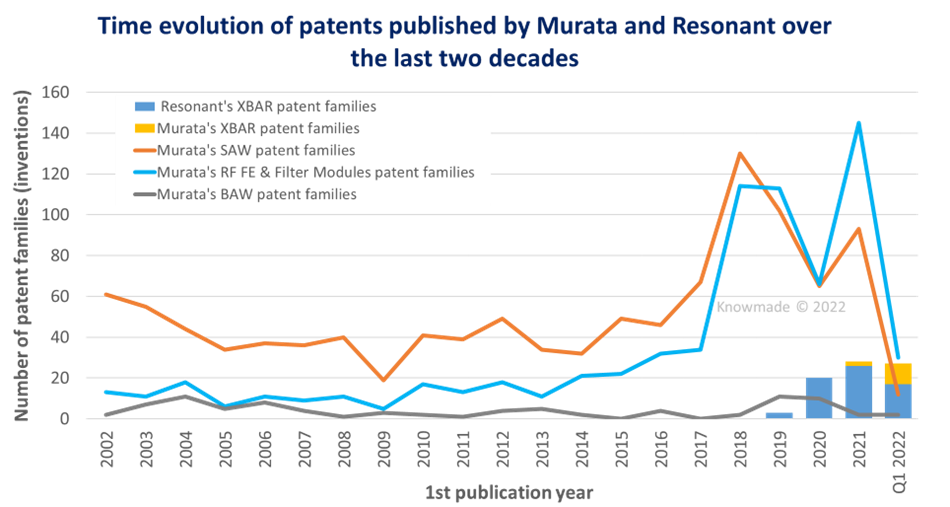

SOPHIA ANTIPOLIS, France – May 3, 2022 | In February 2022, Murata and Resonant announced they have entered into a definitive agreement under which Murata will acquire Resonant for $4.50 per share in cash (see the press release). For years, Knowmade has been monitoring patenting activity related to RF acoustic wave filters through dedicated Quarterly Patent Monitors (see here). In the last 2 years, Knowmade’s analysts have witnessed the evolution of the patent landscape, which shows increasing competition for bulk acoustic wave (BAW) intellectual property (IP). The entrance of Chinese IP players such as XS Semi (深圳新声半导), Huntersun (天下电子) or ROFS Microsystem, combined with the acceleration of Samsung Electro Mechanics’ IP activity, is a challenge to the established patent owners (e.g. Qualcomm, Broadcom, or Taiyo Yuden). Murata’s acquisition of Resonant will result in the merging of two of the most active and leading IP players in the acoustic wave filter patent landscape, and intensify the race and competition occurring in the high frequency bands, especially sub 6GHz 5G.

Murata has been leading the surface acoustic wave (SAW) patent landscape for more than 5 years. In Q1 2022, the company has been the most active IP player once again, with more than 37 new inventions related to acoustic wave filters published and 15 newly granted. Since 2000, Murata’s main strategy has been to strengthen its SAW patent portfolio. Recently, the company has put a lot of effort into protecting its Incredible High Performance (IHP) SAW filter (thin-film SAW), as well as solutions to integrate them in an RF front end module (isolation, noise reduction, power management, etc.). “Today, Murata does not have any serious IP challengers in the SAW patent landscape. With the rise of 5G, the company has enlarged its portfolio by accelerating its patenting activity related to filter integration and RF modules”, says Paul Leclaire, PhD, Technology and Patent Analyst MEMS, Sensors and RF technologies at Knowmade. Thanks to its intense patenting activity, Murata now owns the largest patent portfolio related to RF front end modules and their components. According to Knowmade’s analysis, Murata’s IP position was limited due to its weak patenting activity related to high frequency filters. That is no longer the case with the acquisition of Resonant.

Figure 1: Time evolution of Murata and Resonant patenting activities.

Resonant is among the top 3 most active IP players in the bulk acoustic wave (BAW) filter segment over the last 5 years. In 2018, the company changed its strategy, moving from SAW-related IP to their XBAR® technology. By focusing its patent filings exclusively on XBAR® designs/architectures and manufacturing methods, the company was able to settle and strengthen its unique IP position. Today, Resonant’s XBAR® technology is protected by more than 240 patents grouped into 50+ patent families (inventions). In addition to the acceleration of its patenting activity, Resonant has started to extend its patents abroad, China and Europe being new countries/regions of interest. Thanks to its strong IP portfolio to protect its XBAR® technology, today Resonant is capable of hampering the freedom to operate of any player that would like to provide transversely-excited BAW filters. The downside of Resonant’s IP strategy is that the value of such a specific patent portfolio relies solely on the XBAR® technology being adopted by the market. Note that the VTT Technical Research Centre of Finland, the Shanghai Institute of Microsystem and Information Technology (SIMIT) of the Chinese Academy of Sciences, Wuhan Minsheng New Technology (MEMSonics – 武汉敏声新技术有限公司), XintangChip (Zhejiang Xintang Zhixin Technology – 浙江信唐智芯科技有限公司) and even Skyworks have started to file patents related to transversely-excited film bulk acoustic resonators, which attests to their interest for this breakthrough technology for next-generation wireless networks.

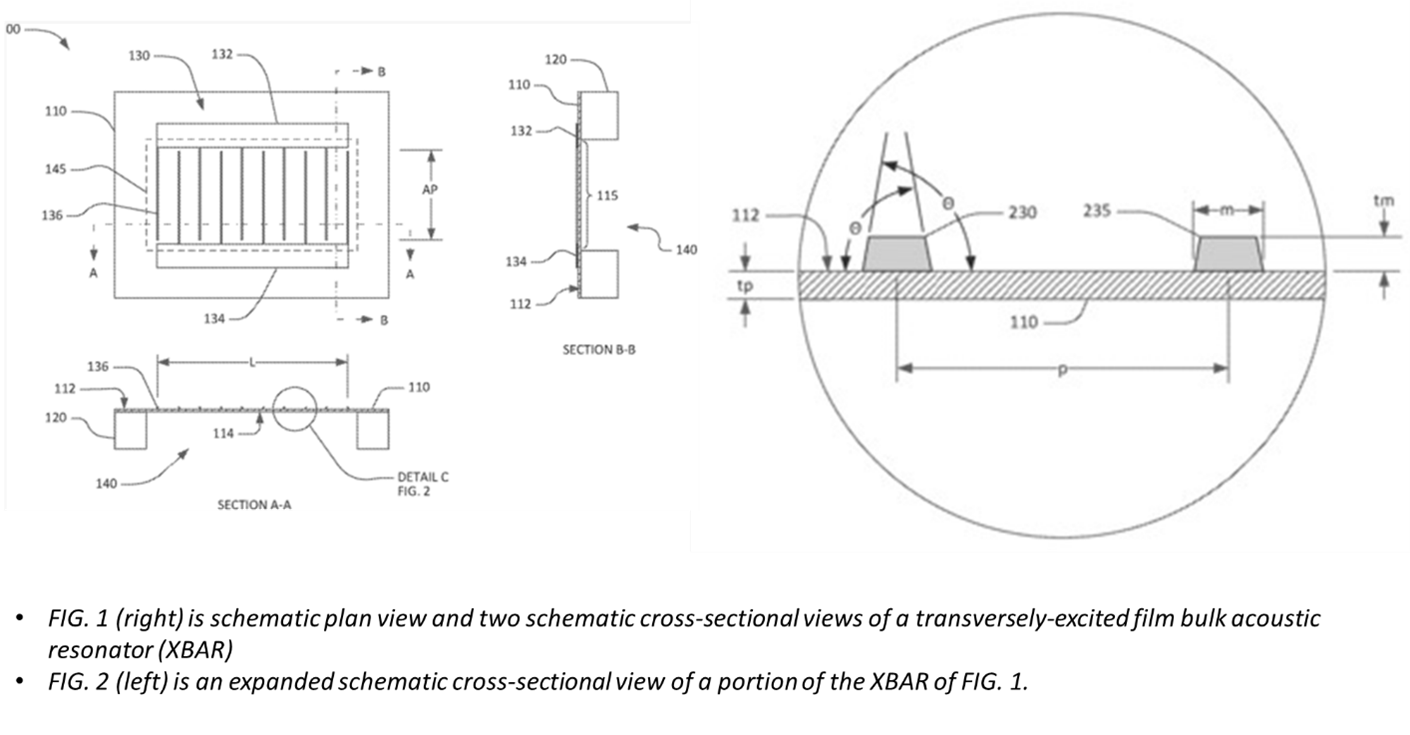

“The benefit of the Murata/Resonant merger is already observable at the IP level”, says Leclaire. In Q1 2022, 20 new XBAR patent applications filed by either Murata or Resonant have been published. Up to now, the new patents described specific interdigitated electrode design and a process for XBAR filters (WO2021222412, WO2021222409). “These patents already confirm that Murata’s know-how and intense patenting activity will be a strong plus to the development of Resonant’s XBAR technology”, adds Leclaire.

Figure 2: Patent application WO2021222409 co-filed by Murata and Resonant and entitled ‘Transversely-excited film bulk acoustic resonator with controlled conductor sidewall angles’.

According to Norio Nakajima, President of Murata, “Murata and Resonant will provide a strong portfolio of Intellectual Property Rights covering the entire XBAR technology”, placing the IP at the heart of their strategy. Resonant’s strong patent portfolio related to XBAR® technology, combined with Murata’s RF front end module patents, already offers Murata a significant advantage for strengthening its IP and market position in the RF industry. By enlarging its patent portfolio, Murata could ensure that the company will be able to provide a unique RF front end module to the handset market.

With this move, the BAW intellectual property landscape is even more competitive. In such a dense and dynamic environment, it becomes increasingly critical to have good knowledge of the patent landscape and understand the strategy of the different players, as well as evaluate the risk that newcomers (Chinese players) represent. As such, Knowmade publishes report and sets up monitoring services in order to track and analyze the competitors’ R&D and IP strategies, to reveal where industry leaders and newcomers are focused, and give an early view into the strategies they are pursuing, technologies they are investing in and products they are building.

Follow this link to find our patent landscape reports on RF technologies.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About our analysts

Paul works for Knowmade in the fields of RF technologies, Wireless communications and MEMS sensors. He holds a PhD in Micro and Nanotechnology from the University of Lille (France), in partnership with IEMN in Villeneuve-d’Ascq and CRHEA-CNRS in Sophia Antipolis (France). Paul previously worked in innovation strategy consulting firm as Consultant.

About Knowmade

Knowmade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

Knowmade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

Knowmade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.