Service

The growing interest in, and need for, a sustainable supply chain has driven innovators into an IP race in Li-ion battery CAM recycling

The rapid adoption of electric vehicles (EVs), renewable energy storage systems, and portable electronics has fueled an exponential increase in the demand for Lithium-ion batteries. The interest in critical raw materials such as lithium, cobalt, nickel, and manganese, increased, to instate a more sustainable supply chain and increase the independence of materials-scarce countries from critical minerals suppliers. This concentration of supply, coupled with environmental concerns and evolving regulatory frameworks, has intensified the need for sustainable end-of-life management strategies, particularly the recycling of spent Li-ion batteries and their cathode materials.

Cathode materials represent the most valuable and resource-intensive components of Li-ion batteries. These include layered oxides like NMC (LiNiMnCoO₂), NCA (LiNiCoAlO₂), and LCO (LiCoO₂); polyanion materials such as LFP (LiFePO₄) and LMFP (LiMnFePO₄); and spinels like LMO (LiMn₂O₄). Each chemistry presents unique challenges and opportunities for recovery and reuse. Efficient recycling not only reduces reliance on virgin mining but also lowers the environmental footprint of battery production, contributing to the circular economy goals set by governments and industries.

In this context, the present report aims to provide a comprehensive analysis of the patent landscape related to the recycling of cathode active materials (CAM) from Li-ion batteries. The general objectives of the present report are:

to identify and map the key IP players in each chosen technological segment (Li & Li precursors, Li ternary oxides, Li phosphates, other cathode materials).

to assess the geographical distribution of patent families, legal status of patent applications, helping stakeholders understand strategic positioning and navigate their competitive environment.

This insight will support R&D, investment, and policy decisions in the evolving field of Li-ion battery recycling.

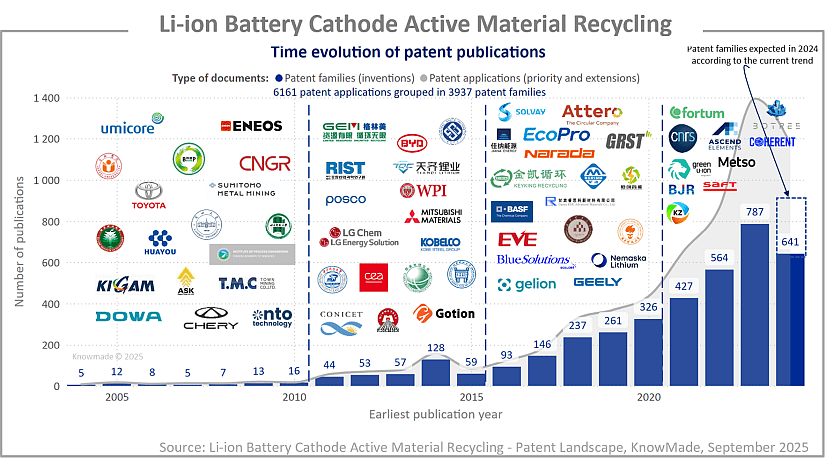

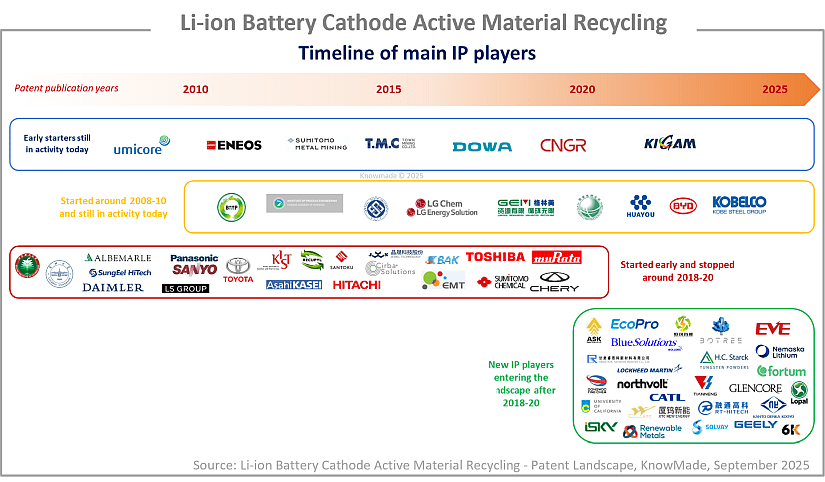

A dynamic IP landscape

In this report, Knowmade’s analysts have selected and analyzed over 6,100 patents and patent applications from more than 3,900 patent families (inventions) related to Li-ion battery cathode active materials recycling. This significant rise clearly demonstrates a strong interest in the technology from various entities, including large companies, start-ups, and R&D labs. Early entrants in this space such as Umicore, Eneos, and Sumitomo Metal Mining were followed over the years by other patent applicants (e.g., LG Chem/LGES, GEM, Brunp Recycling Technology), and they are now competing with more recent new entrants in the patent landscape such as Asaka Riken, EcoPro, and Blue Solutions.

Revealing main trends and key players’ IP position

IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the Li-ion battery CAM recycling field. In this report, KnowMade’s analysts provide a comprehensive overview of the competitive IP landscape and the main players involved. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, and technological segment of interest (Li & Li precursors, Li ternary oxides, Li phosphates, etc.). It also identifies the IP leaders, most active patent applicants, and new entrants in the IP landscape. The report also sheds light on under-the-radar companies and new players in this field.

Entry of new patent applicants

Since 2023, Chinese entities have established themselves as dominant newcomers in the Li-ion battery CAM recycling patent landscape. BJR, CP Lighting, and Chengtun Mining Group are leading the field, while other East Asian IP players such as Orta Materials and Korea Zinc from South Korea, and JFE and Kawasaki Heavy Industries from Japan are following closely behind. Dedicated sections of the report focus on the patent portfolios of key players and IP new entrants from various countries.

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and affiliation segments (Li & Li precursors, Li ternary oxides, Li phosphates, other cathode materials).

Companies mentioned in the report (non-exhaustive)

From China: Brunp Recycling technology, Central South University, Institute of Process Engineering-CAS, GEM (Jingmen Gelinmei New Materials), Narada Power Source, Beijing Institute of Technology, Tianqi Lithium, Guoxuan High Tech Power Energy / Gotion, Keyking Recycling, BGRIMM Technology Group, RSK Advanced materials, Zhuzhou Smelter Group, EVE Energy, Lanzhou University of Technology, and more

From Europe: Umicore, BASF, CEA, Blue Solutions, Veolia, Aurubis, Fortum, Metso, Fraunhofer, and more

From Japan: Eneos Group, Sumitomo Metal Mining, Dowa Holdings, TMC (Town Mining Corporation), Asaka Riken, Toyota, Mitsubishi materials, Kobe Steel, Mitsui Mining and Smelting, Sumitomo Chemical/Tanaka Chemical, Hitachi, and more

From South Korea: SK Group, LG Chem/LG Energy Solution, KIGAM (Korea Insttitue of Geoscience and Mineral Resources), EcoPro, RIST (Research Institute of Industrial Science and Technology), Posco, Cosmochemical, KIST (Korea Institute of Science & Technology), Dongwoo Fince Chem, and more

From USA: Ascend Elements, Worcester Polytechnic Institute, OnTo Technology, Albemarle, Lockheed Martin/UT Battelle, Cirba Solutions, Coherent, University of California, Libus987, Urban Mining, 24M technologies, 6K inc. Aleon Metals, Aqua Metals, Li-Cycle, and more

From the rest of the World: CSIR (Council of Scientific and Industrial Research), Attero Recycling, Conicet, Gelion Technologies, Green Li-ion, Indiana Institute of Technology, Frontier Lithium, Hydro-Québec, and more