Which players show an active patenting activity to stay in and win the 5G race?

Publication January 2018

| Download Flyer | Download Sample |

Report’s Key Features

- PDF >180 slides

- Excel file >3,600 patents

- IP trends, including time evolution of published patents and countries of patent filings.

- Patent segmentation by technology for 5G applications: Carrier aggregation, Beamforming, MIMO, and mm-waves.

- Current legal status of the patents.

- Ranking of main patent assignees by technological segments.

- Key patents and granted patents near expiration by technological segments.

- IP position of key players, and relative strength of their patent portfolios.

- IP profile of key players: Broadcom, Qualcomm, Skyworks, Qorvo, Murata, OPPO.

- Excel database with all patents analyzed in the report, including technology segmentation.

Connected patent landscapes about RF. What kind of patent analysis does your business need? A patent landscape is the most useful tool to understand what patents entail.

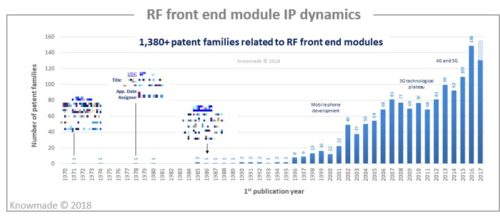

RF front end module IP dynamic: an indicator of the race toward the 5G

The telecommunications revolution of the early 21st century has led to the development and proliferation of more and more communications devices . Recent estimates have shown that there are almost 1 mobile or cellular handset for every person on earth. One consequence of such phenomenal growth in handset proliferation is the concomitant demand for data and has led to the need to use more of the radio spectrum. Indeed, from 4 bands in the 2000’s, we now use more than 30 bands and this number will keep increasing with the upcoming 5G. To manage all these bands, RF modules for mobile handsets have been widely developed in order to fulfil the increasing requirements. Today we are at the first step of 5G networks that will become a RF communication standard in 2020. With approximatively 1.5 Billion cellphones ship in 2025, the market of RF components for 5G applications is already of strategic importance. RF front end modules (RF FEM) are among the key components for 5G applications and the market will be highly impacted by the new standard. According to Yole Développement, the RF FEM market for 5G cellphones is estimated to be valued at USD $7.8 Billion in 2020 and it is further projected to reach USD $35.3 Billion by 2025, at a CAGR of 35% between 2020 and 2025. 5G comes with strong technology challenges that could reshuffle the cards and change the actual mobile telecommunication landscape. The IP strategy is thus becoming critical for insuring the players a strong marketing position in the coming years. In this report, Knowmade has thoroughly investigated the patent landscape for RF front end modules (RF FEM) dedicated to mobile applications. We have evaluated the IP position of key players through detailed analysis of their patent portfolios, including the legal status of the patents, their geographic coverage, their claimed inventions and their prior art contribution. We also study their IP strategy and their IP blocking potential. In addition, we have studied their IP portfolio regarding technical solutions to address 5G application challenges (MIMO, beamforming, carrier aggregation, mm waves).

The telecommunications revolution of the early 21st century has led to the development and proliferation of more and more communications devices . Recent estimates have shown that there are almost 1 mobile or cellular handset for every person on earth. One consequence of such phenomenal growth in handset proliferation is the concomitant demand for data and has led to the need to use more of the radio spectrum. Indeed, from 4 bands in the 2000’s, we now use more than 30 bands and this number will keep increasing with the upcoming 5G. To manage all these bands, RF modules for mobile handsets have been widely developed in order to fulfil the increasing requirements. Today we are at the first step of 5G networks that will become a RF communication standard in 2020. With approximatively 1.5 Billion cellphones ship in 2025, the market of RF components for 5G applications is already of strategic importance. RF front end modules (RF FEM) are among the key components for 5G applications and the market will be highly impacted by the new standard. According to Yole Développement, the RF FEM market for 5G cellphones is estimated to be valued at USD $7.8 Billion in 2020 and it is further projected to reach USD $35.3 Billion by 2025, at a CAGR of 35% between 2020 and 2025. 5G comes with strong technology challenges that could reshuffle the cards and change the actual mobile telecommunication landscape. The IP strategy is thus becoming critical for insuring the players a strong marketing position in the coming years. In this report, Knowmade has thoroughly investigated the patent landscape for RF front end modules (RF FEM) dedicated to mobile applications. We have evaluated the IP position of key players through detailed analysis of their patent portfolios, including the legal status of the patents, their geographic coverage, their claimed inventions and their prior art contribution. We also study their IP strategy and their IP blocking potential. In addition, we have studied their IP portfolio regarding technical solutions to address 5G application challenges (MIMO, beamforming, carrier aggregation, mm waves).

More than 1,380 RF FEM inventions have been published worldwide up to 2017 by more than 500 patent applicants. Patenting activity related to RF FEM emerge in the late 80’s with pioneers of mobile phone applications like Alcatel, Motorola, Panasonic, etc. The RF FEM IP activity has been closely linked to development of new standard. The first increase of patent publications in the 2000’s overlaps the democratization of mobile phones and the arrival of 2G and 3G standards. Since 2010, the upcoming the 4G and 5G that require the development of new technologies have revitalized the patenting activity after the 3G deployment and the market consolidation between 2008 and 2012. Today, the IP landscape related to RF FEM for cellphones is leaded by the market leaders. The rapid development of Chinese companies R&D activity push the long term players to actively deploy and protect their inventions and market.

Identify key technologies

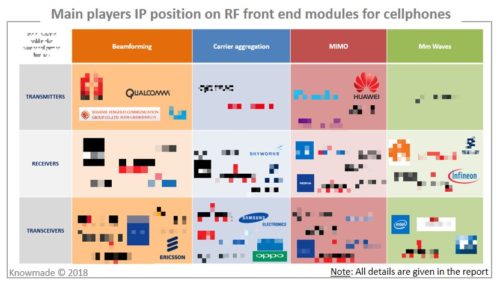

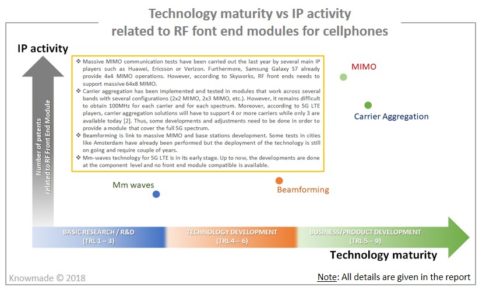

The IP report reveals the key patents in this domain, as well as the current IP position of key players regarding technical approaches related to 5G applications. The >1,380 patent families selected for the present study have been categorized by technology: beamforming, carrier aggregation, MIMO and mm-waves. We have investigated the IP positioning of key players on each technological segments and provide a detailed description of seminal patents, blocking patents and promising patents.

Understand key players’ patented technologies and IP strategies

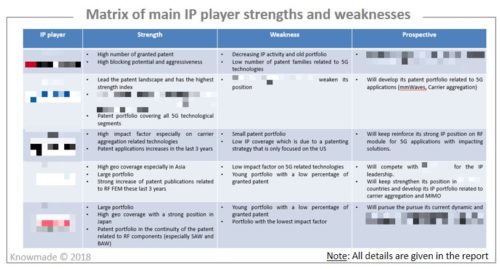

More than 500 patent applicants are involved in the RF FEM related patent landscape. This report unveils the IP position of key players through detailed analysis of their patent portfolios. We provide an understanding of their patented technologies (especially to address 5G application challenges), their IP strategy and their capability to limit both the IP activity and the freedom-tooperate of the other firms. We also reveal the relative strengths of the top patent owners derived from their patent portfolio sizes, technological impact factor, geographic coverage, blocking potential, as well as their most valued patents.

Useful patent database

The report also includes an Excel database containing the >3,800 patents and patent applications analyzed in this study. This useful patent database allows multi-criteria searches and includes patent publication number, hyperlinks to the original documents, priority date, title, abstract, patent assignees, technological segments and current legal status.

Companies mentioned in the report (non-exhaustive)

Qualcomm, Broadcom, Skyworks, TDK, Murata, Nokia, Intel, Qorvo , ST Ericsson, LG Innotek, Samsung Electronics, Mediatek, Sony, RFaxis, Huawei, Renesas, Samsung Electro Mechanics, Motorola, ZTE, NXP, LG Electronics, Foxconn, Nec, Hitachi, Sony Ericsson Mobile Communications, Panasonic, Infineon Technologies, Texas Instruments, Analog Devices, Toshiba, Maxlinear, Apple, Taiyo Yuden, IPR Licensing, Korean Electronics and Telecommunications Research Institute (ETRI), Airoha Technology, Conexant Systems, Provenance Asset, Imec, Brooktree, Renesas Technology, Entropic Communications, Exar, Industrial Technology Research Institute (ITRI), Blackberry, Marvell World Trade, Cisco, Microchip Technology, DSP, Maxim Integrated, etc.